Investing.com’s stocks of the week

The soy complex has been moving higher even in the face of a massive US harvest over strong demand for bean oil, strong demand for beans and meal in general, and some recent planting weather concerns arising down in South America.

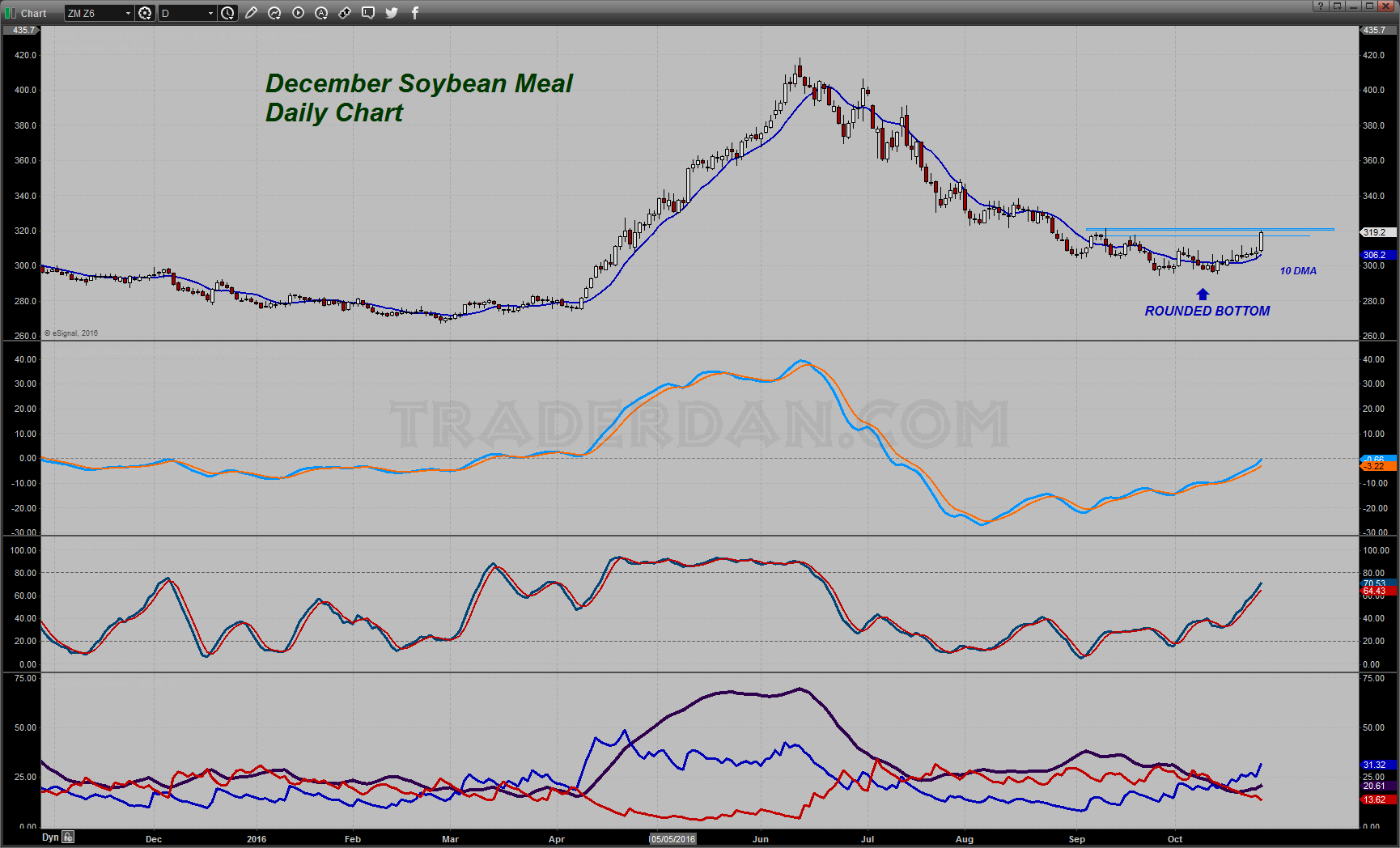

The charts are looking very strong with both the beans and the meal on the verge of breaking out.

This is the first time the RSI has been able to climb up towards the overbought level of 70 since June of this year. Meal is forging a ROUNDED BOTTOM formation on its daily chart:

The iPath Bloomberg Grains Subindex Total Return Exp 22 Oct 2037 (NYSE:JJG), the grain ETF we highlighted not that long ago, continues its improving chart pattern with price now firmly above the 50-day moving average and back above the 10-day.

The 200-day is still way above the market so the longer term trend has not yet turned, but the near term and intermediate terms are both higher.

In the grains, it has become all about demand. The supply side is now well known and is fully factored into current price levels. Traders are watching very closely for new demand signals that might indicate low prices have attracted increased buyers’ interest.

When they get that sort of signal, they buy. The thinking is, as low as prices had moved, buyers sitting on the sidelines waiting for a chance to buy lower are now being forced to forego the luxury of waiting and instead are having to buy sooner to avoid having to potentially pay even higher prices if they wait too long.

What makes this rally in the grains even more surprising is that it is taking place in spite of the recent strength of the US dollar.