Southern Power, a subsidiary of leading energy utility firm Southern Company (NYSE:SO) , declared the purchase of Lamesa Solar Facility – with 102-megawatt capacity – from RES America Developments Inc. This represents the third Texas solar farm acquirement of Southern Company in a time frame of less than one year.

It is to be noted that Southern Power is expected to sell electricity and related renewable energy credits (RECs) produced by the Lamesa Solar unit for a period of 15 years to Garland city. Investors should also know that the acquisition price has not been mentioned by any of the companies.

The Lamesa Solar Facility – likely to consist of more than 400,000 solar panels – is expected to spread across 887 acres of land in Dawson County. The construction activities are anticipated to start by July end and the project is slated to be operational by mid next year. Most importantly, the development is projected to provide sufficient electricity capable of catering to the energy needs of 26,000 houses in the U.S.

Overall, Southern Power – which bought a controlling equity interest in the 102-megawatt (MW) Henrietta Solar Project yesterday from U.S. solar power developer, SunPower Corporation (SPWR) for an undisclosed amount – believes that that this development will perfectly fit its business model.

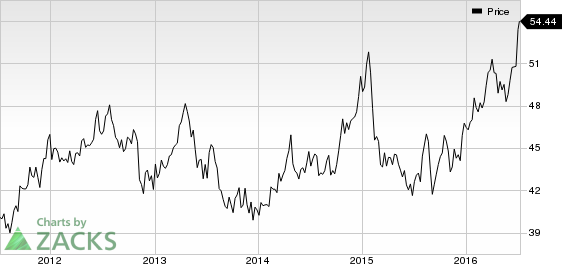

Headquartered in Atlanta, GA, Southern Company is one of the largest generators of electricity in the nation, serving both regulated and competitive markets across the southeastern U.S. Currently, the company carries a Zacks Rank #3 (Hold), which implies that the stock will perform in line with the broader U.S. equity market over the next one to three months.

Some better-ranked players in the utility-electric power industry are Black Hills Corporation (NYSE:BKH) , Spark Energy Inc. (NASDAQ:SPKE) and Korea Electric Power Corp. (NYSE:KEP) . Each of the stocks sports a Zacks Rank #1 (Strong Buy).

SOUTHERN CO (SO): Free Stock Analysis Report

KOREA ELEC PWR (KEP): Free Stock Analysis Report

BLACK HILLS COR (BKH): Free Stock Analysis Report

SPARK ENERGY (SPKE): Free Stock Analysis Report

Original post

Zacks Investment Research