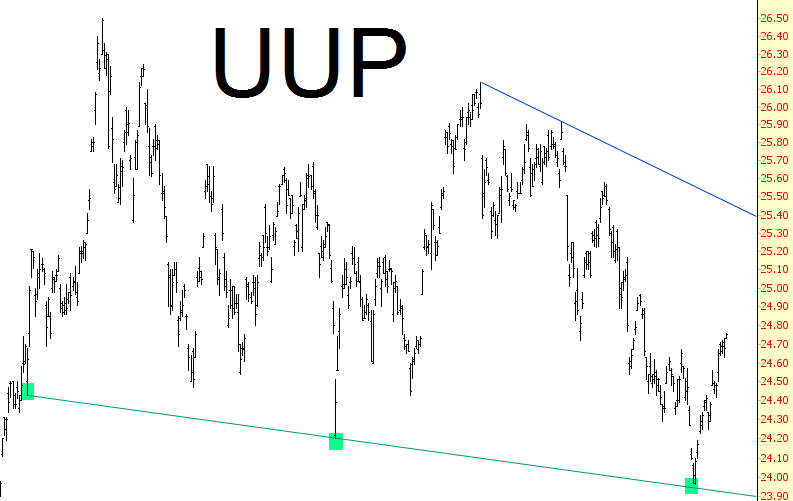

Back on May 3 I suggested going long the U.S. dollar. As I phrased it at the time:

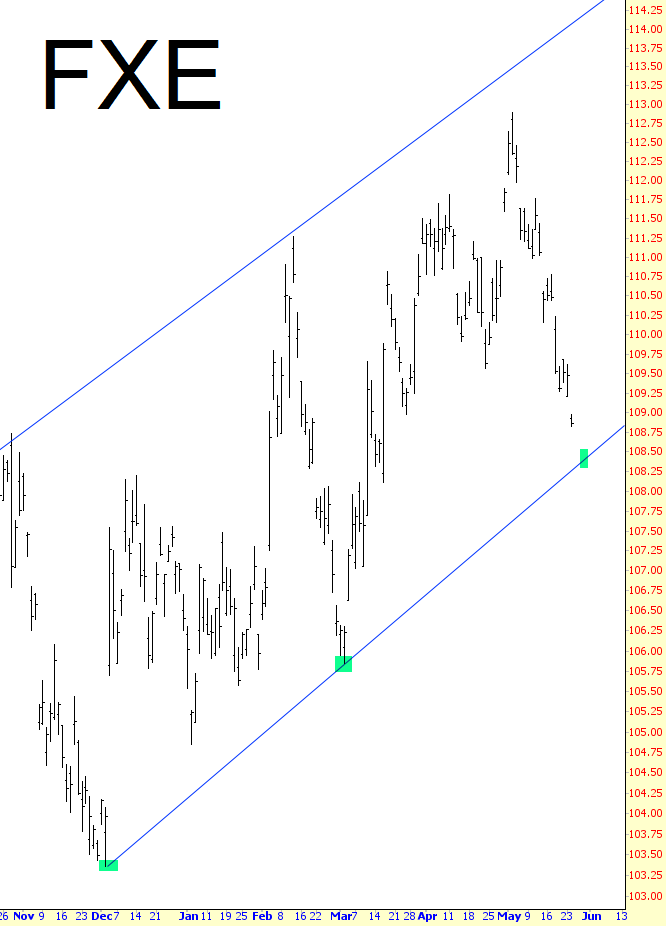

The Yen and Euro have been very strong in recent months. I believe this is about to turn, and thus I am banking on a strengthening dollar. There are plenty of ways to play this (short the Euro, short the Yen, etc.) but I’m going to use the lame-o, thinly-traded (NYSE:UUP).

Well, let’s take a fresh look at the charts. Shorting the Yen has gone pretty well, and there doesn’t seem to be much in the way of support, so this probably is a good “hold”:

The euro has a little way to go before its lower trendline, but I’ve got to say that it’s looking pretty close to being done for now.

As for the dollar itself, I was pleased that my post went up at the perfect time for a long entry. With tightened stops, it’s a virtually assured profit. I guess it’s still a pretty good long position, until and unless it tags that upper trendline. But the strength of the dollar might diminish given, as shown above, that the euro may be nearing some strength itself.