Southern Power, a subsidiary of leading energy utility firm Southern Company (NYSE:SO) , along with Turner Renewable Energy declared the purchase of Rutherford Farm facility from Cypress Creek Renewables. The facility has a 74-megawatt capacity.

This represents the second solar project acquisition by both Southern Company and Turner Renewable in North Carolina. In Jan 2010, Southern Company teamed up with Ted Turner – owner of Turner Renewable Energy – for renewable energy developments in the U.S. The latest purchase has improved the overall solar capacity of the partnership to more than 415 MW.

Coming back to the news, Rutherford Farm – that spreads over 489 acres of land in Rutherford County – will likely comprise 89,104 fixed-tilt, monocrystalline solar panels. It is to be noted that the work related to construction of the Rutherford Farm started in February and is anticipated to be operational commercially by December. Most importantly, the development is expected to be covered by lucrative long-term power purchase accords. When fully operational, it is projected to generate sufficient electricity to cover the energy needs of 11,500 houses in North Carolina.

Overall, Southern Power believes that this project will fit its business model of improving operations related to wholesale activities primarily through the purchase and manufacture of generating properties.

Southern Power has been expanding its portfolio of solar projects. Last week, Southern Power purchased Lamesa Solar Facility – with 102-megawatt capacity – and a controlling equity interest in the 102-megawatt (MW) Henrietta Solar Project.

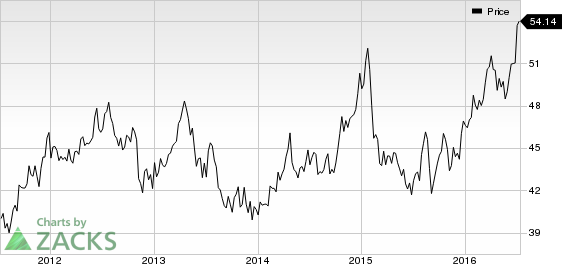

SOUTHERN CO Price

Headquartered in Atlanta, GA, Southern Company is one of the largest generators of electricity in the nation, serving both regulated and competitive markets across southeastern U.S. Currently, the company carries a Zacks Rank #3 (Hold), which implies that the stock will perform in line with the broader U.S. equity market over the next one to three months.

Some better-ranked players in the utility-electric power industry are Black Hills Corporation (NYSE:BKH) , RWE AG (OTC:RWEOY) and Korea Electric Power Corp. (NYSE:KEP) . Each of the stocks sports a Zacks Rank #1 (Strong Buy).

SOUTHERN CO (SO): Free Stock Analysis Report

KOREA ELEC PWR (KEP): Free Stock Analysis Report

BLACK HILLS COR (BKH): Free Stock Analysis Report

RWE AG -SP ADR (RWEOY): Free Stock Analysis Report

Original post