As we close out the week and watched the markets trade in a rotational price manner, it became very clear to us that the patterns setting up in price continue to support our overall analysis of the markets and the potential for a bigger downside price move. We issued a call that an August 19th breakdown was expected on or near the trigger date (Aug 19th). We’ve taken some heat from our followers and readers regarding this call and the fact that the markets have yet to really breakdown below current support levels.

As we’ve learned from our experience and previous analysis/calls – the markets can continue to act in ways that run counter to our analysis for much longer and in a much more irrational manner than we can survive the risks associated with any irrational price moves. Yet, at this point, we don’t see anything irrational in the markets – we see opportunity.

Our last few trades for our members have been incredible successes – totaling more than +30% over the past 5 trades. We believe our research team and proprietary price and predictive modeling systems have clearly identified price weakness in the markets. Until price confirms otherwise, our believe is that price will attempt to move lower – establishing new lows.

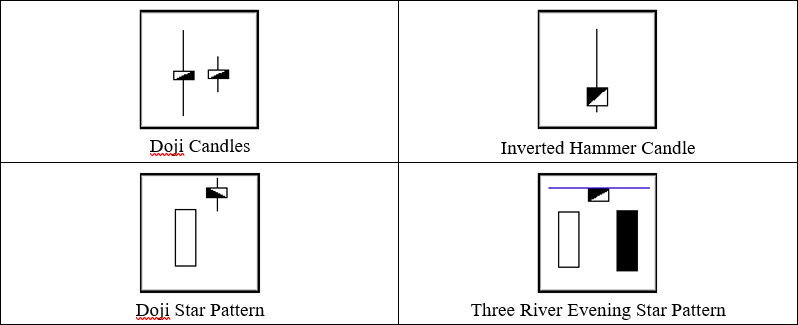

Important Japanese Candlestick Reversal Patterns

The Doji Star and Shooting Star Japanese Candlestick patterns are part of a unique group that identifies potential price reversals, support/resistance and can often build into other types of patterns. Our belief is these setups in the current chart will eventually create an Evening Star formation with a downside price move early next week. This type of pattern would confirm resistance near the body of the current Doji or Shooting Star candlestick and also confirm our analysis that a price breakdown should continue.

S&P 500 – ES Daily Chart Highlights the Doji Reversal Pattern

This ES Daily chart highlights the Doji pattern created by the close of Friday trading near 2923.75. The fact that price narrowed on Friday into a Doji pattern forming below the previous highs suggests general weakness in price and a possibility that early next week we may see price breakdown to complete a Harami or Doji Star Reversal Pattern.

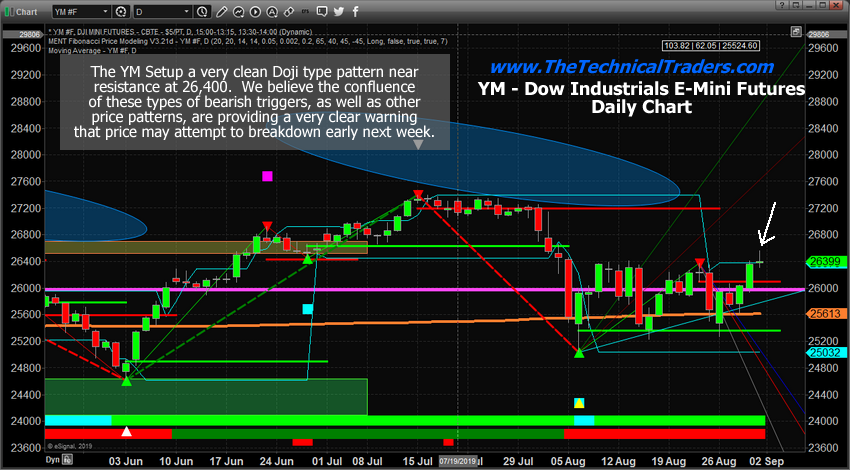

Dow Jones 30 Futures – YM Daily Chart Highlights the Doji Star Reversal Pattern

This YM Daily chart shows a similar pattern – another Doji Star setup. The Doji pattern sets up right at a key resistance level, near 26,400, and aligns with other chart and patterns to warn that price may weaken into a strong Candlestick reversal pattern. All it would take is for the price to move below 26,000 and begin a new downside leg.

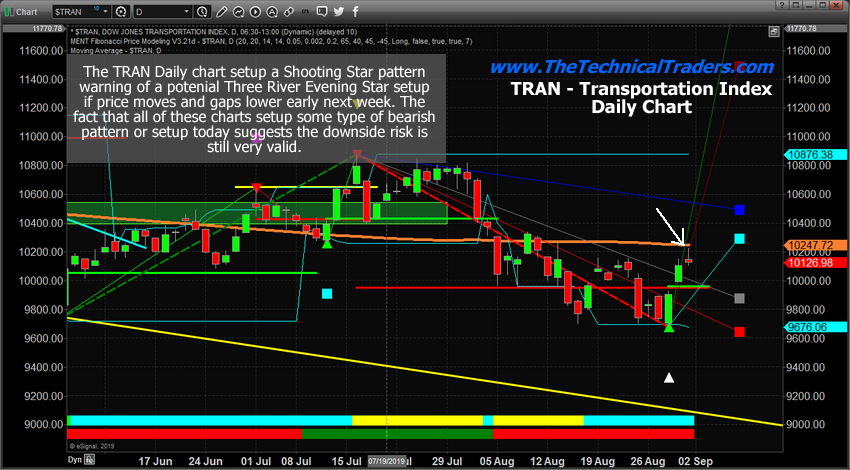

Transportation – TRANS Daily Chart Highlights the Shooting Star Reversal Pattern

This Dow Jones Transportation chart shows a true Shooting Star pattern. The unique shape of the Inverted Hammer candlestick (part of the Umbrella Group) shows clearly. The gap between the last to candlestick bodies sets up the Shooting Star pattern. This is a classic Top Reversal setup. Found at this point in price action suggests price may be set up for a big breakdown. At the very least is shows clear resistance is at 10,130 and that we must be aware that price was rejected at this level.

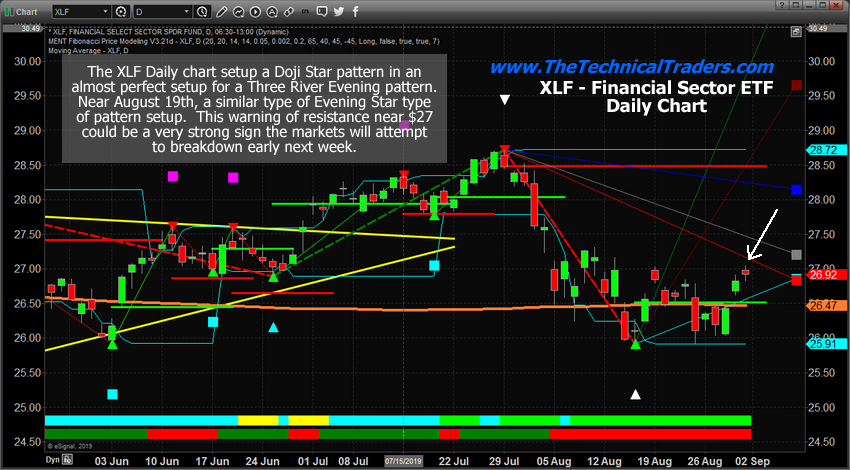

Financials – XLF Daily Chart Highlights the Doji Start Pattern

Lastly, this Financial Select Sector SPDR (NYSE:XLF) Daily chart shows a true Doji Star pattern where a Doji candlestick sets up with a gap between the real bodies of the last two candlesticks. Again, this pattern sets up just below $27 which has continued to operate as strong resistance. Any breakdown in this sector early next week will confirm this pattern and set up a Three River Evening Star pattern – a Sell Signal.

CONCLUDING THOUGHTS:

Every one of these patterns provides a clear definition of resistance and also show price weakness set up near the end of last week. At this point, we are just waiting to see what happens early next week after a long holiday weekend. Based on our past research, we believe the downside potential far outweighs the upside potential – unless some major news event pushes the price much higher – like the news of the new US/China trade talks.

We would advise traders and investors to take advantage of these higher prices to pull profits out of open long positions and take some risk off the table at this juncture in price. We entered a new trade today and our portfolio is primed and ready for big moves going into next week.

We believe our super-cycle research and other proprietary modeling systems are suggesting that price weakness will dominate the markets for the next few months. Ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next financial crisis and recession.