Those that view the message of the market on daily basis are likely confused by trading noise. While trading noise contributes to the long-term trends, it does not define them. Human behavior tries to explain trading noise as a meaningful trend. This confuses the majority which, in turn, contributes to their role as bagholders of trend transitions.

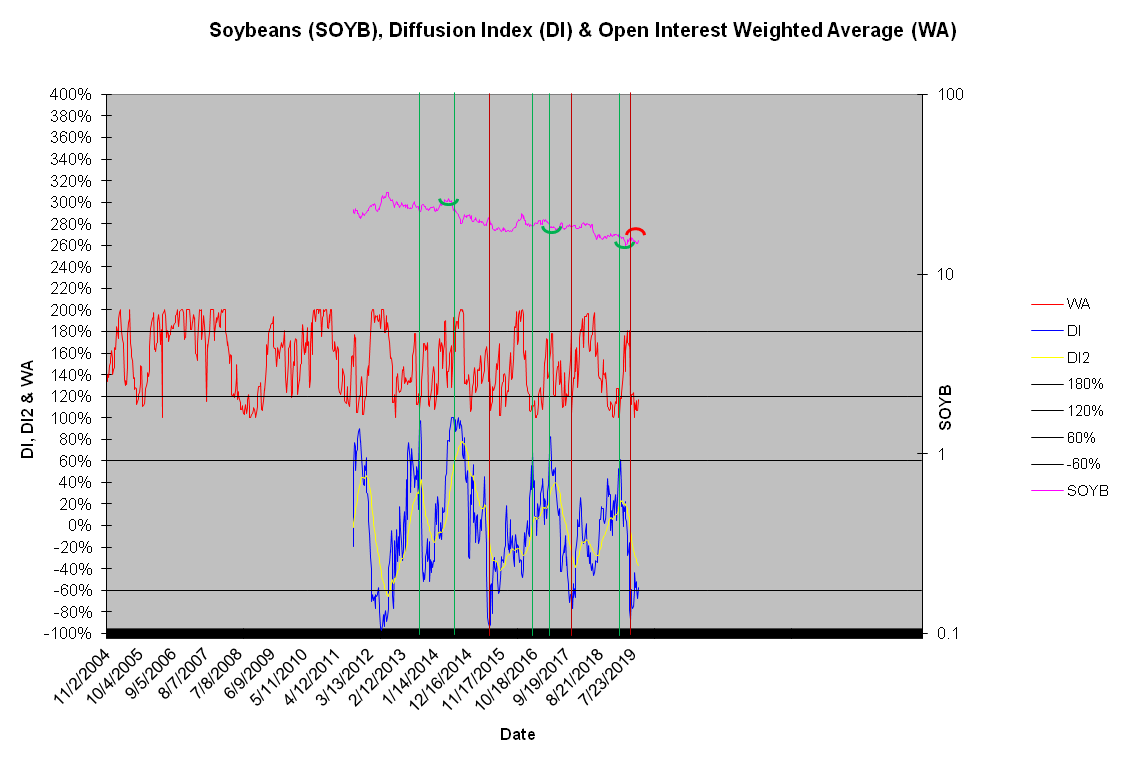

Soybean (NYSE:SOYB) yields are well below recent years totals. Many are interpreting 2019/20 weak run rate as supportive of a rally, it's difficult to understand why the invisible hand does not agree. Soybean's DI, the distribution of futures and options (DI = -58% and DI2 = -37%), define a strong bearish energy build. DI2 = -37%, a low number reflective of persistent bearish build, does not favor bullish interpretations.

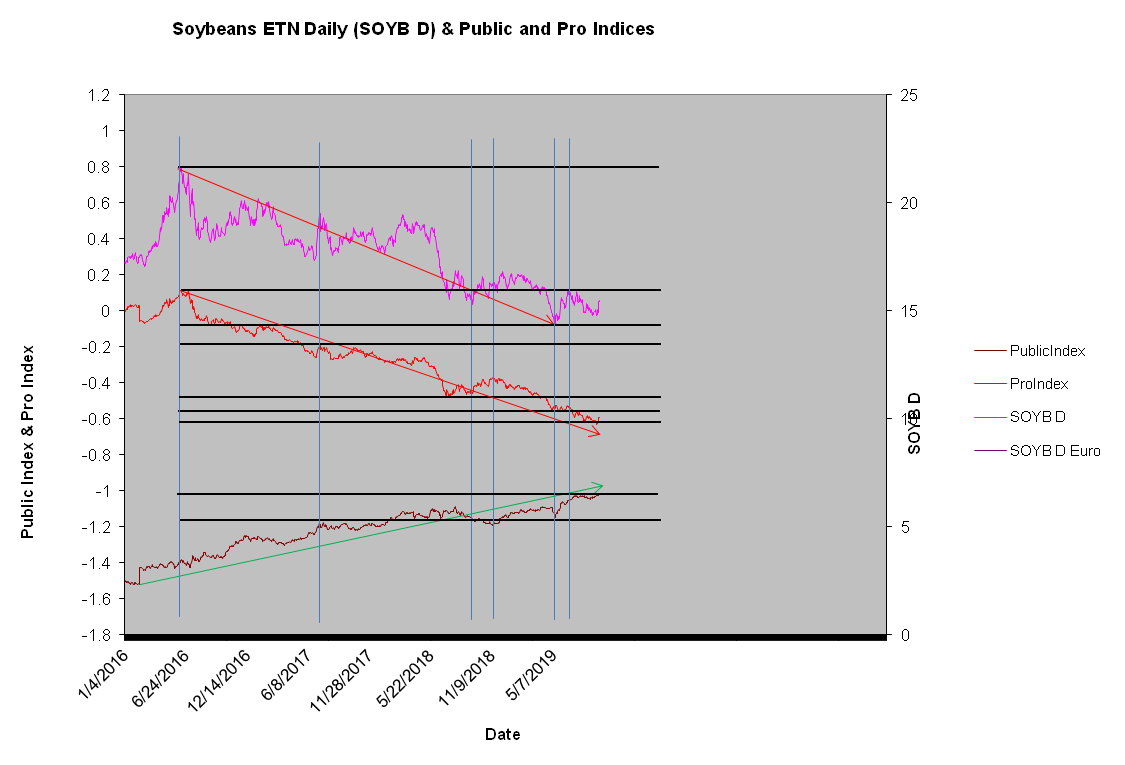

Bean's ProIndex also favors the bears. The ProIndex's new lows, creating a negative divergence with price, defines on going professional selling. The soybean market is being held up by hopeful retail buying. Retail buying, the weak hands, suggests vulnerability.

Soybeans DI

Soybeans ProIndex