Investing.com’s stocks of the week

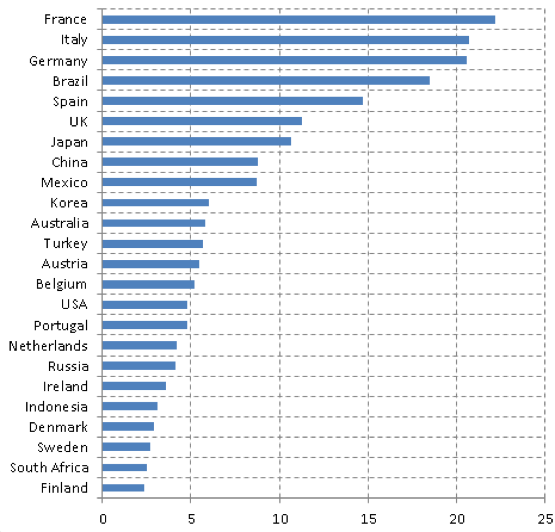

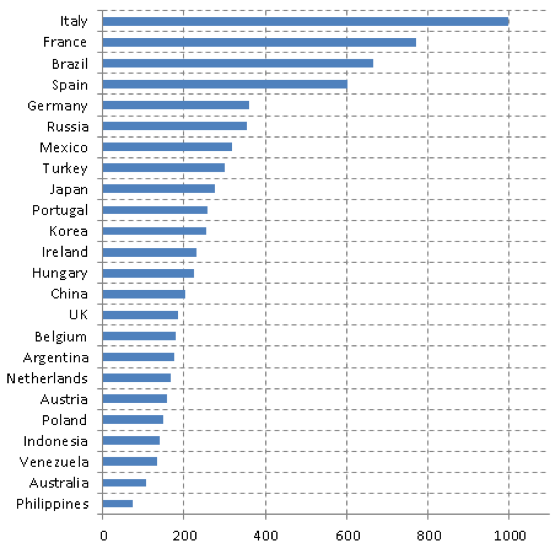

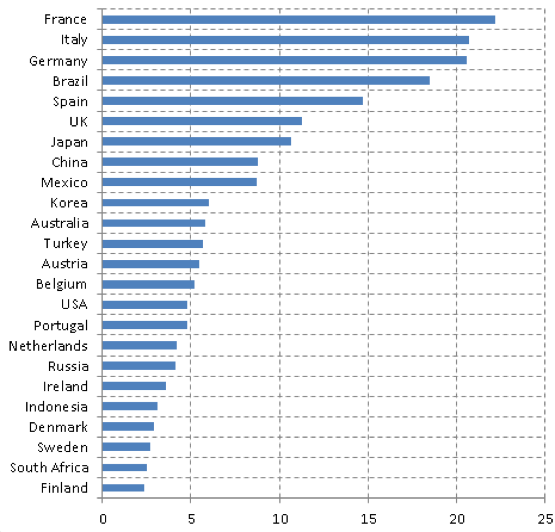

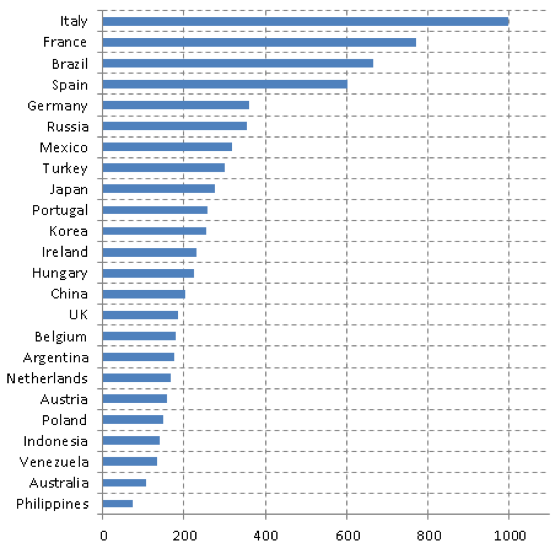

Here is the latest sovereign CDS volumes from DTCC. The two charts show the net CDS outstanding (one month average) and the daily trading volume (also one month average).

A Few Items To Note:

A Few Items To Note:

- Italy and Spain being in the top 5 is not a surprise, but it looks like France is also a concern to market participants. The new Socialist government is not helping the matters.

- It seems that Brazil's slowdown and capital outflows are causing lively activity and large net exposures in the CDS of that nation.

- Germany is making the top 5 as well. That is an indication that traders are once again pricing in the risk that Germany will have to bail out (directly or indirectly) a large periphery nation at the expense of increased leverage (debt/GDP). That "bailout" could also take the form of addressing a default / re-denomination, should such a periphery nation exit (for example having to recapitalize Eurozone's institutions). That concern is causing German CDS to widen out, even as bunds trade at historically low yields.