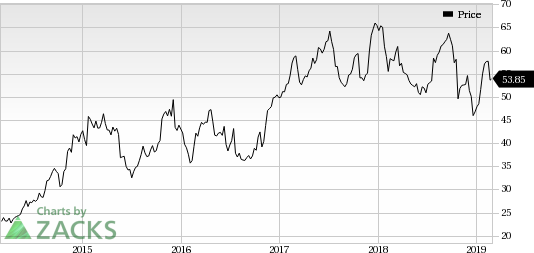

Shares of Southwest Airlines (NYSE:LUV) increased on Feb 28, closing the trading session at $56.04, up 4.1% over Feb 27’s closing price. Notably, resurfaced speculation that billionaire investor Warren Buffett’s Berkshire Hathaway (NYSE:BRKa) was planning to buy this Dallas-based low-cost carrier triggered an uptick in the carrier's stock price.

According to the Omaha, NE-based company’s latest 13-F filing, it had more than 9.5% stake in Southwest. This made the iconic investor’s company the second-biggest shareholder in Southwest, after Primecap Management Company’s nearly 13% stake. Reportedly, a post on Twitter by an online trading portal, StockTraders.Net, hinted at “unconfirmed talk” that Berkshire was looking to buy the rest of Southwest shares for $75 a piece. The figure is much higher than Southwest’s current trading price.

Buffett, the founder and CEO of Berkshire Hathaway, is commonly regarded as one of the greatest (if not the greatest) investors of all time. Therefore, even rumors surrounding a takeover by his company pleased investors.

In response to the rumors, Southwest said that “As a policy, we do not comment on speculation, but appreciate Berkshire’s continued support of Southwest Airlines.” However, this is not the first time such speculations have risen.

We remind investors that Berkshire Hathaway bought stakes in Delta Air Lines (NYSE:DAL) , American Airlines (NASDAQ:AAL) , United Continental Holdings (NASDAQ:UAL) apart from Southwest in 2016, after having shunned the sector for more than three decades. In fact, in 2013, Buffett had termed airlines as a death trap for investors.

Speculations had emanated that the Oracle (NYSE:ORCL) of Omaha’s cash-rich company might acquire an airline player, ever since the iconic investor reversed his opinion regarding the industry. Subsequently, Southwest, which carries a Zacks Rank #2 (Buy), has been viewed as the most likely takeover candidate by most market watchers. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We expect investors to remain focused on updates on this burning issue moving ahead.

This Could Be the Fastest Way to Grow Wealth in 2019

Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>

American Airlines Group Inc. (AAL): Free Stock Analysis Report

United Continental Holdings, Inc. (UAL): Free Stock Analysis Report

Delta Air Lines, Inc. (DAL): Free Stock Analysis Report

Southwest Airlines Co. (LUV): Free Stock Analysis Report

Original post

Zacks Investment Research