Updates on Boeing (NYSE:BA) 737 MAX jets have been flooding the aviation space ever since the deadly Ethiopian Airlines’ crash on Mar 10. In fact, this was the second accident involving Boeing 737 MAX jets within a span of five months as the same model went down in Indonesia last October, killing 189 people.

Naturally, safety-related concerns regarding 737 MAX planes have become the major talking point. Highlighting the snags, the Federal Aviation Administration (FAA) announced its decision on Mar 13 to ground all U.S.-registered Boeing 737 MAX jets. The grounding of the above-mentioned planes resulted in wide spread cancellations by carriers with Boeing 737 Max aircraft in its fleet.

The latest update regarding Boeing 737 Max jets came from Southwest Airlines (NYSE:LUV) , which has 34 such jets in its fleet. This Dallas-based carrier and the union representing its pilots — Southwest Airlines Pilots' Association (“SWAPA”) — recently notified that Boeing 737 MAX jets will not operate at Southwest Airlines until the end of May 2019.

The carrier had earlier stated that the jets would remain grounded until Apr 20. Following the decision to extend the tenure by a month, Southwest Airlines will publish a new flight schedule for May. In fact, the airline expects MAX 8 groundings to negatively impact its first-quarter 2019 revenues. Besides the groundings, factors like the partial government shutdown and inclement weather induced Southwest Airlines to anticipate a $150-million negative impact on its top line for the January-March period. Detailed results should be out on Apr 25.

Southwest Airlines apart, another airline heavyweight, American Airlines (NASDAQ:AAL) , lately extended its tenure of grounding the Boeing 737 MAX jets. American Airlines, which currently has 24 such jets in its fleet, prolonged cancellations of the Boeing 737 MAX jets through Apr 24. The carrier is calling off 90 flights per day due to the grounding.

Zacks Rank & Key Picks

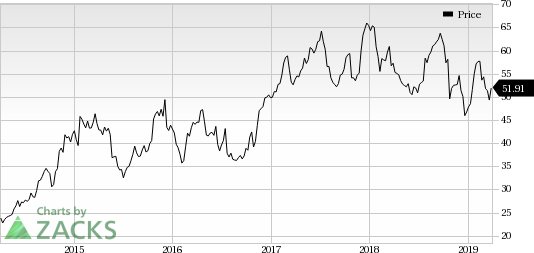

Southwest Airlines carries a Zacks Rank #3 (Hold). Some better-ranked airline stocks are SkyWest (NASDAQ:SKYW) and Azul (NYSE:AZUL) , sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of SkyWest and Azul have rallied more than 22% and 5%, respectively, on a year-to-date basis.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, wouldn't you like to know about our 10 finest buy-and-holds for the year?

From more than 4,000 companies covered by the Zacks Rank, these 10 were picked by a process that consistently beats the market. Even during 2018 while the market dropped -5.2%, our Top 10s were up well into double-digits. And during bullish 2012 – 2017, they soared far above the market's +126.3%, reaching +181.9%.

This year, the portfolio features a player that thrives on volatility, an AI comer, and a dynamic tech company that helps doctors deliver better patient outcomes at lower costs.

See Stocks Today >>

SkyWest, Inc. (SKYW): Free Stock Analysis Report

American Airlines Group Inc. (AAL): Free Stock Analysis Report

Southwest Airlines Co. (LUV): Free Stock Analysis Report

AZUL SA (AZUL): Free Stock Analysis Report

Original post