Summary & Key Takeaways:

- Inflation has moderated, while the lead indicators of inflation suggest benign prints are likely for the rest of 2024. Wage growth should also continue to trend down into year end.

- These dynamics should allow the Fed to undertake one or two rate cuts in the coming quarters.

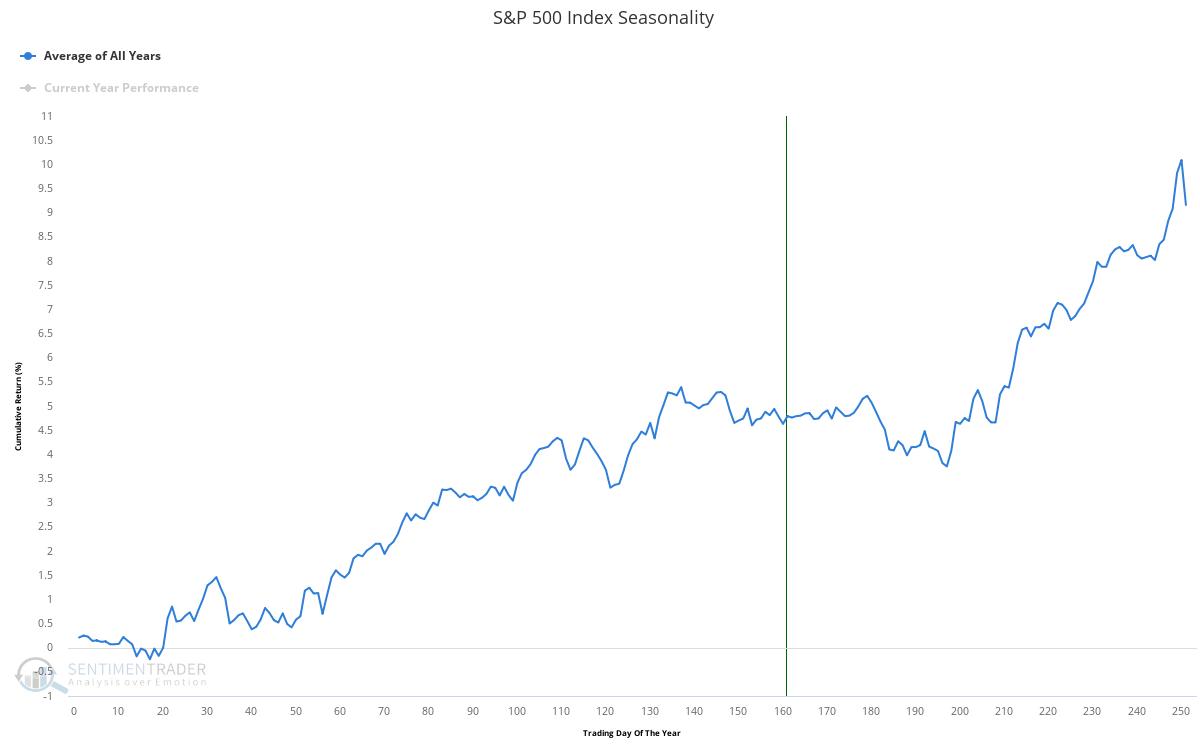

- Positioning, liquidity and financial conditions are all relatively supportive of the stock market, but investors should be aware there remain some immediate headwinds in the form of seasonality and short-term growth risks. Stocks have aggressively priced in a rebound in economic growth.

- Overall, the stock market should be relatively be well supported into year end, with the potential for the Fed cutting rates and tapering QT amidst a robust economy a recipe for a blow off top.

Inflation Pressures Remain Subdued, For Now

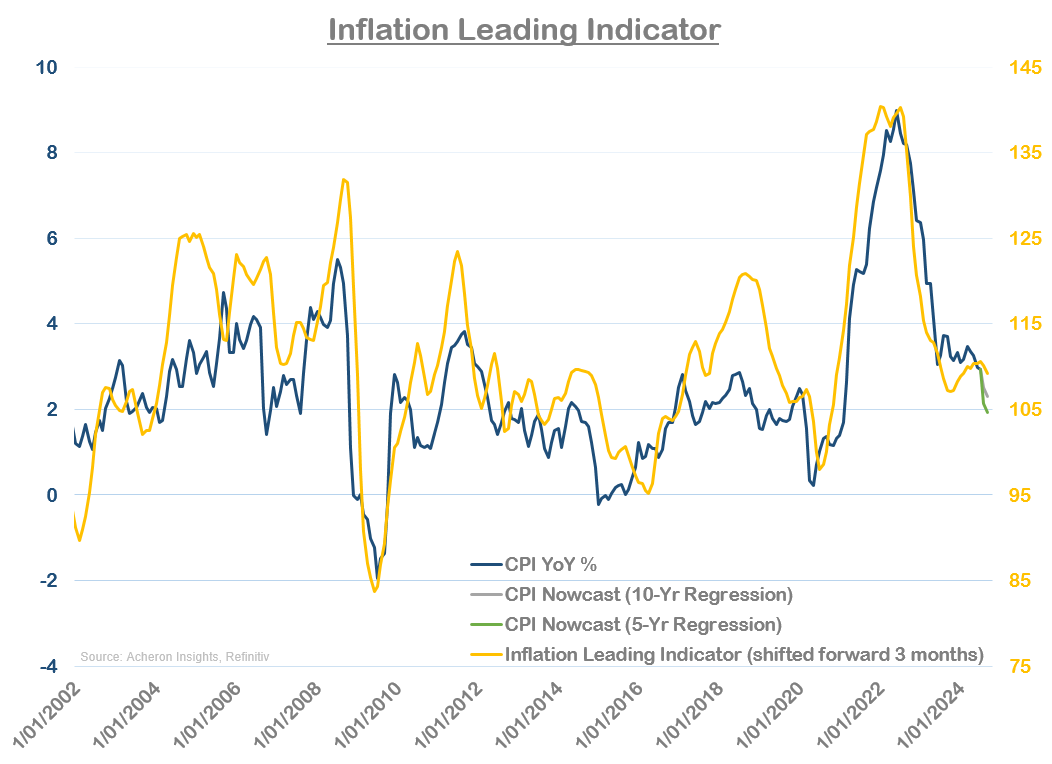

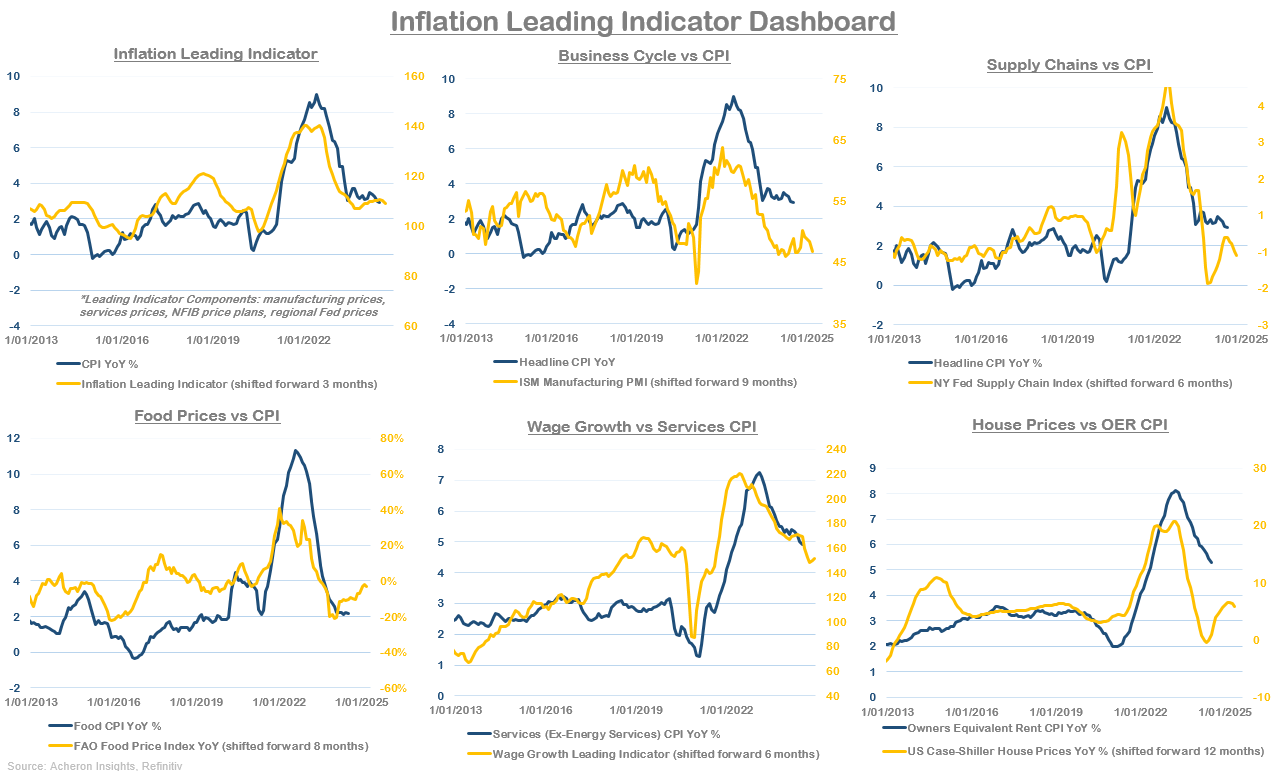

While elevated, inflation continues to moderate around the 2.5%-3% level. When we consider recent inflation trends in context with what the inflation lead indicators are suggesting, the outlook remains relatively robust on the inflation front.

None of my primary lead indicators are pointing to material upside inflation pressures over the medium-term. Thus, I would think over the next quarter at least (and probably the rest of 2024) we should see relatively benign inflation prints, particularly if wage growth moderates and Services/Rent CPI trends lower.

Owners’ Equivalent Rent CPI looks to potentially be the biggest concern, given the spike in house prices we have seen of late, but I’m not sure we see notable upside pressures from an OER front in the short-term.

We will probably start to see some upside pressures from Goods and Food CPI at some point soon, but at this stage, I suspect they are unlikely to be overly impactful. Even with inflation unlikely to return to the 2% level for any prolonged period of time (if at all), the overall outlook remains relatively supportive of easier monetary policy over the short to medium-term.

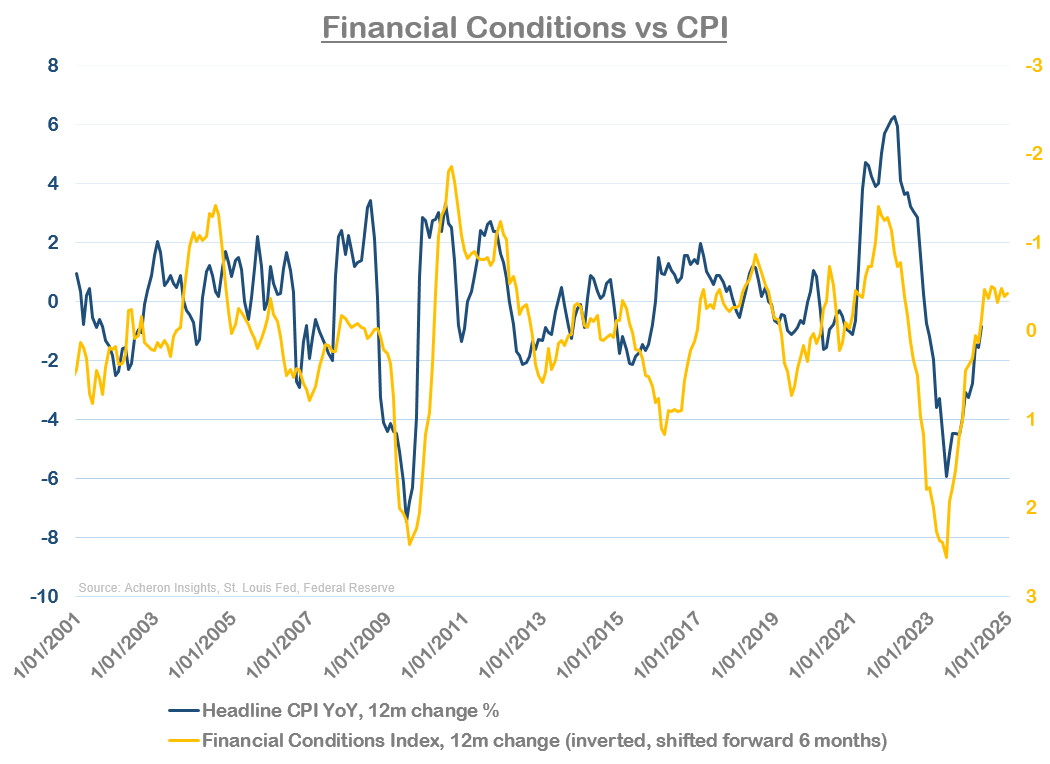

Even financial conditions (compared below to the second derivative of CPI) is pointing to moderating upside CPI momentum over the next six months.

Employment and wages also support easier monetary policy

Similar to the inflation front, the jobs market also continues to trend in the right direction from a monetary policy perspective.

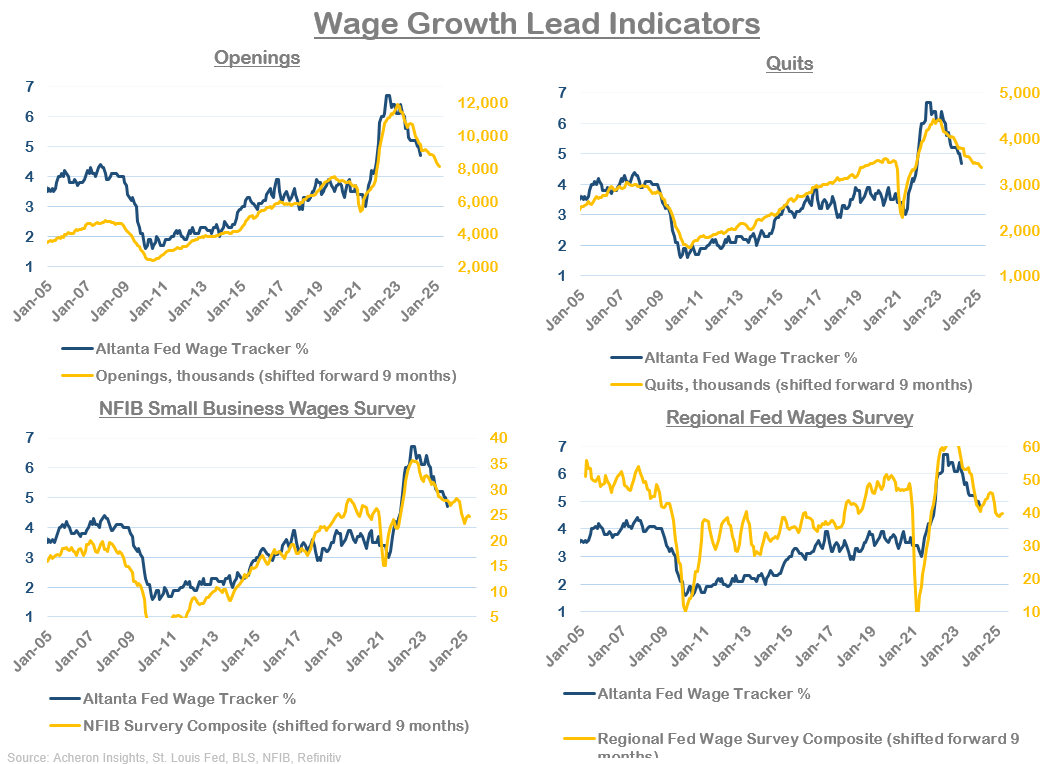

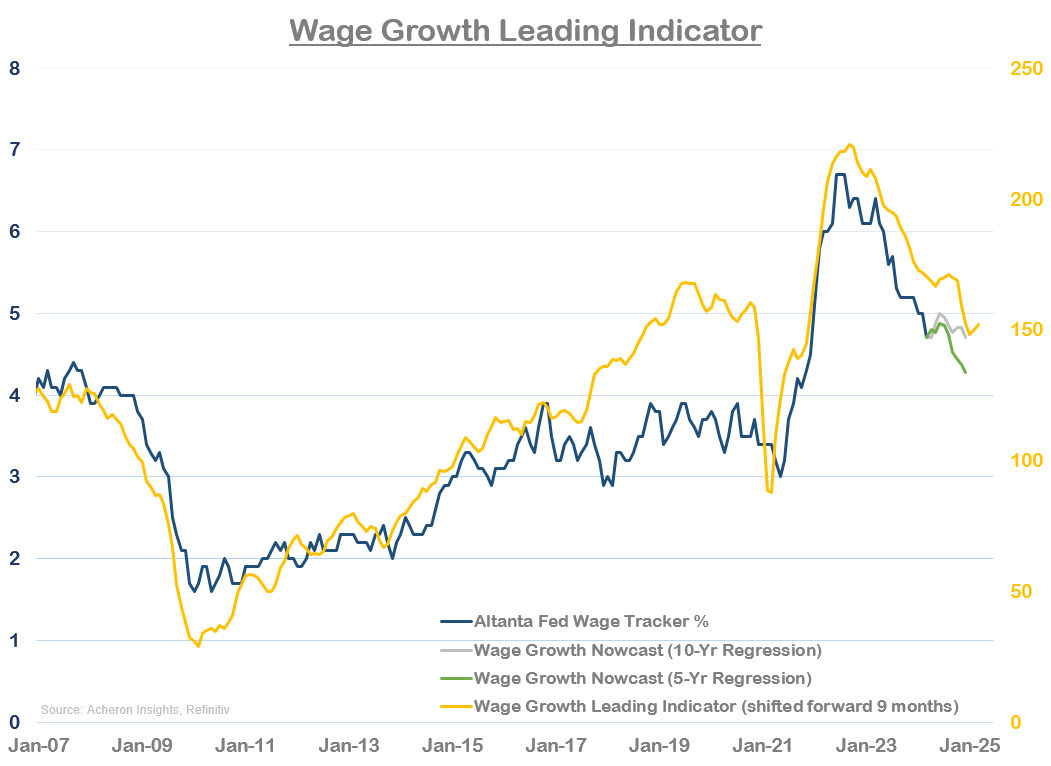

Lead indicators of wages are unanimously pointing to downside wage growth for the rest of 2024, a trend likely to translate into downside services inflation pressures (particularly as it relates to Rent CPI).

Even if wage growth finds a trough at much higher levels to what we have seen in recent decades, the cyclical outlook on the wage front continues to appear supportive of easier monetary policy, similar to inflation. At times like this it is important to differentiate between cyclical and secular trends.

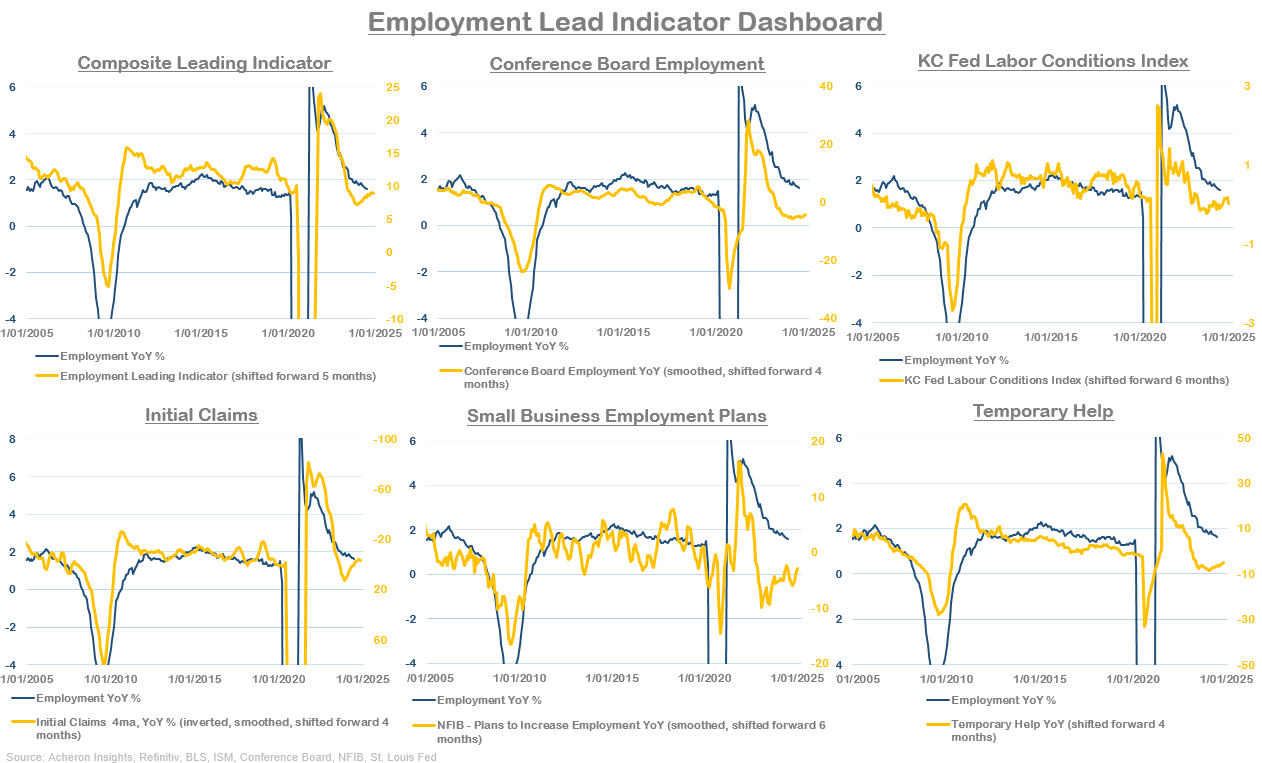

On the employment front, as I have stated for much of 2024 does not appear to be signaling an imminent spike in the unemployment rate. Employment growth lead indicators have all bottomed and are turning higher, suggesting employment growth is likely to do the same.

As a result, I continue to be of the belief the concern surrounding impending deterioration in employment data to recessionary levels is overblown. I understand that unemployment is reflexive and could well move higher from here, but in a situation such as this, I am always going to rely on what the leading indicators are signalling. It’s also important to remember much of the weakness we have seen in employment data of late has been as a result of an increase in labour supply, no necessarily layoffs.

From a monetary policy perspective, this may appear somewhat at odds with the dovish message wage growth is sending, but I think it’s fair to say current employment data is at levels that does not require tighter monetary policy. That employment growth also appears unlikely to move meaningfully higher until later in 2024 also appears supportive of easier monetary policy.

Rate Cuts Incoming

It’s no secret the Fed wants to cut rates. And as we have seen, both inflation and employment leave the Fed in a situation where they can easily get away with one or two cuts in addition to the taping of their QT program.

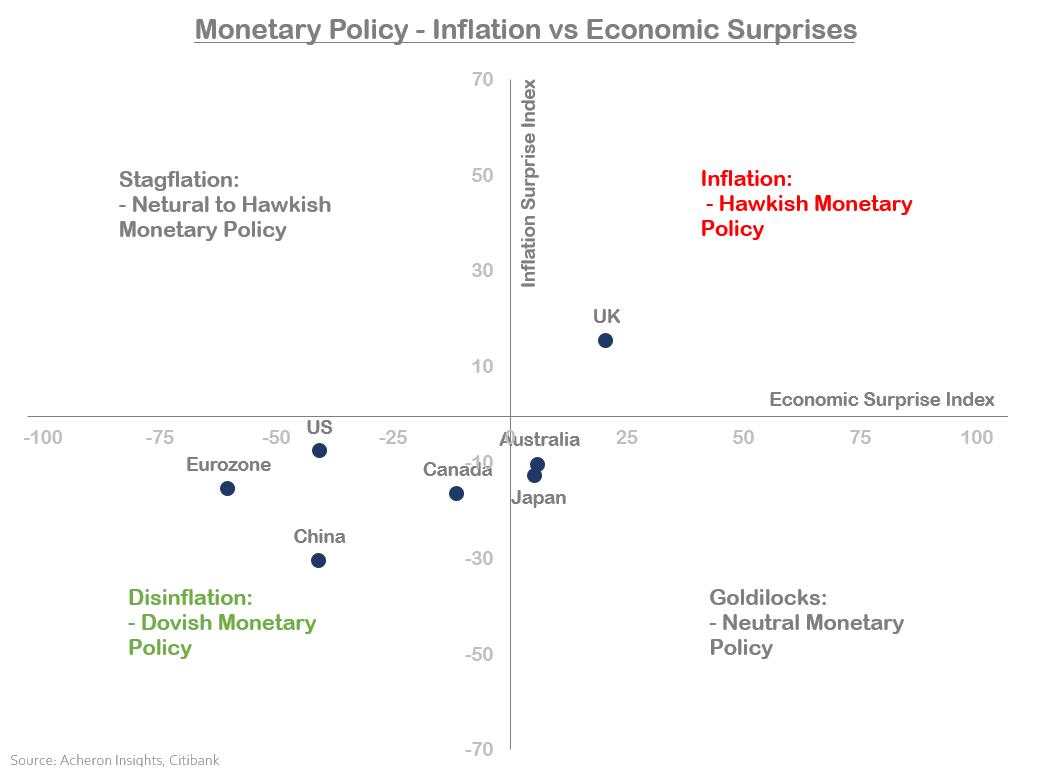

Recent downside surprises in both inflation as well as economic growth are supportive of this, as we can see below.

Similar trends can be seen in both the Eurozone and Canada, suggesting the global easing cycle should continue for the time being.

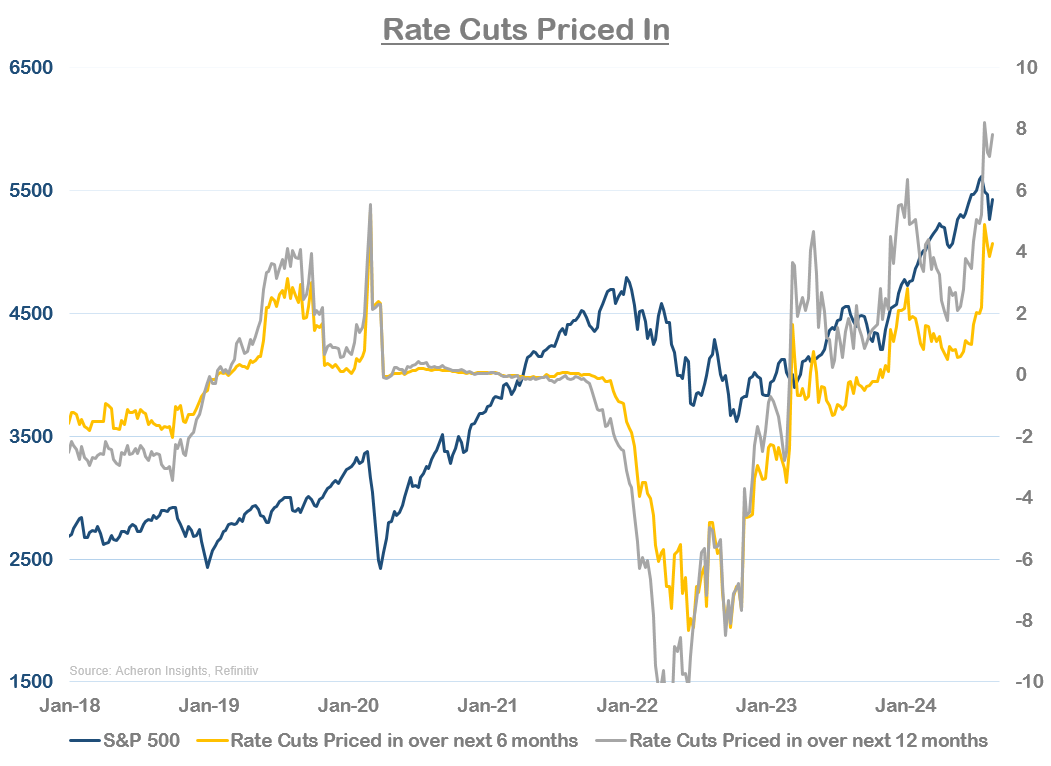

Unsurprisingly, following the de-rising earlier in August that was driven by the dollar/yen unwind among other factors, the market has been quick to once again price in rate cuts. The rates traders now expect around four cuts over the next six months, with at least one cut this September. Now, I do not think we get four cuts over the next six months, nor do I think we get more than one cut at the September meeting, but I do think the data will remain relatively supportive of rate cuts over the next six months, giving markets little reason to price in less any time soon.

The big risk is if J-Powell surprises the market with hawkishness at this week’s Jackson Hole event, which could trigger some short-term unwinding of the aggressive level of rate cuts priced in. But on net, monetary policy should be supportive of risk assets over the next couple of quarters given the short-term outlook for inflation and employment. Importantly, easing monetary policy into an economy which is robust and financial conditions are already loose appears to me a recipe for a blow-off top in stocks.

The economic outlook remains constructive, though not outstanding

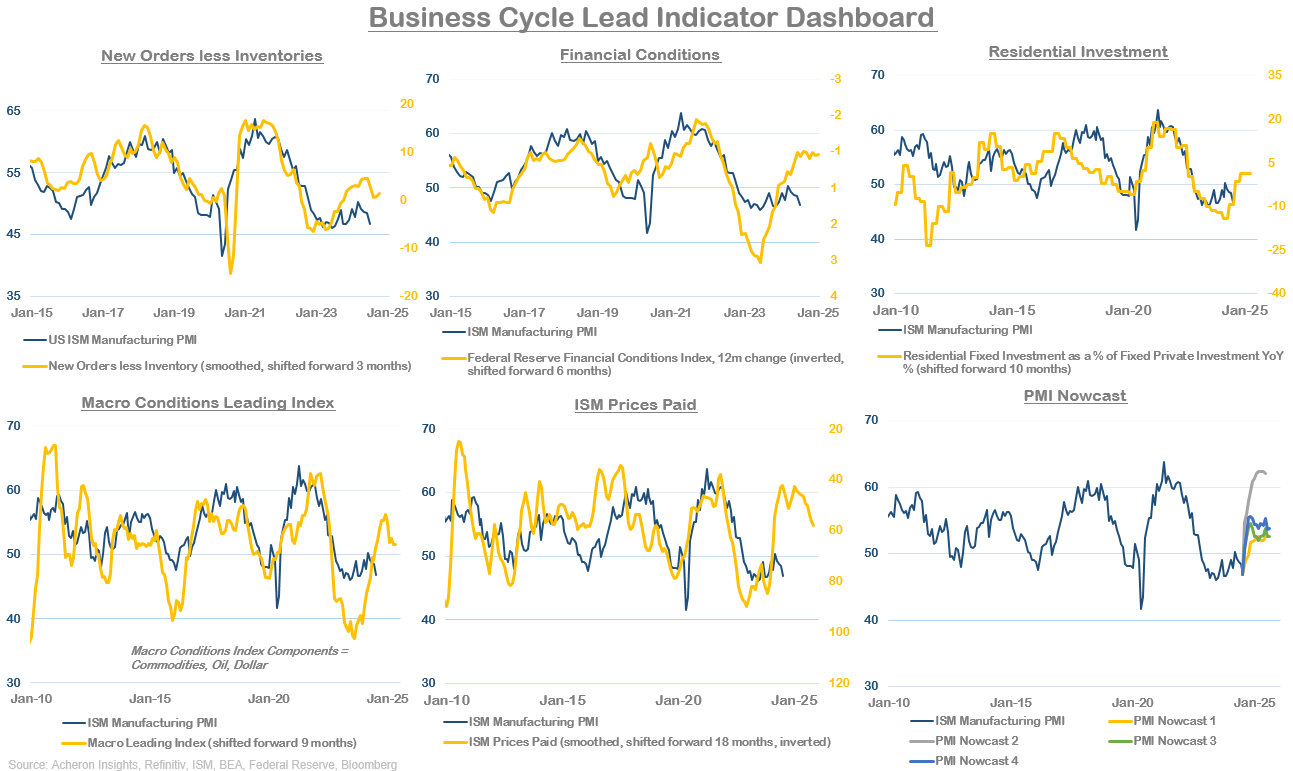

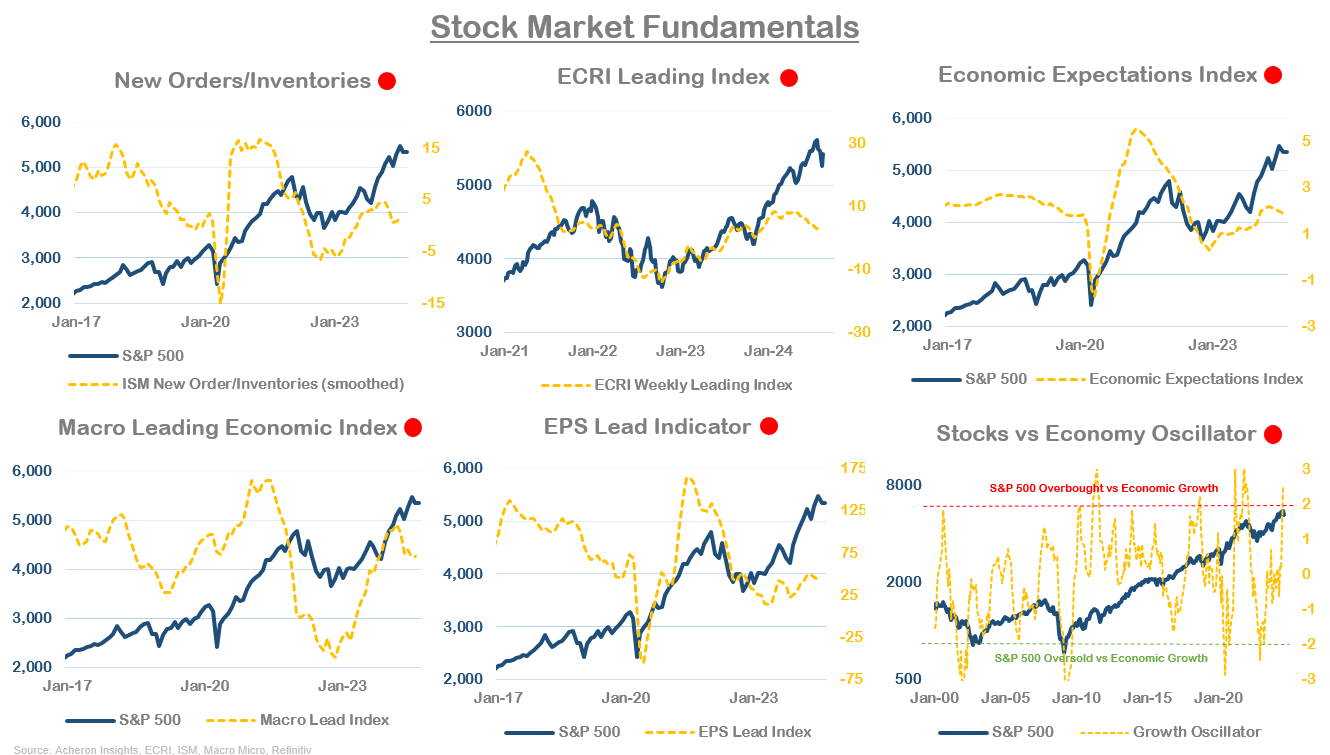

Speaking of the growth picture, where the data has been much less supportive of the stock market in recent months has been from an economic perspective. Although the majority of lead indicators have been and remain relatively supportive of the business cycle over the medium-term (as we can see below), the market aggressively priced this in during the first half of the year.

I wrote in depth recently regarding my outlook for the US and global business cycles here, with my overall outlook being the US business cycle appears constructive, with recent hard data weakness driven by the most lagging areas in the form of incomes and employment.

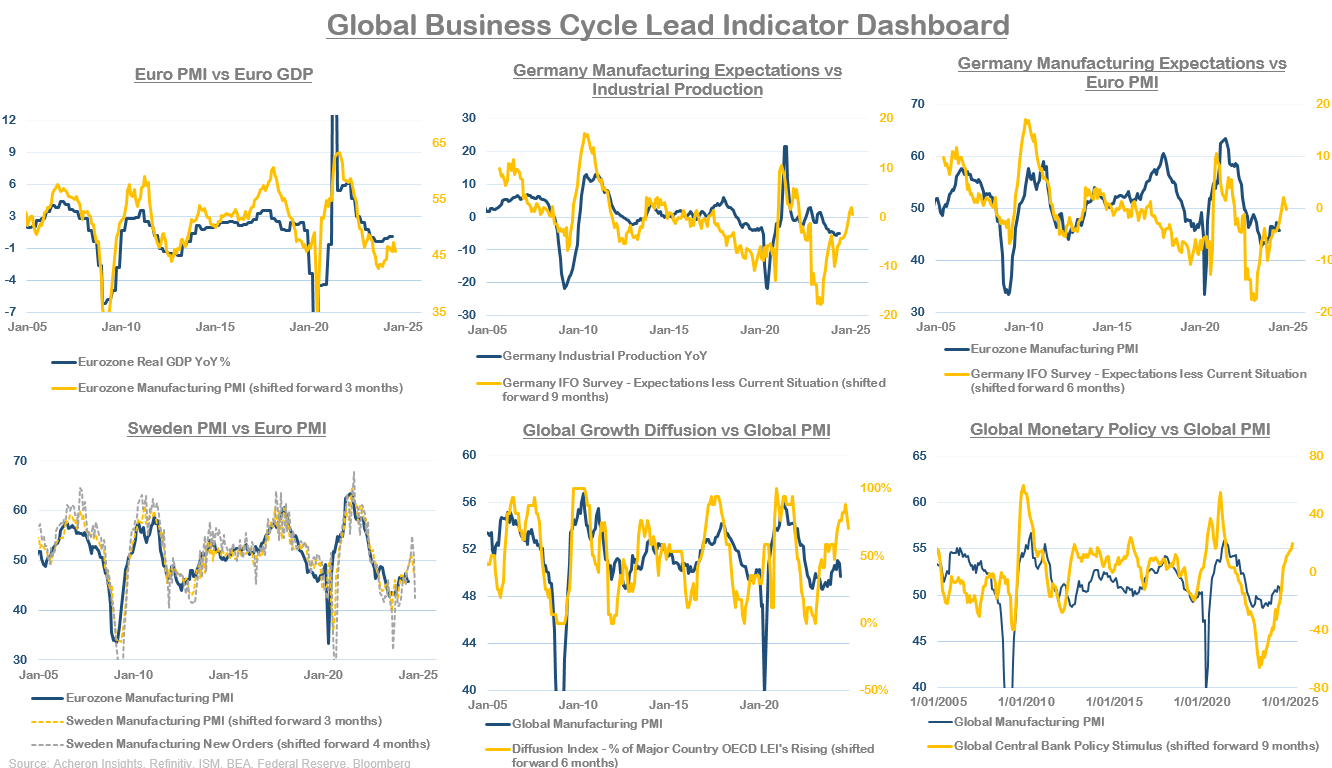

Although some of the short-term lead indicators of the business cycle weakened over the past quarter (such as the ISM New Orders/Inventories spread) which led to recent downside surprises in economic growth, the majority of medium-term lead indicators remains constructive. This is true for the US above, and the global business cycle below.

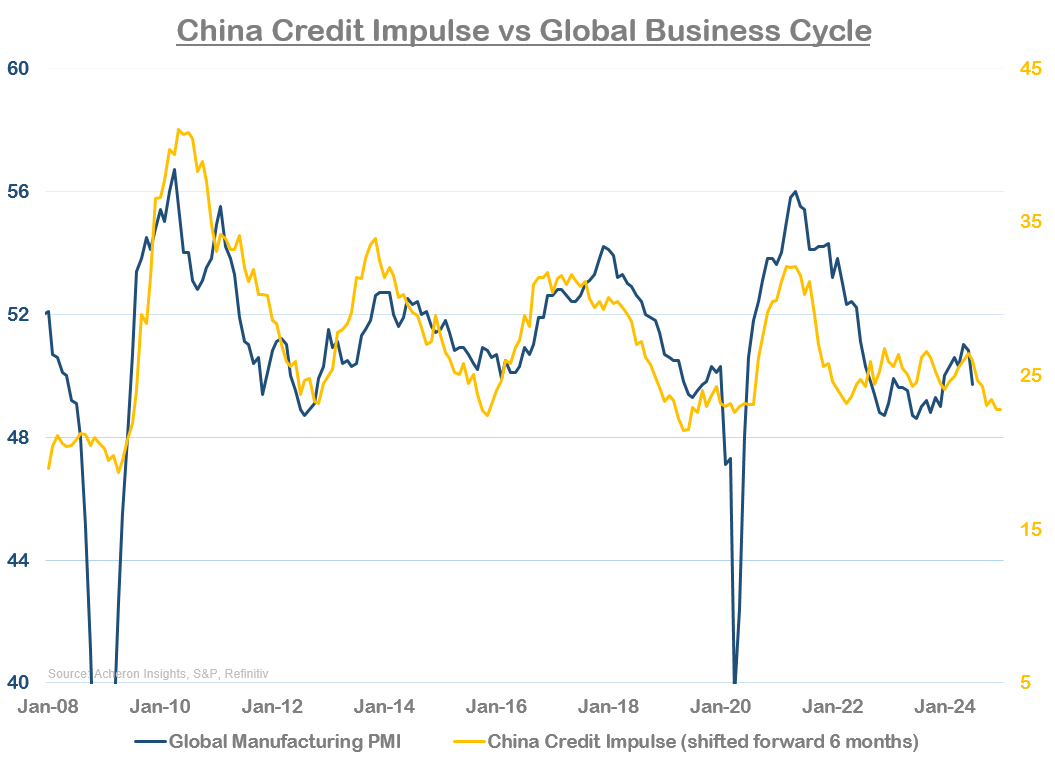

Having said that, an important player in the global economy has been exceptionally weak of late. That is China. Weak Chinese growth will constrain any upside to the global business cycle in the short-term, as we can see below.

Positioning, liquidity and financial conditions should continue to support stocks

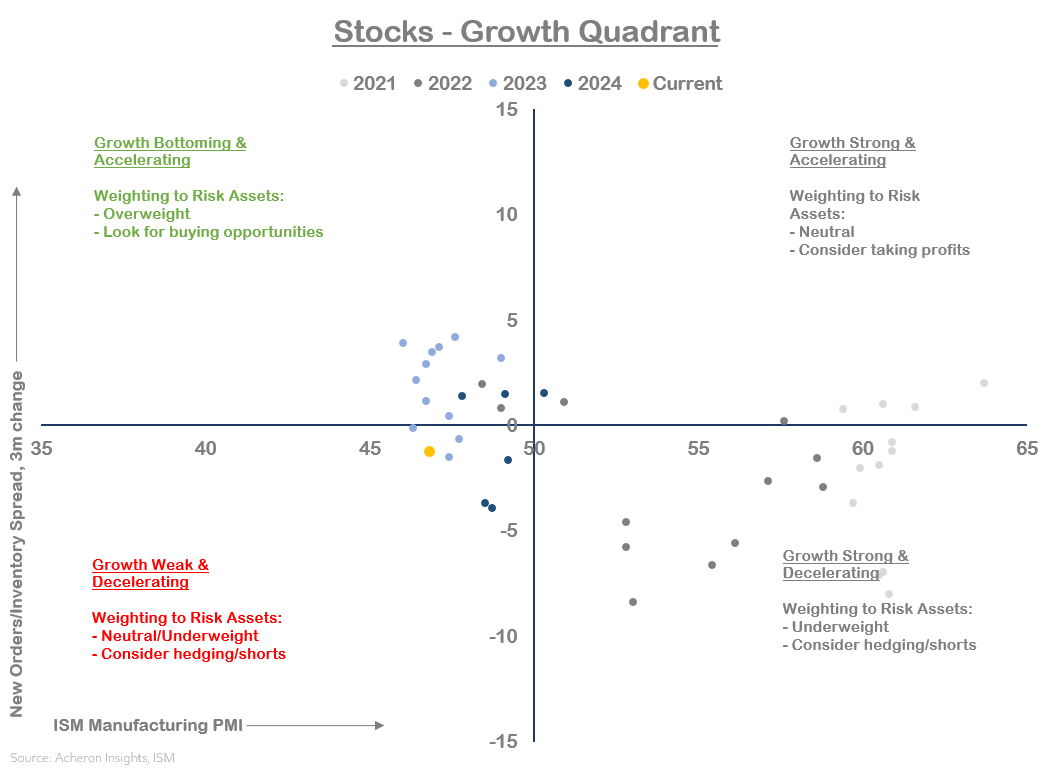

This aggressive pricing by the stock market of the positive growth outlook left if vulnerable to short-term downside disappointments in economic growth, which is exactly what we have seen over the past few months. As we can see below, this largely remains true as of today.

The market remains overbought versus economic fundamentals. But, given the business cycle outlook appears far from bearish, we may need to see stocks trend sideways for a little longer until some of the data and short lead indicators improve. Should this occur, along with rate cuts and easing QT by the Fed, the bull case for stocks should reignite.

But for now, my stock market growth quadrant remains in the bearish zone.

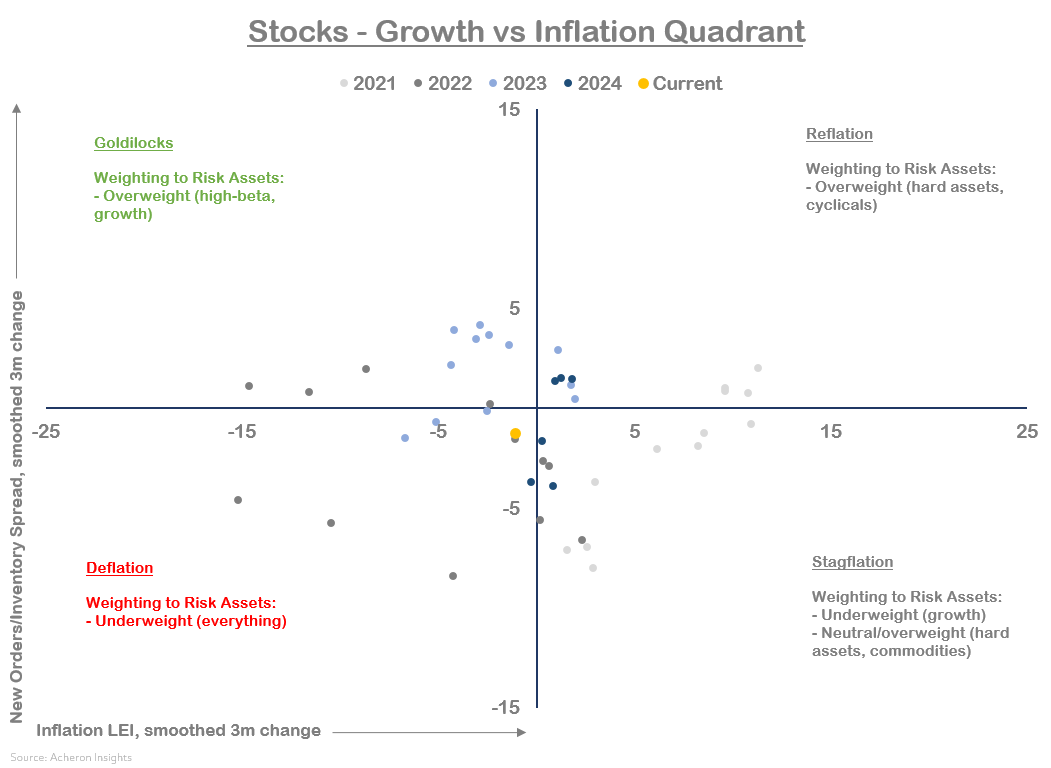

The same can be said of my growth vs inflation quadrant.

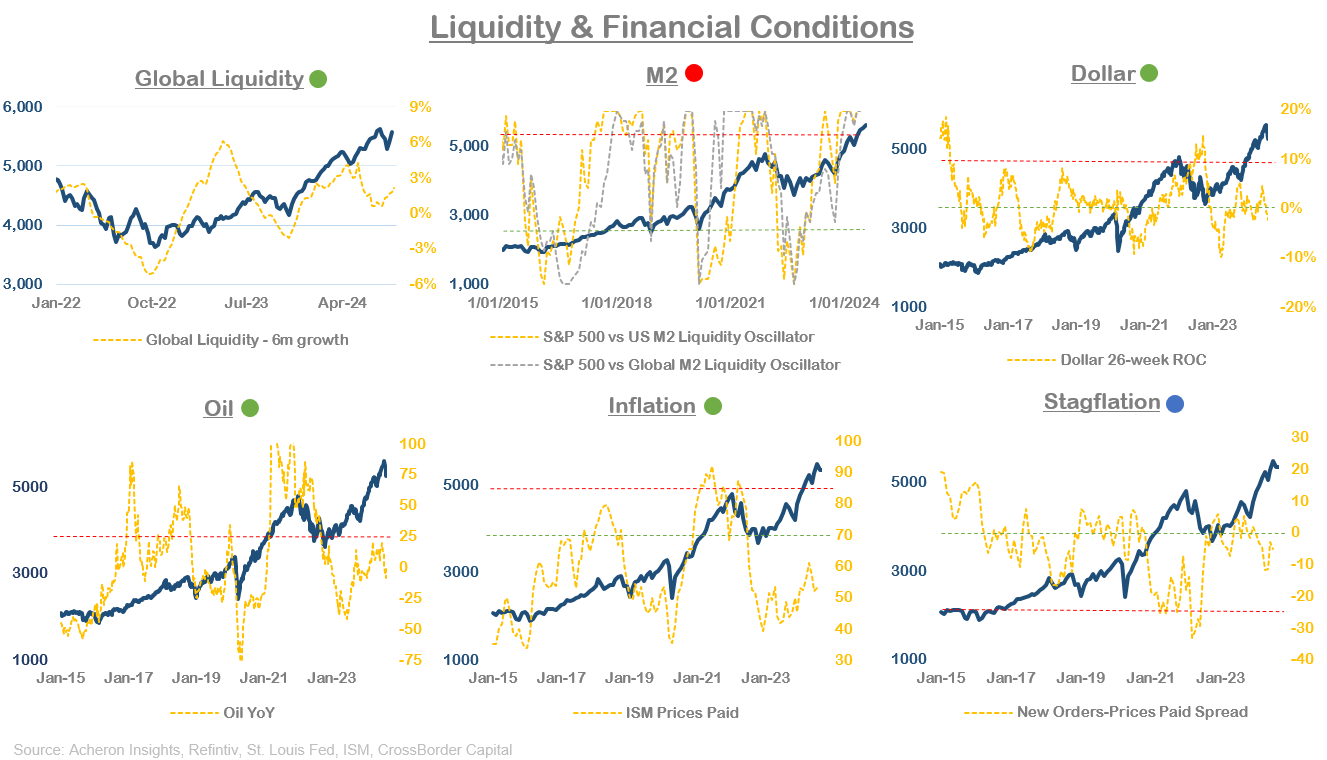

But we must remember, economic fundamentals are not the only driver of stocks. Liquidity and financial conditions are also important considerations, and as we can see below, they are currently supportive of the market. Importantly, the past few weeks has seen two important factors in global liquidity tick higher and the dollar lower. Inflationary pressures and oil prices also remain at comfortable levels for stocks.

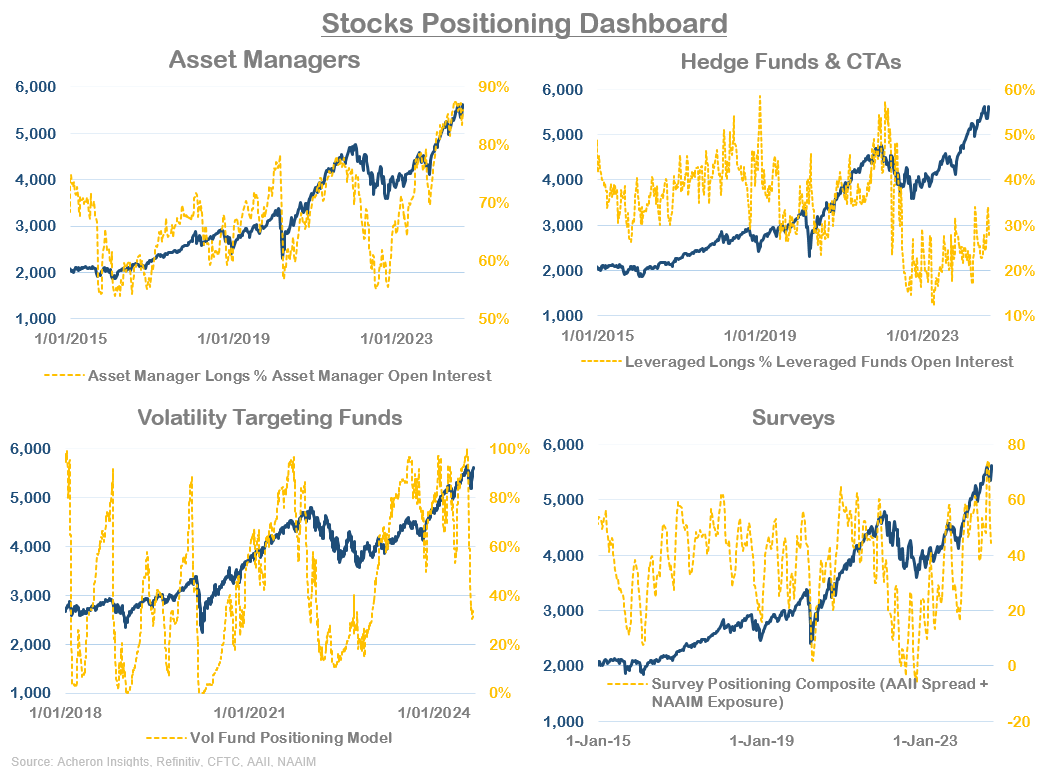

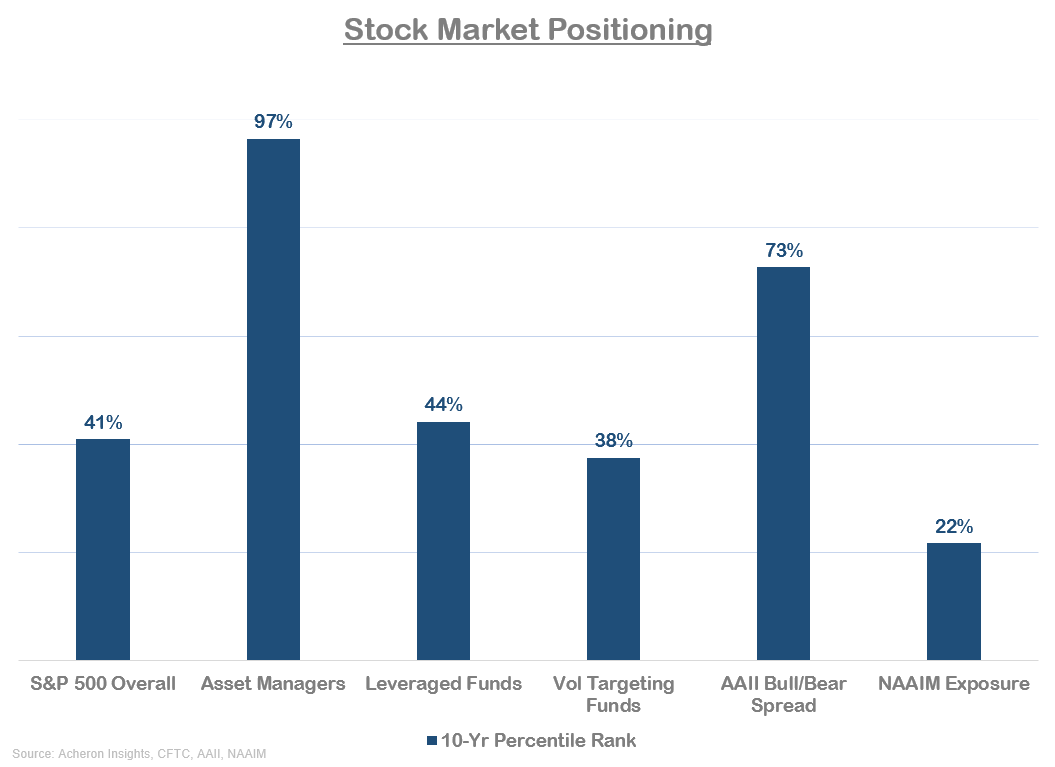

Meanwhile, August’s sell-off also saw a very constructive washout of excessive sentiment and positioning. Although asset managers remain massively overweight stocks, hedge funds and systematic/trend following positioning has moved to much more favourable levels. We have also seen investor surveys move back to much more neutral levels.

As it stands, sentiment and positioning are no longer the headwind they were for the market a month ago.

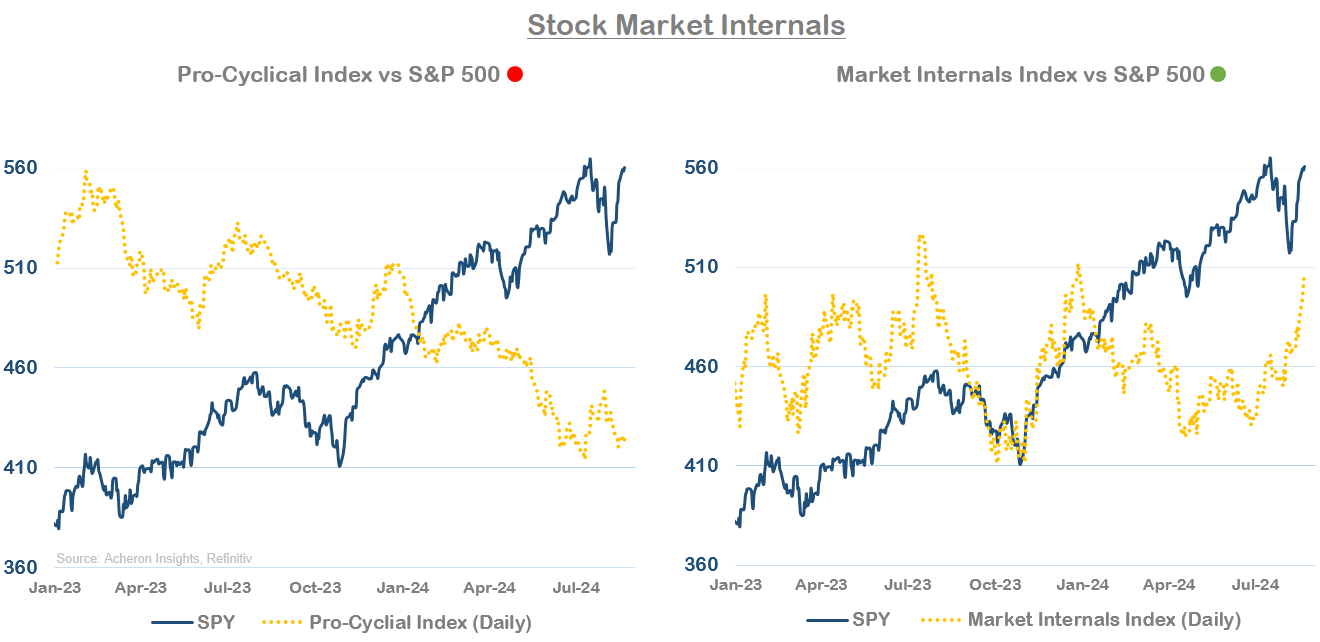

We have also seen significant improvement in stock market internals over the past couple of weeks. While my pro-cyclical index has been trending lower as cyclical and economically sensitive stocks continue to underperform the market, my overall market internals index has soared higher. The high-beta/low-beta ratio, credit spreads and dollar are currently the most supportive factors.

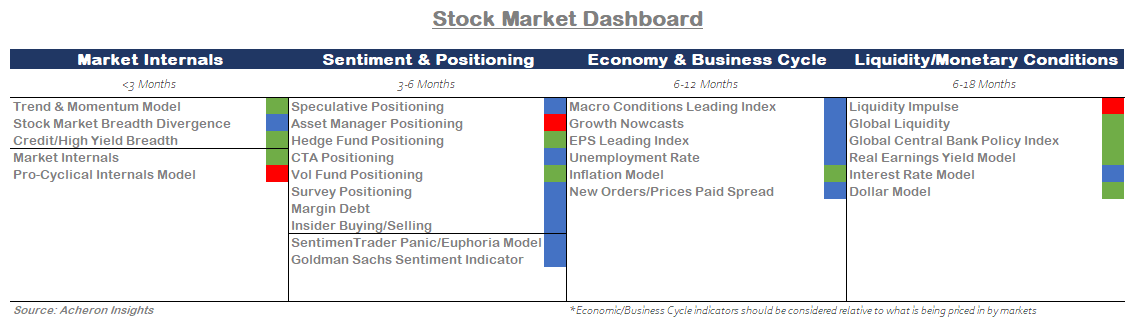

Putting this all together, this leaves my stock market indicator dashboard predominately with neutral to bullish readings.

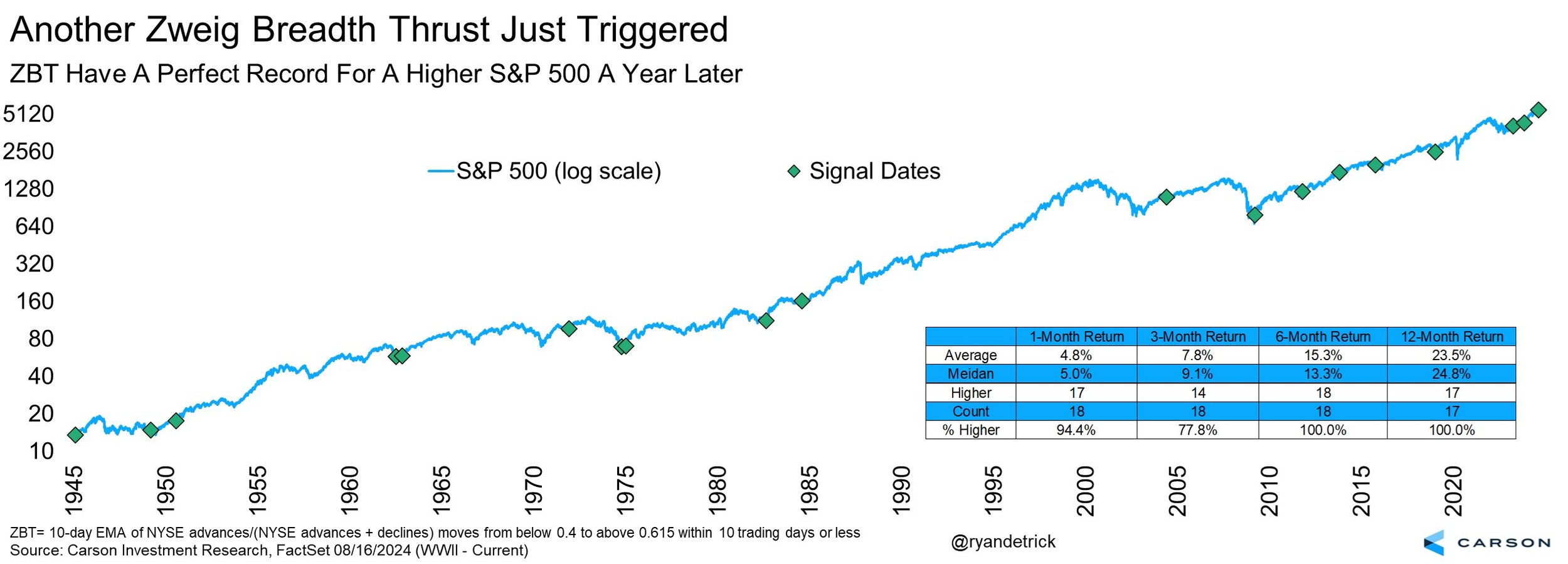

Also worth noting is the Zweig Breadth Thrust buy signal that triggered on recent rally following August’s sell-off, which generally has been one of the most reliable buy signals for stocks over the medium-term.

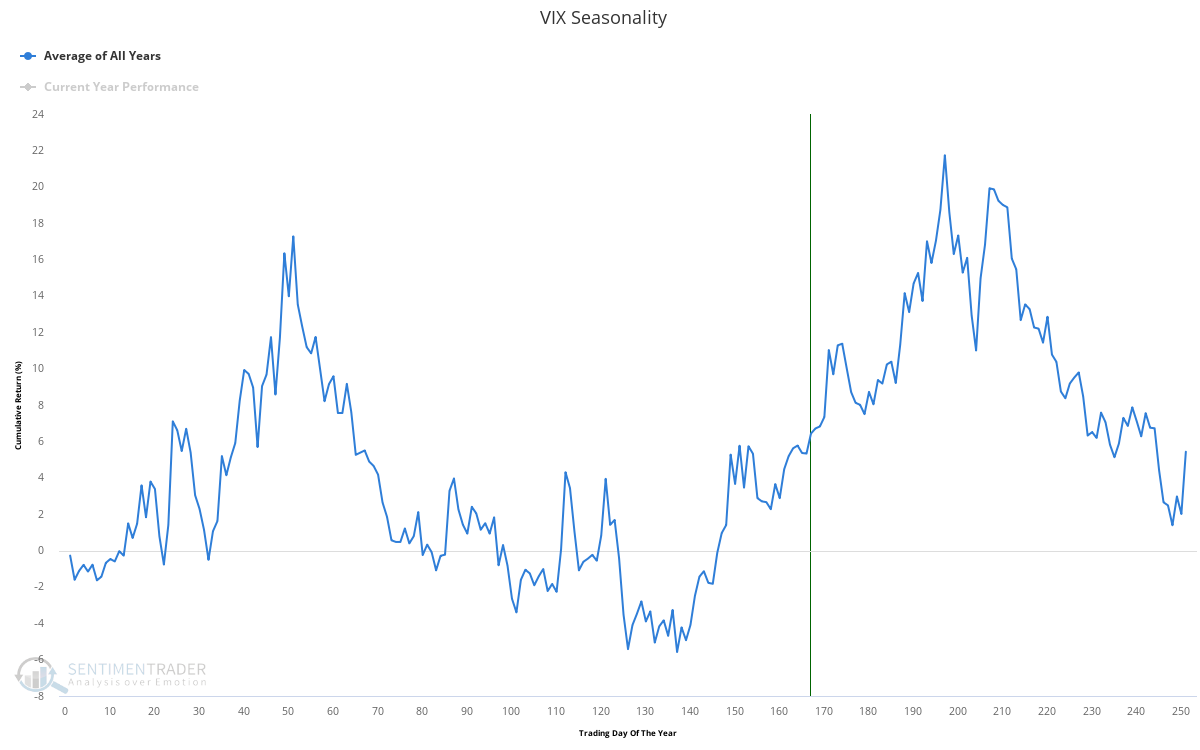

One final point I would like to mention however is seasonality, which is another factor that could keep a lid on stocks over the short-term. Not only are stocks generally sideways to down in the September to early October period, but we have also just entered what is one of the longest monthly options expiration periods of this year. This leaves the market particular susceptible to adverse flows during the weeks leading up to mid-September.

Volatility is generally much higher during this period of the year as a result.

By no means does this dynamic justify a sell-off, but is a point worth highlighting in the context of the market remaining heavily overbought relative to underlying economic fundamentals. As a result, I remain cautious stocks over the short-term, but relatively constructive risk assets over the medium-term.