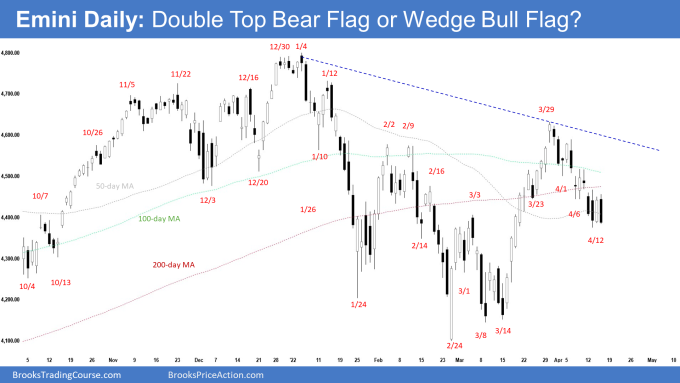

E-mini S&P 500 bears are hoping to get the 3rd consecutive bear bar trading far below March 3 high. If they get that, the odds of a test of the February low increases. The bulls see this as a 50% pullback and want a 2nd leg sideways to up to re-test March 29 high.

S&P 500 E-mini futures

- This week’s E-mini candlestick was a bear bar closing near the low with small tails above and below. It closed slightly below the March 3 high.

- Last week, we said that odds slightly favor sideways to up after a pullback but if the bears get consecutive bears bars closing near the low, odds will swing in favor of a test of the February low and possibly a breakout below.

- Bears want the E-mini to stall around February 2 high and reverse lower from a double top bear flag. They got the consecutive bear bar this week which represents follow-through selling.

- The bears want a strong break below the February 24 low which is the neckline of the double top bear flag and a measured move down towards 3600 based on the height of the 8-month trading range.

- We have said if the bears get strong consecutive bears bars closing near their low, odds will swing in favor of a test of the February low and possibly a breakout below. This remains true.

- Bulls hope that the move up from March 14 is the start of the reversal to re-test the trend extreme followed by a new high.

- The bulls expect at least a small second leg sideways to up, even if there is a pullback first.

- The bulls want next week to be a bull bar, even if the E-mini trades slightly lower first. They see the current move as a 50% pullback of the strong rally from March 14.

- So, which is more likely? A pullback and a continuation higher or a double top bear flag and a reversal lower to test the February low?

- The E-mini is currently trading around the middle of the 8-month trading range. Lack of clarity is the hallmark of a trading range. Trading ranges tend to disappoint both the bulls & bears and have poor follow-through.

- There have not been 3 consecutive bear bars since October 2020. Will next week be another bear bar? Or will the bears be disappointed with a bull bar instead?

- Odds are, the prior leg up from March 14 was a bull leg within a trading range, not the start of a new bull trend.

- Since this week was a bear bar closing near the low, it is a reasonable sell signal bar for next week. Odds are, the E-mini will trade at least slightly lower.

- It may even gap down at the open. However, small gaps usually close early.

- If the bears get another bear bar next week, especially if it is big and closes near the low, the odds will swing in favor of a test of the February low.

- However, if next week trades lower, but reverses to close near the high, odds of a reversal from a wedge bull flag to re-test the March 29 high increases.

The Daily S&P 500 E-mini chart

- The E-mini traded lower testing the March 3 high and stalled around the 50-day moving average for the whole shortened week (market closed on Friday).

- Last week, we said if the 3rd leg sideways to down forms but then stalls around the March 3 high, there would be a wedge bull flag pattern. From there, odds are we will see buyers return and the second leg sideways to up to re-test March 29 high begin.

- We also said if the bears manage to get strong consecutive bear bars trading far below the March 3 high instead, the odds of a test of February low increases.

- The last 4 trading days were sideways and consolidated around the March 3 high. While it did close slightly below the March 3 high, the bears will need to create consecutive bear bars closing far below it to convince traders that a re-test of the February low is underway.

- The bears want the E-mini to reverse lower from a double top bear flag (February 2 and March 29). They then want a strong break below February 24 low and a measured move down to around 3600 based on the height of the 8-month trading range.

- The bulls want the rally from March 14 low to re-test the trend extreme, followed by a breakout to a new all-time high.

- We have said that the rally from the March 14 low was in a tight bull channel and strong enough for traders to expect at least a small 2nd leg sideways to up. The bulls see the current move lower as a 50% pullback and a wedge bull flag.

- There are two problems with the bull’s case: 1) The bears are starting to get big bear bars closing near the low and 2) The bull bars have weak or no follow-through buying.

- The bulls need to start creating strong consecutive bull bars here and prevent the bears from breaking far below the March 3 high.

- The current pullback from March 29 is in a tight bear channel. However, it has a lot of overlapping bars and a wedge pattern. The bears are not as strong as they could be.

- The market has been in a trading range for 8 months. Lack of clarity is the hallmark of a trading range.

- The trading range is more likely to continue than a strong breakout from either direction.

- We will likely see traders BLSH (Buy; Low; Sell; High) at the extremes of the trading range.

- Since Thursday was a bear bar closing near the low, it is a good sell signal bar for Monday. It may even gap down on Monday. Small gaps usually close early.

- Odds slightly favor sideways to down early next week. Traders will be monitoring whether the bulls can create a reversal up from a wedge bull flag, or the bears continue to create consecutive bear bars trading far below March 3 high.

- If the bears manage to get strong consecutive bear bars trading far below the March 3 high instead, the odds of a test of the February low increases.