Investing.com’s stocks of the week

Market Overview: S&P 500 Emini Futures

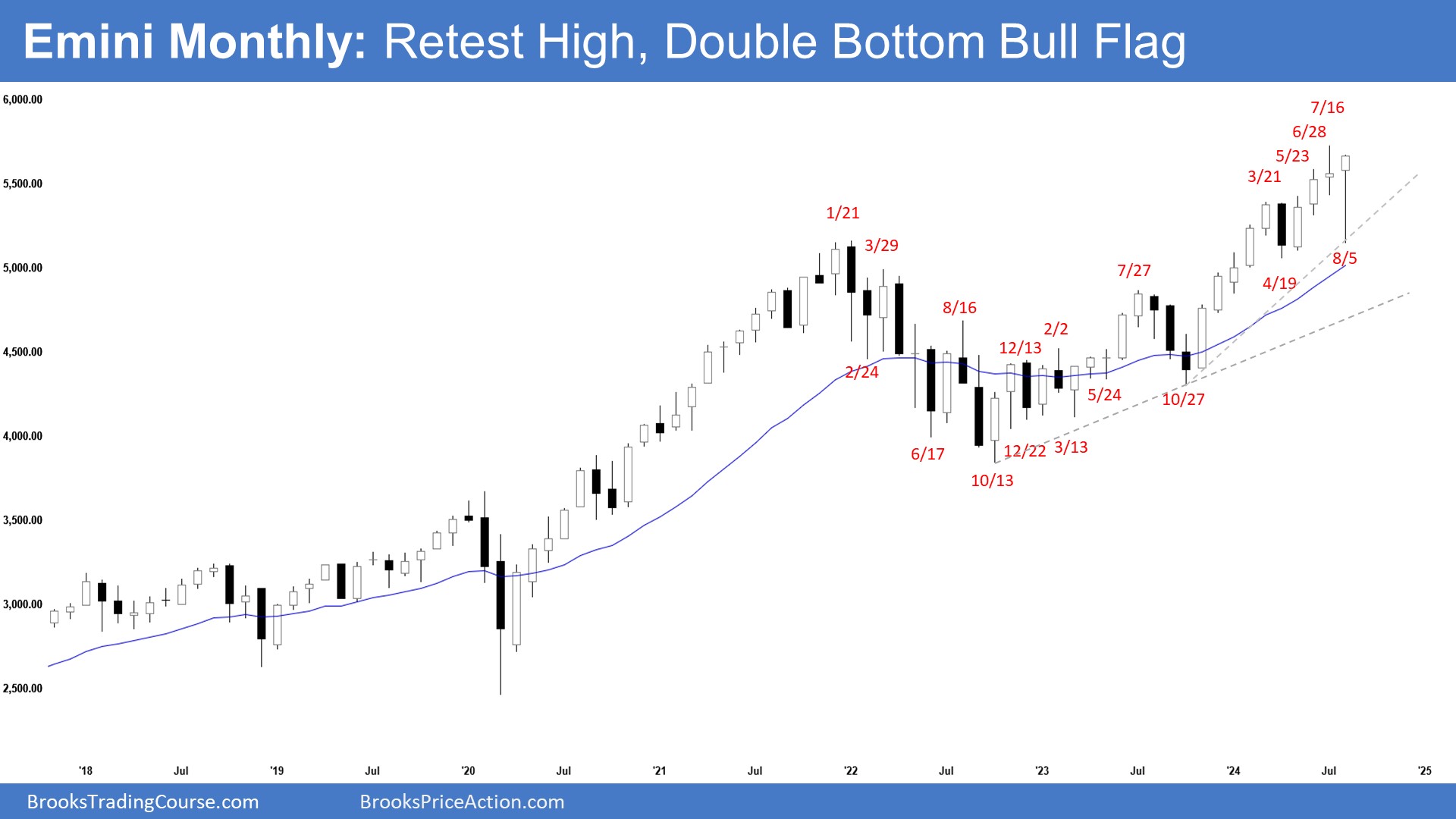

The market formed a monthly S&P 500 Emini double-bottom bull flag and retest of the all-time high. The bulls want a breakout with follow-through buying, resuming the broad bull channel. The bears see the current move as a retest of the all-time high and want a reversal from a lower high major trend reversal or a double top with the all-time high.

S&P 500 Emini Futures

- The August monthly Emini candlestick was a bull bar closing near its high with a long tail below.

- Last month, we said that traders would see if the bears could create a strong bear bar in August or if the market would trade lower (as it did early in the month) but reverse to close with a long tail or a bull body by the end of the month. The odds slightly favor the pullback to be minor.

- The bulls got a strong rally starting in October in the form of a tight bull channel.

- They hope that the market has entered a broad bull channel phase which will last for many months.

- They want the current pullback to be sideways and shallow (filled with weak bear bars, bull bars, doji(s) and overlapping candlesticks).

- They want the pullback to form a higher low or a double-bottom bull flag with the April 19 low, followed by a resumption of the broad bull channel.

- At the very least, they want a retest of the July 16 high, even if it forms a lower high.

- So far, the Bulls got what they wanted.

- Next, they want a retest of the all-time high followed by a breakout with follow-through buying, resuming the broad bull channel.

- They want another leg up completing the wedge pattern with the first two legs being the March 21 and July 16 highs.

- The bears got a reversal from a higher high major trend reversal, a large wedge pattern (July 27, March 21, and Jul 16), and a micro wedge (May 23, June 28, and Jul 16).

- The selloff moved almost 10%. However, it lacked sustained follow-through selling.

- The bears see the current move as a retest of the all-time high and want a reversal from a lower high major trend reversal or a double top with the all-time high.

- Since August’s candlestick was a bull bar closing near its high with a long tail below, it is a buy signal bar for September.

- The market may gap up in September. Small gaps usually close early.

- The selloff in August likely has alleviated the prior overbought conditions.

- The market remains Always In Long.

- Odds slightly favor the market to trade at least a little higher in September.

- Traders will see if the bulls can create a strong retest of the all-time high followed by a breakout above.

- Or will the market trade slightly higher but stall around the all-time high area instead?

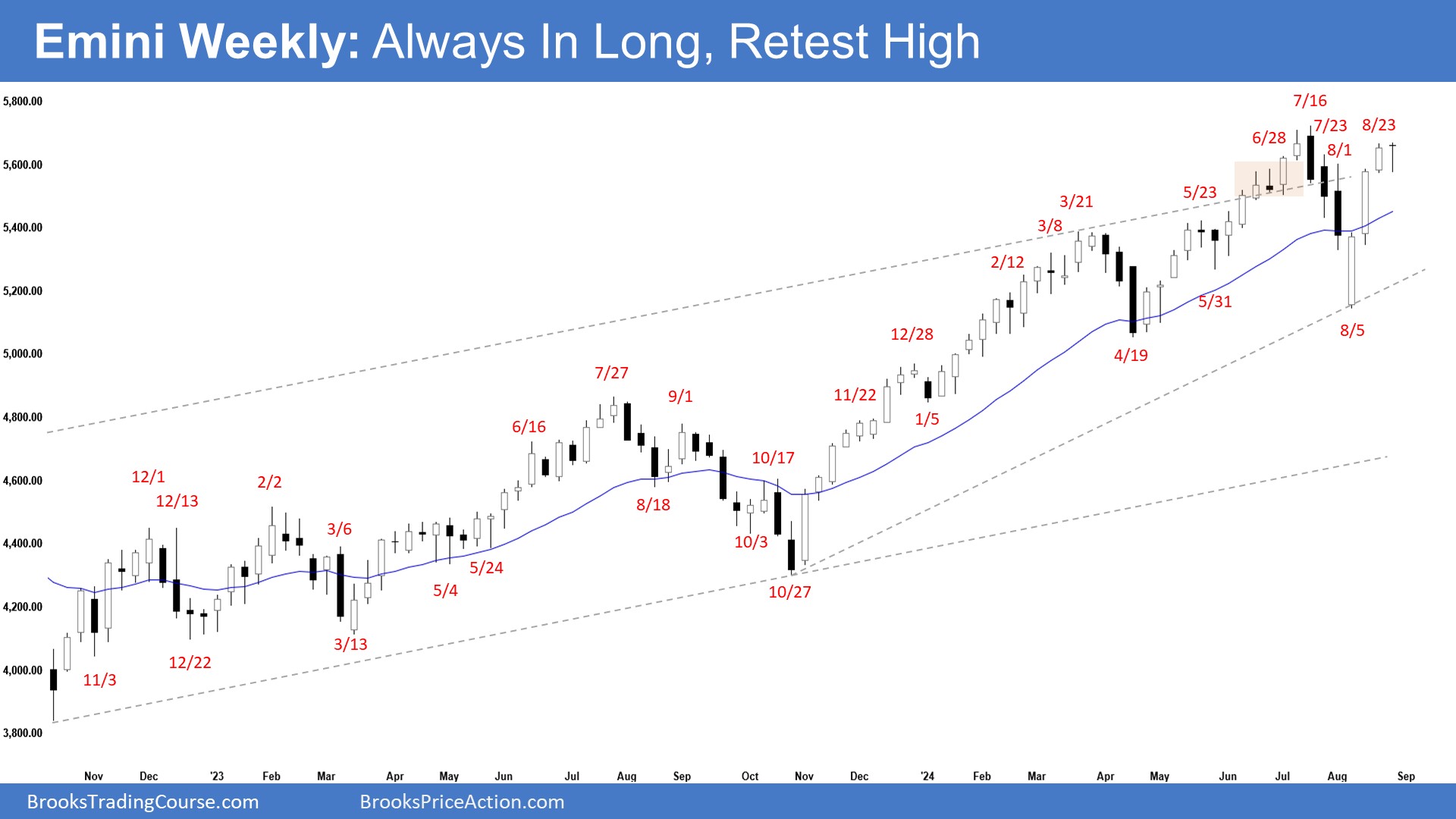

The Weekly S&P 500 Emini Chart

- This week’s Emini candlestick was a doji bar closing near its high with a prominent tail below.

- Last week, we said that while odds continue to favor sideways to up, the move up since the August 5 low is slightly climactic. The market may need to trade sideways to down for a week or two to relieve the overbought condition.

- The bulls got a strong retest of the all-time high.

- They hope that the market is in the broad bull channel phase.

- They want a breakout into new all-time high territory followed by a resumption of the broad bull channel.

- The move up is strong enough for traders to expect at least a small second leg sideways to up after a small pullback.

- If there is a deep pullback, they want the 20-week EMA to act as support.

- The bears see the current move simply as a retest of the prior high.

- They want a reversal from a lower high major trend reversal or a double top with the all-time high.

- Because of the strong move-up, the bears will need a strong reversal bar or a micro double top before traders consider selling aggressively.

- They must create consecutive bear bars closing near their lows to increase the odds of a deep pullback.

- Since this week’s candlestick is a doji bar closing near its high, it is not a sell signal bar for next.

- The pullback phase may have begun this week. Traders will see the strength of the pullback.

- If it is weak and sideways (with doji(s), bull bars, and overlapping candlesticks), the odds of another strong leg up will increase. So far, the pullback looks weak.

- For now, traders will see if the bulls can continue to create bull bars testing the all-time high soon.

- Or will the bears be able to create more sideways-to-down candlesticks instead?

- Odds slightly favor the market to have flipped into Always In Long and any pullback is likely minor.