South32 Ltd. (AX:S32) was downgraded by research analysts at Citigroup (NYSE:C). to a "neutral" rating in a report issued on Friday, MarketBeat.com reports. They currently have a GBX 170 ($2.22) price objective on the stock, down from their previous price objective of GBX 180 ($2.35). Citigroup Inc.'s price target would suggest a potential downside of 0.58% from the company's previous close.

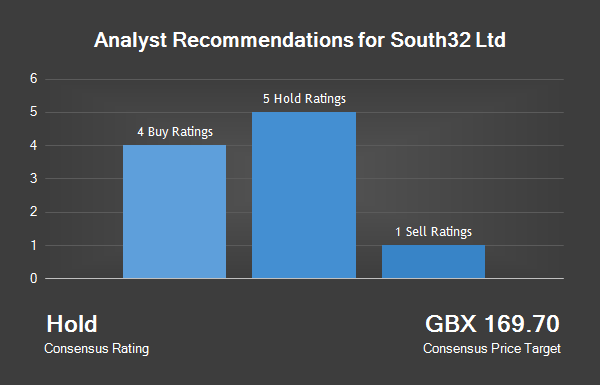

Other equities research analysts have also issued reports about the stock. HSBC Holdings (LON:HSBA) plc raised their price objective on shares of South32 from GBX 185 ($2.42) to GBX 205 ($2.68) and gave the company a "buy" rating in a report on Wednesday, April 19th. Jefferies Group LLC raised their price objective on shares of South32 from GBX 215 ($2.81) to GBX 225 ($2.94) and gave the company a "buy" rating in a report on Tuesday, April 18th. Deutsche Bank AG (DE:DBKGn) restated a "hold" rating and issued a GBX 150 ($1.96) price objective on shares of South32 in a report on Thursday, May 4th. BNP Paribas (PA:BNPP) restated a "neutral" rating and issued a GBX 177 ($2.31) price objective on shares of South32 in a report on Tuesday, March 28. Finally, Macquarie restated an "outperform" rating and issued a GBX 220 ($2.87) price objective on shares of South32 in a report on Friday, May 5th. One investment analyst has rated the stock with a sell rating, six have issued a hold rating and four have issued a buy rating to the company's stock. The stock has a consensus rating of "Hold" and a consensus target price of GBX 170.18 ($2.22).

South32 opened at 165.50 on Friday, MarketBeat.com reports. The firm's 50 day moving average price is GBX 160.15 and its 200-day moving average price is GBX 163.20. South32 has a 12-month low of GBX 101.25 and a 12-month high of GBX 184.00. The stock's market cap is GBX 8.80 billion.

South32 Company Profile