Southwestern Energy Company (NYSE:SWN) issued 2017 highlights and 2018 guidance based on a NYMEX gas price of $2.85.

Amid commodity price volatility, the company was able to achieve targets cited in 2017 guidance. Southwestern Energy made investments through net cash flow, which included $200 million from the 2016 equity offering. In 2017, total net production was 897 billion cubic feet equivalent (Bcfe), of which 89% was natural gas and 11% was NGLs and condensates. Of the total production, 578 Bcfe came from the Appalachian Basin and 316 Bcf from the Fayetteville Shale. Gross operated exit rate production of 2.35 Bcfe per day from the Appalachian Basin was up 40% from December 2016 levels.

Preliminary total proved reserves was about 14.8 trillion cubic feet equivalent (Tcfe), including 11.1 Tcfe from the Appalachian Basin, up 181% and 393%, respectively, compared with 2016 figures. At end-2017, total proved reserves comprised 75% natural gas and 25% NGLs and condensate compared with 93% and 7% in 2016, respectively. Proved undeveloped at year-end 2017 was 46%.

For 2018, the company intends to invest $1.15-$1.25 billion and fund it entirely through net cash flow. Average net production for 2018 is expected in the range of 930-965 Bcfe, up 6% from production of 897 Bcfe in 2017. Net production from Appalachian Basin is expected in the range of 671-698 Bcfe, showing an improvement of 18% over 2017. NGLs and condensates yield is expected to increase 31% to 130 Bcfe in 2018 from 2017 levels.

The company’s capital efficiency is expected to improve, which will be demonstrated by $100 million less investment in drilling and completion activities. Southwestern Energy projects higher value and production growth compared with the 2017 program. In 2018, for the first time Northeast Appalachia is projected to generate positive cash flow from operations, net of capital of about $150 million. Southwestern Energy plans to prioritize 2018 spending on the Appalachian Basin, where the company intends to commence operation of four rigs from the beginning of the year and use three completion crews in Southwest Appalachia and two rigs and two completion crews in Northeast Appalachia.

For 2018, Southwestern Energy proposes to allocate $1,130 million to $1,215 million in its E&P business. The 2018 program comprise drilling of 100-120 wells, completion of 105 to 125 wells and placing 125 to 145 wells to sales.

Southwestern Energy expects net production in the range of 2.48-2.54 Bcfe per day during first quarter of 2018, down from the fourth quarter of 2017 level, thanks to lower activity levels in late 2017 and the negative impacts of severe winter on operations in January 2018.

.

Based on the regions, Southwestern Energy expects production from Northeast Appalachia, Southwest Appalachia and Fayetteville Shale in the range of 440-454 Bcfe per day, 231-244 Bcfe per day and 258-265 Bcfe per day, respectively, in 2018.

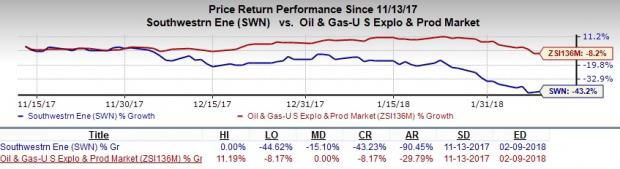

Price Performance

In the last three months, Southwestern Energy’s shares have underperformed the industry. The company’s shares have lost 43.2% compared with the industry’s 8.2% decline.

Zacks Rank & Other Key Picks

Southwestern Energy flaunts a Zacks Rank #1 (Strong Buy).

A few other top-ranked players in the same sector are EOG Resources (NYSE:EOG) , Pioneer Natural Resources Company (NYSE:PXD) and Devon Energy (NYSE:DVN) . All these stocks sport a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Houston, TX-based EOG Resources is a major independent oil and gas exploration and production company. The company delivered an average positive earnings surprise of 40.94% in the preceding four quarters.

Headquartered at Irving, TX, Pioneer Natural Resources Company is an independent oil and gas exploration and production company. The company delivered an average positive earnings surprise of 66.92% in the preceding four quarters.

Devon Energy Corporation, based in Oklahoma City, is an independent energy company engaged primarily in the exploration, development and production of oil and natural gas. The company delivered a positive earnings surprise of 13.77% in the preceding quarter.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Southwestern Energy Company (SWN): Free Stock Analysis Report

Devon Energy Corporation (DVN): Free Stock Analysis Report

Pioneer Natural Resources Company (PXD): Free Stock Analysis Report

EOG Resources, Inc. (EOG): Free Stock Analysis Report

Original post