Market Overview: S&P 500 Emini Futures

The S&P 500 Emini continue trading sideways to up with no credible selling pressure. The bulls see the market as being in a broad bull channel and want the market to continue sideways to up for many months.

If there is a pullback, they want the 20-week EMA or the bull trend line to act as support. The bears need to do more to show that they are at least temporarily back in control. They have yet to do so.

S&P 500 Emini Futures

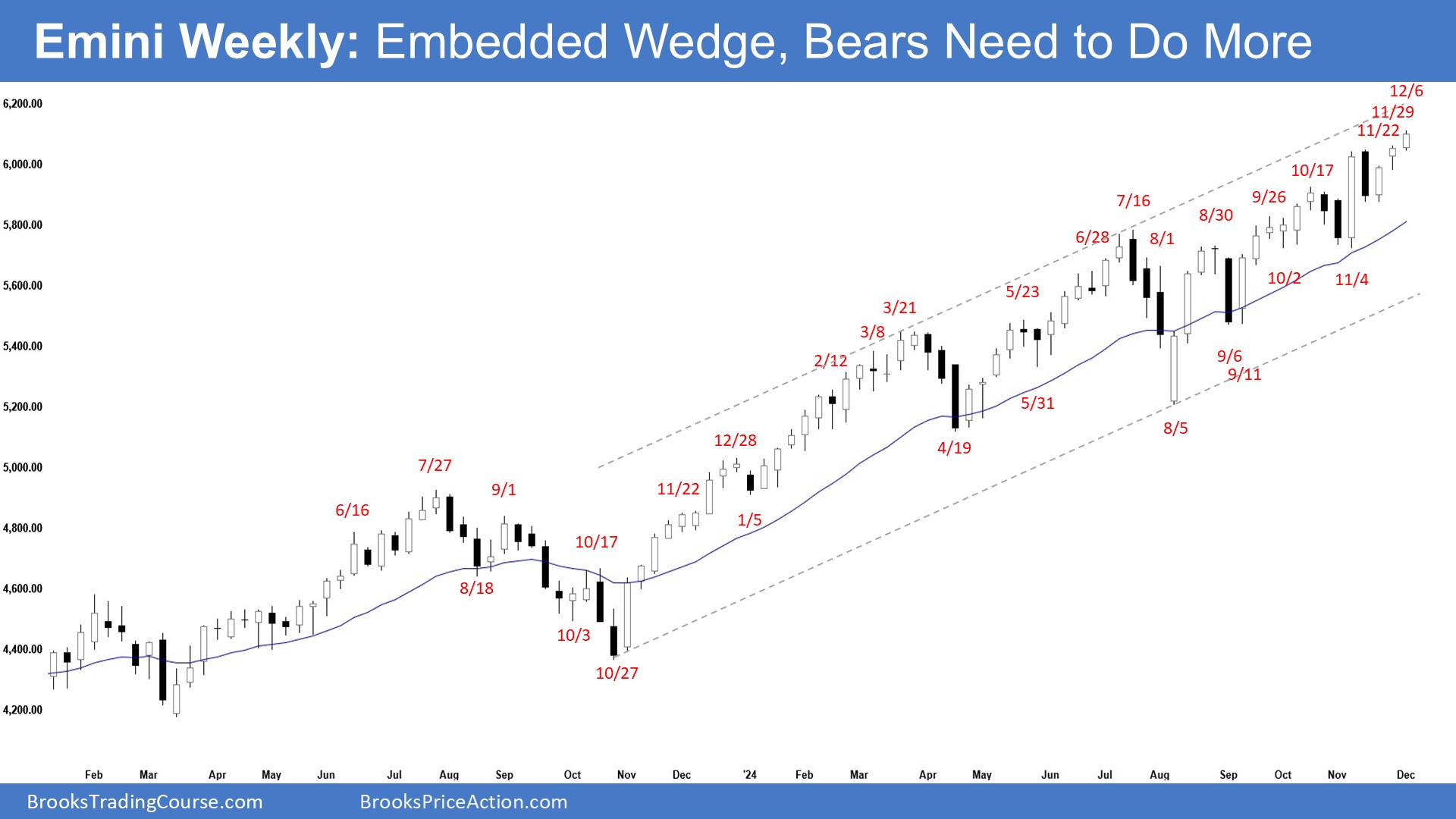

The Weekly S&P 500 Emini Chart

- This week’s Emini candlestick was a bull bar closing near its high and in new all-time high territory.

- Last week, we said the market may still trade at least a little higher. Traders would see if the bulls could create a follow-through bull bar breaking into a new all-time high or if the market would trade slightly higher, but stall followed by some profit-taking activity.

- So far, the market continues to trade higher with no significant selling pressure.

- The bulls got another leg up, creating the wedge pattern (Mar 21, Jul 16, and Dec 6) and the embedded wedge (Aug 30, Oct 17, and Dec 6).

- They see the market as being in a broad bull channel and want the market to continue sideways to up for many months.

- If there is a pullback, they want the 20-week EMA or the bull trend line to act as support.

- The bears want a reversal from a large wedge (Mar 21, Jul 16, and Dec 6) and an embedded wedge (Aug 30, Oct 17, and Dec 6).

- They see the market as being extended and overbought. However, they have not yet been able to create credible bear bars with follow-through selling.

- They need to create consecutive bear bars closing near their lows to show that they are back in control.

- Since this week’s candlestick is a small bull bar closing near its high, it can be a buy signal bar for next week.

- For now, the market may still trade at least a little higher.

- Without significant credible selling pressure with sustained follow-through selling, traders will not be willing to sell aggressively.

- Traders will see if the bulls can create another follow-through bull bar breaking into a new all-time high.

- Or will the market trade slightly higher but start to stall and close with a bear body or a long tail above instead?

- The move up since October 2023 while strong, has lasted a long time and is slightly climactic. The odds of a deeper pullback are increasing.

- However, the bears need to do more to show that they are at least temporarily back in control. They have yet to do so.

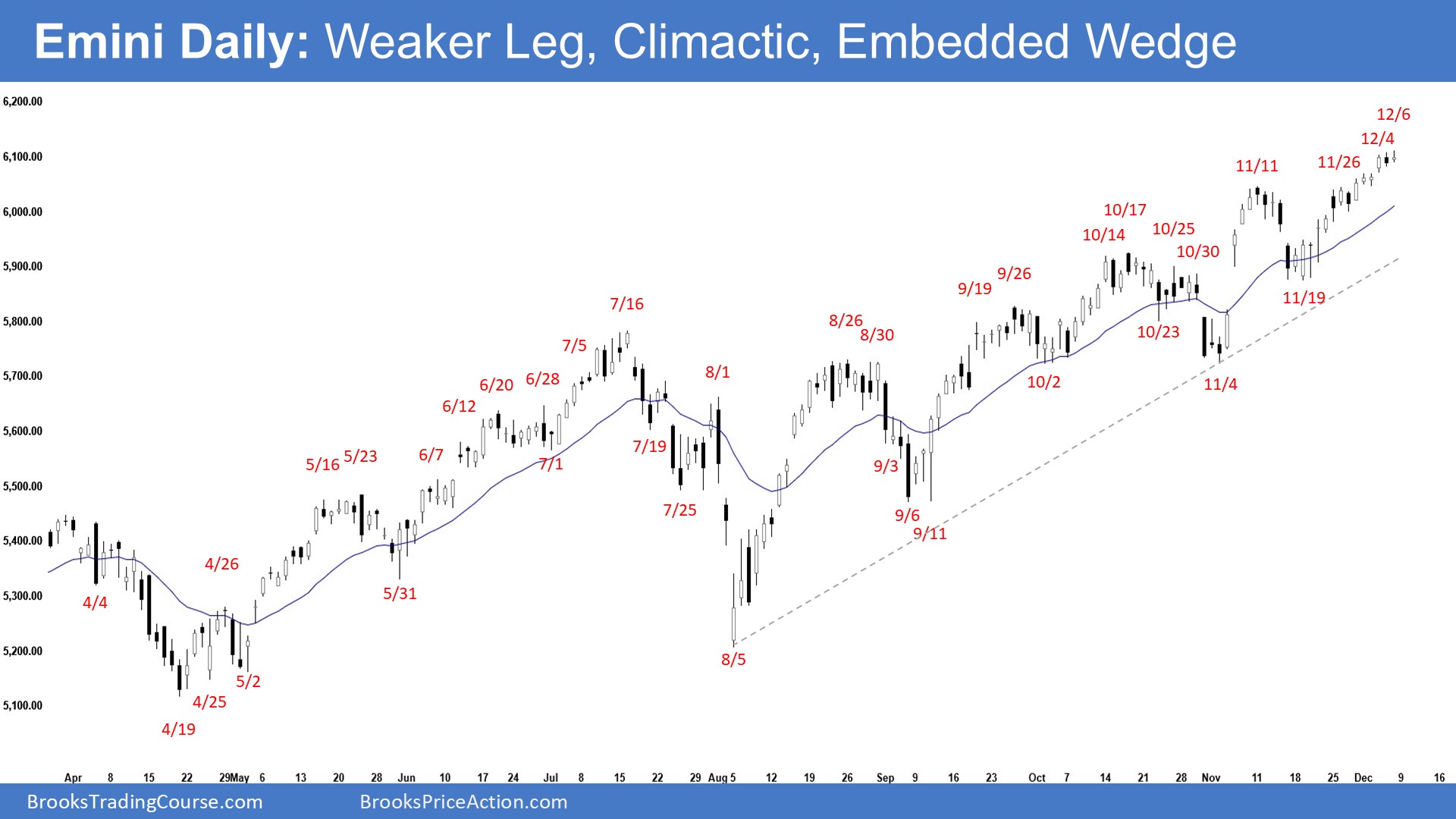

The Daily S&P 500 Emini Chart

- The market traded sideways to up for the week. The candlesticks have small bodies with prominent tails (looking like trending doji bars).

- Previously, we said the market may still trade slightly higher to retest near the November 11 high area. Traders would see if the bulls could create a strong retest and breakout above the November 11 high or if the sideways to up leg would be weak.

- While the market traded higher this week, the candlesticks have small bull bodies and prominent tails which indicate weaker momentum (compared with prior legs).

- The bulls got the third leg up creating the large wedge pattern (Mar 21, July 16, and Dec 6) and the embedded wedge (Aug 30, Oct 17, and Dec 6).

- They see the market trading in a broad bull channel and want the move to continue for many months.

- If there is a pullback, they want the 20-day EMA or the bull trend line to be support areas. They want an endless pullback bull trend.

- The bears want a reversal from a large wedge pattern (Mar 21, Jul 16, and Dec 6) and an embedded wedge (Aug 30, Oct 17, and Dec 6).

- They see the current move as part of a buy climax.

- They want a pullback lasting at least a few weeks – a TBTL (ten bars, two legs) pullback.

- They need to create consecutive bear bars closing near their lows trading far below the 20-day EMA and the bull trend line to show they are back in control.

- So far, the market continues to trade higher with increasingly smaller bull bars in search of sellers. The move up is becoming climactic.

- For now, while the market may still trade slightly higher, the risk of a minor pullback to the 20-day EMA or the bull trend line is increasing.

- Traders will see if the bulls can continue to create more bull bars.

- Or will the market start to stall and form a two-legged sideways to down pullback within the next few weeks?

- The move up since October 2023 has lasted a long time. The wedge and embedded wedge increase the odds of a pullback lasting at least a few weeks.

- The bears need to do more to show that they are back in control. Until they can do that, traders will not be willing to sell aggressively.