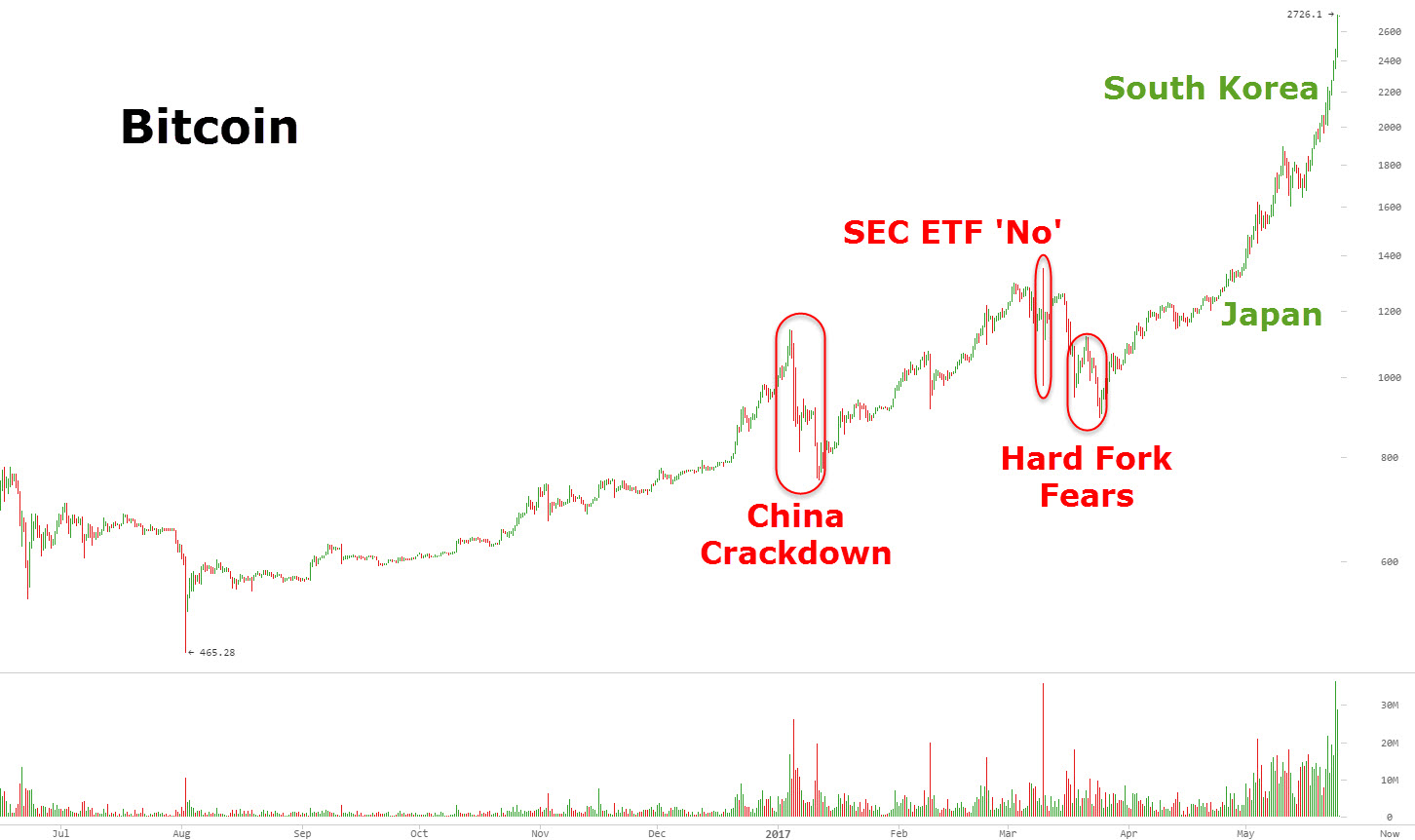

From Tyler Durden: In recent weeks it has been Japanese demand (and notable premia) that has driven the exponential rise in Bitcoin, but recently, as CoinTelegraph reports, it has been South Korea.

Overnight saw Bitcoin prices explode once again, smashing through $2500, $2600 and $2700 for the first time ever.

CoinTelegraph.com reports that South Korean Bitcoin traders are facing asking prices of $4,500 as the virtual currency’s price continues to surge.

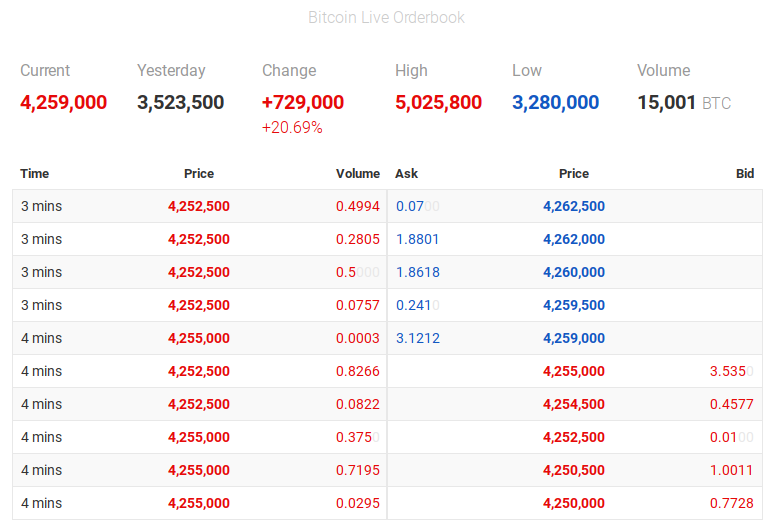

Domestic exchange Coinone's order book lists a current price of 4,254,000 won ($3805), with a 24-hour high of 5,025,000 ($4494).

As Bitcoin.com reports, the region has also been blossoming with startups dedicated to bitcoin remittance and financial tech advancement.

The South Korean government has been very friendly towards digital currencies, and the country is steadily becoming a technology hub. Just recently the government lowered the equity capital requirement for bitcoin companies working with remittances. The new statutes will begin on June 18 with a reduction of required capital to 1 billion KRW in contrast to the prior requirement of 2 billion KRW.

Additionally, researchers from the South Korean central bank recently released a report that detailed that virtual currencies like bitcoin can “coexist with fiat.”“The recent emergence of digital currency opens up a new type of dual currency regime in which digital currency, which has no intrinsic value and a government-issued fiat currency coexist,” explained the researchers from Seoul’s Hongik University and members of the Bank of Korea’s (BOK) report.

The wide spreads are unprecedented, even compared to other recently inflated markets such as Japan where local exchange bitFlyer lists a price of 333,200 yen ($2980).

On Coinbase, one Bitcoin is currently selling for $2667.53 as of press time on Thursday.

Users have presented various theories as to why South Korea’s exchange market is so varied, ranging from capital controls to en-masse arbitrage and even a debt-fueled bubble economy.

Bitcoin itself, meanwhile, is continuing to produce new price highs, flying in the face of those concerned that a new bubble has formed.