Market Overview: S&P 500 E-Mini Futures

TheS&P 500 E-Mini market formed a monthly bear bar in December. The bears must create consecutive bear bars (something they haven’t been able to do since Oct 2023) to show they are back in control. The bulls want the pullback to have poor follow-through selling.

S&P 500 E-Mini Futures

The Monthly E-Mini Chart

- The December monthly E-Mini candlestick was a bear bar closing near its low with a small tail below.

- Last month, we said that the odds slightly favor the market to trade at least a little higher. Traders would see if the bulls could create more follow-through buying in December, or if the market would trade slightly higher but stall and close with a long tail above or a bear body instead.

- The market traded slightly higher in the first half of the month followed by sideways to down from mid-month onwards.

- The bulls created a large wedge pattern (Mar 21, Jul 16 and Dec 6) and an embedded wedge (Aug 30, Oct 17, and Dec 6).

- They want the market to continue in a broad bull channel for months.

- If there is a pullback, the bulls want it to be sideways and shallow (filled with weak bear bars, bull bars, doji(s) and overlapping candlesticks) and form a higher low or a double bottom bull flag with the September 6 or August 5 lows.

- They want the pullback to have poor follow-through selling.

- The bears want a reversal from a wedge (Mar 21, Jul 16 and Dec 6) and an embedded wedge (Aug 30, Oct 17, and Dec 6).

- They managed to create a sell signal bar in December and triggered the sell entry by trading below the December low recently.

- They must create consecutive bear bars (something they haven’t been able to do since Oct 2023) to show they are back in control.

- Since December candlestick was a bear bar closing near its low, it is a sell signal bar for January.

- Odds favor January to trade at least a little lower (which it has done).

- The move up since October 2023 has lasted a long time and is slightly climactic.

- While the risk of a pullback increases, the bears need to do more to show that they are back in control.

- Until they can do that, traders will not be willing to sell aggressively.

- For now, traders will see if the bears can create a follow-through bear bar in January.

- Or will the market trade slightly lower (which it has done) but stall and close with a long tail below or a bull body (poor follow-through selling) instead?

- We could still see the market retest the December low again sometime in January.

- Some traders may see the December low as not being adequately tested (Jan 2).

- For now, odds favor any pullback to be minor and not lead to a reversal.

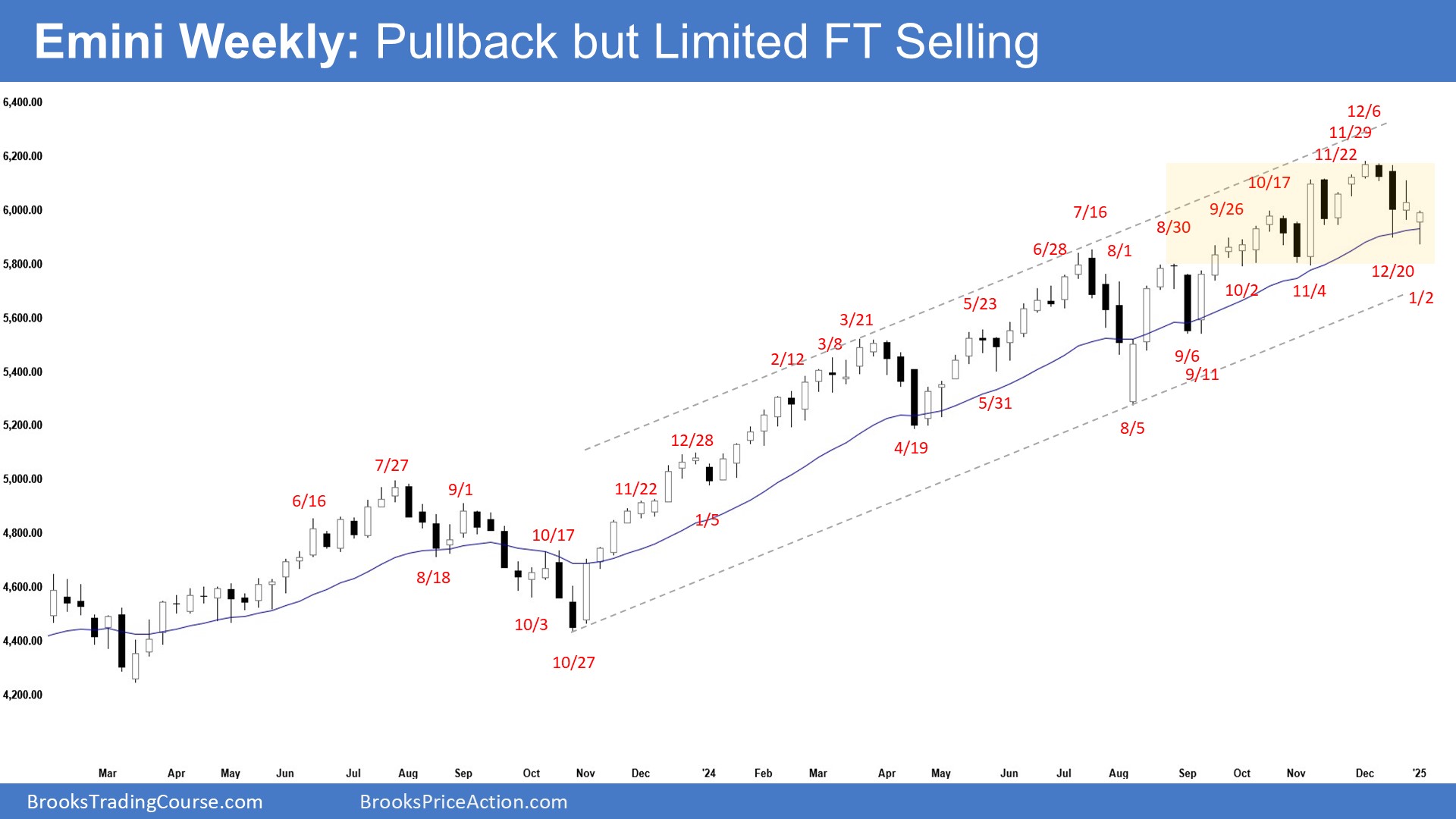

The Weekly S&P 500 E-Mini Chart

- This week’s E-Mini candlestick was a bull bar closing near its high with a long tail below.

- Last week, we said that traders would see if the bears could create a second leg sideways to down breaking far below the 20-week EMA or the bull trend line, or if the market would continue to stall sideways and retest the all-time high (Dec 6) in the next few weeks instead.

- The market gapped down and traded below the December low but reversed into a bull bar on Friday.

- The bears got a pullback from a large wedge (Mar 21, Jul 16, and Dec 6), an embedded wedge (Aug 30, Oct 17, and Dec 6) and a micro wedge (Nov 22, Nov 29, and Dec 6).

- They see the market as being extended and overbought and hope to get a TBTL (Ten Bars, Two Legs) pullback lasting at least a few weeks.

- While the market has traded lower, the move lacked strong follow-through selling (bull doji(s), long tails below) which indicates that the bears are not yet as strong as they hoped to be.

- They must create consecutive bear bars closing near their lows to convince traders that they are back in control.

- They hope to get a retest of the October / November lows area.

- If the market trades higher, they want a reversal from a lower high major trend reversal.

- The bulls see the market as being in a broad bull channel and want the market to continue sideways to up for months.

- They see the current move simply as a two-legged pullback (Dec 20 and Jan 2) and want the market to resume higher from a double bottom bull flag (Nov 4 and Jan 2).

- They hope that the pullback will have poor follow-through selling. So far, this is the case.

- They want the 20-week EMA, the October/November lows, or the bull trend line to act as support.

- Since this week’s candlestick is a bull bar closing near its high with a long tail below, it can be a buy signal bar for next week.

- The market should trade at least a little higher early next week.

- Traders will see if the bulls can create a strong bull entry bar (a follow-through bull bar) closing near its high.

- Or will the market trade slightly higher but stall and close with a long tail above or a bear body instead?

- If the market trades higher over the next couple of weeks but is weak (bear bars, doji(s), bull bars with long tail above, overlapping candlestick, the odds of another leg lower from a lower high major trend reversal will increase.

- For now, the market may have entered a trading range phase.

- The bears need to do more and create sustained selling pressure to convince traders that they are back in control.

- If the pullback remains sideways and shallow (overlapping candlesticks, with bull bars, doji(s), and candlesticks with long tails below), the odds of a bull trend resumption will increase after that.

- For now, odds slightly favor the pullback to be minor and not lead to a reversal.