Those that view the message of the market on a daily basis are likely confused by trading noise. While trading noise contributes to the long-term trends, it does not define them. Human behavior tries to explain trading noise as a meaningful trend. This confuses the majority, which in turn contributes to their role as bagholders of trend transitions.

Teucrium Soybean (NYSE:SOYB) focused bull opportunity has produced a -4% annualized return for the bulls since the third week of April (see COT Matrix 04/19/16). This opp recorded a 211% and 151% annualized return after the fourth and first week of April and June, respectively. Traders following the old Wall Street saying that 'bulls and bears make money while pigs get slaughtered' should have booked profits and reduced risk after these returns.

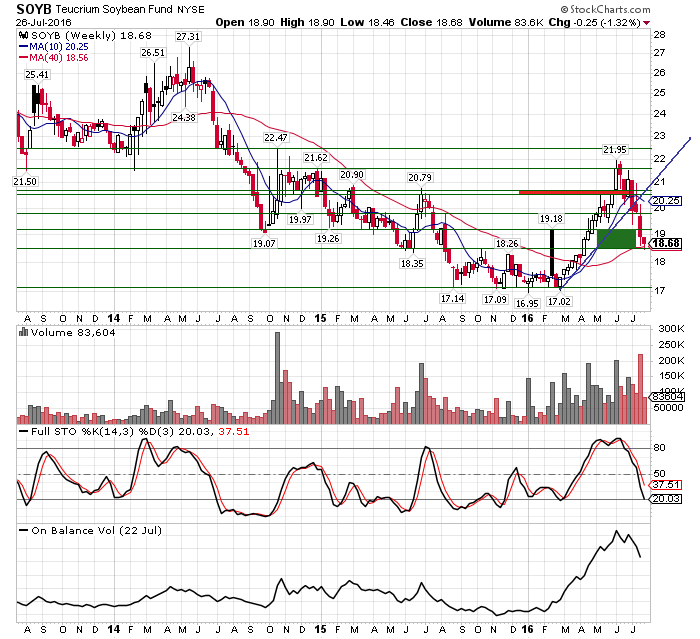

A weekly close above the June gap from 20.54 to 20.71 (red zone) maintains the up impulse, while a close below support from 18.50 to 19.18 (green zone) pauses it and favors at least a retest of the 2016 low.