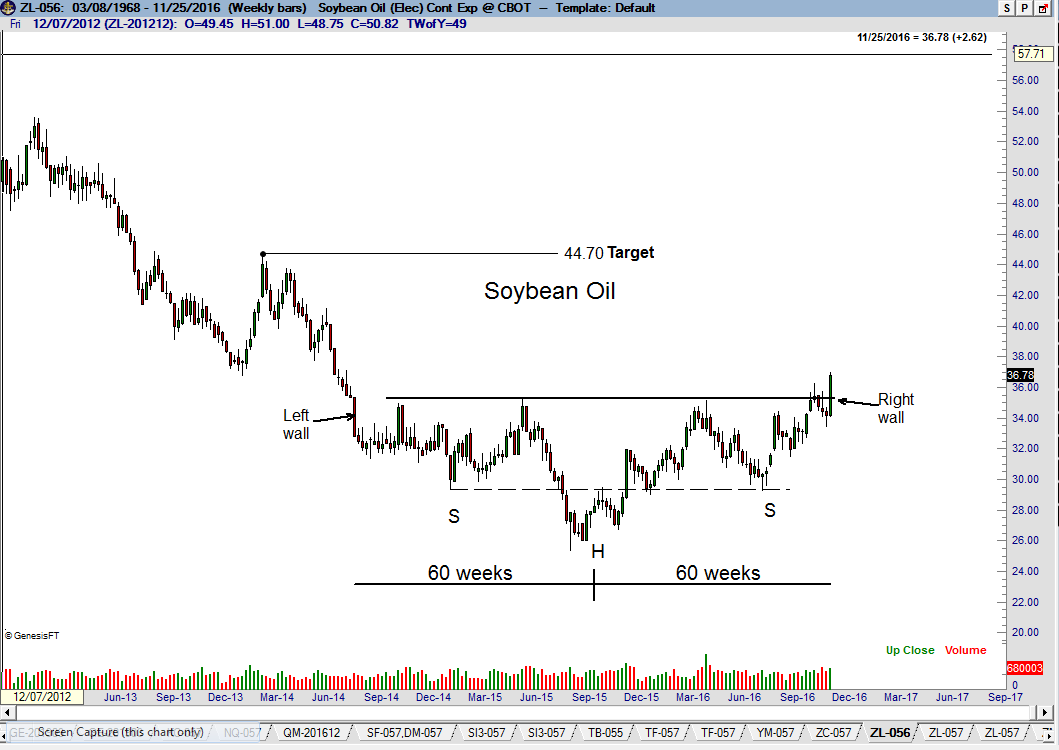

The weekly soybean oil continuation graph has completed one of the most perfect textbook head-and-shoulder bottom patterns I have seen in 41 years following the futures markets.

A perfect H&S bottom pattern contains the following elements:

- H&S is undeniable in its identification

- Not only is the 27-month H&S on the soybean oil graph undeniable, but the WBB decline in mid Aug 2014 along with the WBB advance this past week represent rare “pattern walls.” In other words, these WBBs clearly demarcate the pattern from all other price.

- Flat or slightly up-slanted neckline

- The neckline is horizontal. The orthodox highs of the left shoulder and right shoulder are only 15 ticks different.

- Symmetry in height between the elements

- The left shoulder and right shoulder lows are almost identical (dashed line) – only four ticks.

- Symmetry in time between the elements

- The length between the WBB left-wall in Aug 2014 to the mid- point of the head in mid Oct 2015 is 60 weeks. The length between the mid-point of the head in mid Oct 2015 to this past week’s WBB right-wall breakout is 60 weeks.

- A decisive pattern completion

- The breakout on Wednesday occurred with a powerful 262 point.

Factor is long and I am interested in increasing leverage if the market can dip back to the 36.11 level (Mar. contract). The soybean oil target is 44.50 to 45.00. If such a dip occurs, the risk on the entire trade will be 130 BPs. My potential gain is 900 to 1,000.