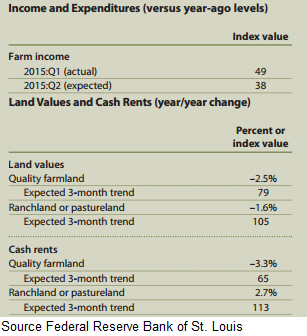

Farmland values declined year over year by 2.5% in the first quarter of 2015, after 11 quarterly year over year increases. Lower grains prices during the second half of 2014 caused farmland values to decline in the eighth federal district for the first time since 2011.

Credit conditions in the district also struggled as falling grain prices suppressed 2014 farm income. Bankers reported an increase in loan demand while loan repayment rates fell. Respondents suggested low grain prices would continue to suppress farmland values over the next three months, while also impacting the credit condition for the district.

Farmland Values

The Eighth Federal Reserve District, which is made up of portions of Arkansas, Illinois, Indiana, Kentucky, Missouri, and Tennessee, reported a 2.5% decrease in farmland values over the past year. The annual decrease is the first reported by the district in three years. Corn, soybean, and wheat prices all declined over 15% last year, causing farmland values and farm income to decline.

Cash rent values for farmland also decreased in the first quarter 2015 in comparison to a year ago. The fall in grain prices over the past six months squeezed farmer’s profit margins. Input costs remained stubbornly high forcing farmers negotiate lower rents.

Bankers reported that farm income decreased in the first quarter 2015, but the decline was less severe than expected in last quarters report. Farm income has struggled under the mountain of grain produced domestically and globally in 2014.

Credit Conditions

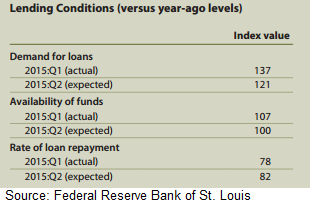

Similar to other federal districts reporting on the state of agriculture in the first quarter 2015, credit conditions across the eighth district declined. Bankers reported an increase in loan demand from a year ago and a decrease in loan repayment rates.

This trend of increased loan demand and worsening repayment rates has been a topic of concern for bankers over the past six months. It has been suggested in the past two reports that if the trend of increased loan demand and lower repayment rates continue, the result would be banks tightening lending and increasing credit requirements. That has not been the case thus far, as fund availability increased over the past year.

Outlook

Bankers expect that farmland values and credit conditions across the district will continue to struggle over the next three months. Global and domestic stockpiles of corn, soybeans, and wheat remain high, leaving little potential for short-term price relief.