When a weather market develops in the grains a chartist might as well throw away his or her charts.

The jet stream has been pushed north all winter and spring. The result is dry weather at a critical point in the growing season in much of the corn-belt states.

Grain prices are strong today because there is no rain in the forecast. If we come back after the July 4 holiday to wide rains in the corn belt, then prices will be sharply lower. If we return on Thursday to a dry forecast for next week, and especially if we remain dry next Monday with no rain in sight, then look out.

The question is whether the charts offer any clue for “how high is high.” In fact, the Soybean Meal chart does offer a clue.

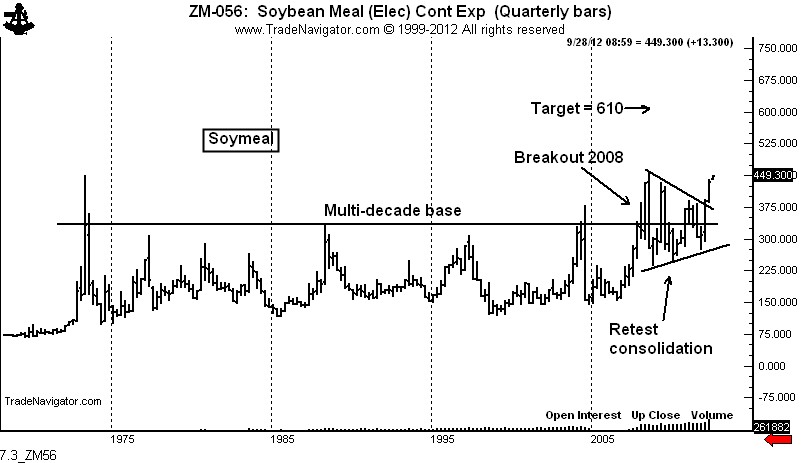

Shown below is the quarterly chart of Soybean Meal dating back four decades. This chart shows that a massive base was completed in 2008 followed by a hard retest and consolidation. This period of consolidation was resolved by the advance in April.

It can be argued that the construction of the Meal chart is presently right where Silver was in September 2010 prior to its price explosion. In other words, if the corn belt gets plenty of rain, the Meal chart will continue to consolidate. If rain is not sufficient, the Meal chart is set to go now.

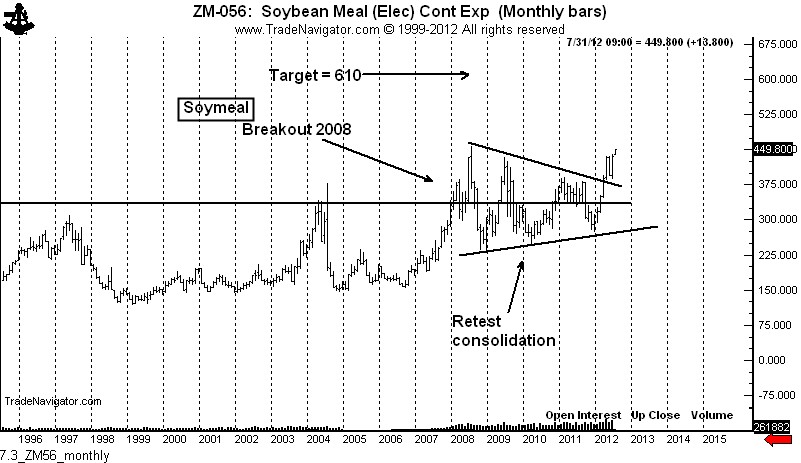

Importantly, the end-of-month June close was a new all-time high monthly close, as shown on the monthly graph below.

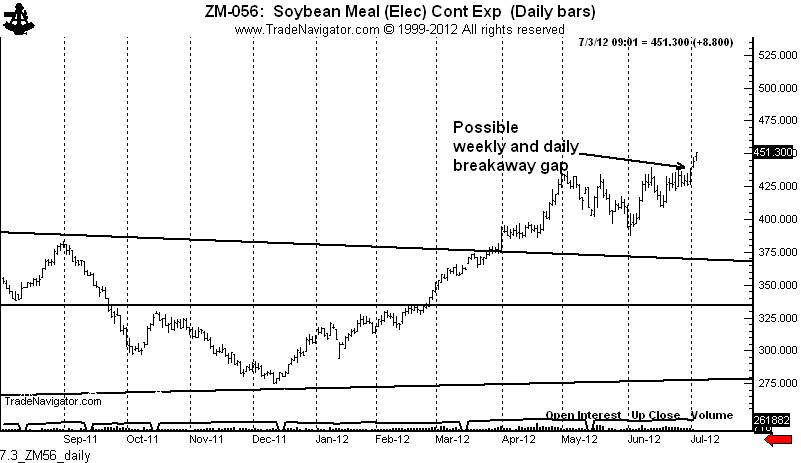

The daily Meal chart shows that Monday’s up gap is a potential weekly and daily break away gap.

The measured target for a bull market in Meal (whether it takes place in 2012 or in some future year) is 610 per ton.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Soybean Meal: The Next Silver?

Published 07/04/2012, 01:52 AM

Updated 07/09/2023, 06:31 AM

Soybean Meal: The Next Silver?

A weather market in grains is something to behold

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.