Electric utility firm Southern Company (NYSE:SO) is set to release its second-quarter 2017 results before the opening bell on Wednesday, Aug 2.

In the preceding three-month period, the Atlanta, GA-based service provider reported stronger-than-expected earnings due to robust performance by its wholesale unit.

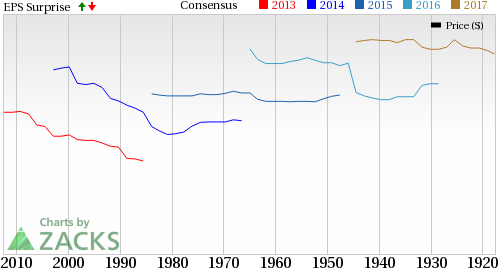

However, coming to earnings surprise history, Southern Company has a good record: its beaten estimates in 3 of the last four quarters.

Let’s see how things are shaping up for this announcement.

Factors to Consider This Quarter

A leading utility holding entity in the U.S., Southern Company dominates the power business across the Southeast. With a strong rate base growth and constructive regulation, we expect the firm to generate steady earnings.

Also, with operations in a stable and growing industry, Southern Company has a steady stream of cash flow. The utility’s history of consistent dividend payments indicates its confidence in itself.

We further believe that the AGL Resources (NYSE:GAS) acquisition will be accretive to Southern Company earnings.

However, with customer growth tepid and likely to remain so for some time, sales might be affected. This together with a large base, might make it difficult for Southern Company to manage rates. Higher operating and maintenance expenses is another concern.

Moreover, the recent positive news regarding Toshiba’s financial guarantee to help complete the half-finished Vogtle project in Georgia, we remain skeptical regarding Southern Company’s $20 billion twin nuclear plants. The Vogtle project is being bankrolled with more than $8 billion in federal loans and loan guarantees.

Georgia Power believes that the project has already exceeded the budget by $3 billion and is unlikely to be completed before the end of 2020. This will substantially increase Southern Company’s leverage and deteriorate its credit metrics. Additionally, the increasing capital intensity of its operations may result in reduced returns going forward.

Southern Company’s much delayed clean coal power plant project Kemper in Mississippi recently suffered yet another setback with a postponement in the projected in-service date. The extension of the schedule, together with certain technical glitches, would also hike the overall cost of the plant by $186 million.

As it is, the economics of the Kemper project is a major cause of concern for the company as the plant is not competitive at the current natural gas prices. Overall, the project has been a major overhang on Southern Company's stock owing to its poor execution, cost overruns and multiple delays.

Earnings Whispers

Our proven model does not conclusively show that Southern Company will beat estimates this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) to be able to beat consensus estimates. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

That is not the case here as you will see below.

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is +1.43%. This is because the Most Accurate estimate stands at 71 cents, while the Zacks Consensus Estimate is pegged lower, at 70 cents.

Zacks Rank: However, Southern Company’s Zacks Rank #4 (Sell), when combined with a positive ESP makes surprise prediction difficult.

As it is, we caution against Sell-rated stocks (Zacks Ranks #4 and 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Share Performance: Southern Company has lost 3.8% of its value during the second quarter versus the 0.03% growth of its industry.

Stocks to Consider

While earnings beat looks uncertain for Southern Company, here are some utilities you may want to consider on the basis of our model, which shows that they have the right combination of elements to post earnings beat this quarter:

NiSource Inc. (NYSE:NI) has an Earnings ESP of +10.00% and a Zacks Rank #2. The firm is expected to release earnings results on Aug 2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The AES Corp. (NYSE:AES) has an Earnings ESP of +20.00% and a Zacks Rank #2. The utility is anticipated to release earnings on Aug 8.

ALLETE Inc. (NYSE:ALE) has an Earnings ESP of +5.36% and a Zacks Rank #2. The utility is likely to release earnings on Aug 2.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Southern Company (The) (SO): Free Stock Analysis Report

NiSource, Inc (NI): Free Stock Analysis Report

The AES Corporation (AES): Free Stock Analysis Report

Allete, Inc. (ALE): Free Stock Analysis Report

Original post

Zacks Investment Research