A shock no-confidence motion asking President Jacob to step down has been posted this weekend at the ruling ANC’s National Executive Committee meeting.

The motion was tabled by the 3 Senior Ministers (a shock in itself) including the Chief Whip. Voting has been postponed until today and should happen sometime in the next few hours. President Zuma’s situation has been described as tenuous after a series of scandals over the last few years.The fact that the Presidents own ANC Party appears to be closing ranks against him is significant having put up a previously united front.

The South African Rand (ZAR) has rallied this morning against the USD as the markets clearly see a Zuma departure as a positive sign for an economy creaking at the seams and facing the threat of a downgrade of its debt to “junk’ status.

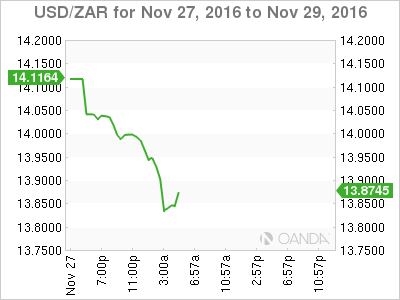

USD/ZAR has fallen from a 14.1164 close on Friday to a low around 13.8000 this morning in Asia. Of course, the market is anticipating a victory for the anti-Zuma faction, and this is not a given. Should Mr Zuma win, we may see a lot of today’s USD/ZAR sell-off unwound. Conversely, if Mr Zuma loses, we may see a continuation of today’s move.

ZAR has been battered, like all emerging markets, by the ebbs and flows of the USD rally and the hike in USD yields. Recently it has consolidated in a 14.0000/ 14.30000 range until this morning.

14.0000 is shown short-term resistance as per the hourly chart below with today’s low at 13.8000 support.

In the bigger picture, longer-term support lies at 13.1800 a multi-day low. Resistance lies at 13.9700/14.0000 the 100-day moving average and the aforementioned multi-hour lows.

SUMMARY

Traders should keep a close eye on newswires today as to whether Mr Zuma wins or loses, there is almost certainly going to be more volatility in USD/ZAR because of it. Possibly a lot of it! As ever, when trading gets “noisy,” it is always good to have the bigger picture levels of importance in your mind.