Evaluating rare earth projects is a tricky business, and the ambiguous reporting methods some companies use don't make it any easier. In this interview with The Mining Report, Ryan Castilloux of Adamas Intelligence examines misleading metrics that hide the devil in the details. He also explains the complex, objective methodology he uses to rank the world's 52 most advanced rare earth projects, and names five development-stage projects and three exploration-stage projects with lucrative upside potential. A must-read for anyone interested in rare earth elements.

The Metals Report: What implications will recent news of China's rare earth element (REE) industry consolidation have on prices in 2014 and beyond?

Ryan Castilloux: In the near term, it will firm up REE prices in China and elsewhere. This consolidation is part of Beijing's larger efforts to stamp out illegal REE production, phase out inefficiencies and secure China's position as the world's lowest-cost REE producer and supplier.

TMR: How significant is illegal REE production in China?

RC: China has two competing REE industries: legal and illegal. This results in an abundance of REE suppliers. End-users are aware of this and exploit it by shopping around. They use the last guy's offer to negotiate a lower price with the next supplier, and ultimately, the spread between prices widens, and prices trickle downward.

China's consolidation plans aim to remedy this situation. The Baotou Rare Earth Products Exchange shares this goal. In the long term and in the context of the recent World Trade Organization (WTO) ruling against China's REE restrictions and tariffs, consolidation is a power play. It aims to drive down production costs, so that China can undercut emerging suppliers, should it find its grip on the industry weakening.

TMR: How powerful is that grip?

RC: China yields separated rare earth oxides (REOs) at costs that no one else can match. In the mid-1990s, China exploited this fact to dramatically undercut global REO prices, which resulted in the end of production from most other regions—most notably the U.S. with the closure of Molycorp Inc.'s (MCP) Mountain Pass mine.

For almost a generation, China has enjoyed an enduring monopoly on global REO supply. It has also absorbed most value-added production capacity in the supply chain by attracting foreign manufacturers to set up facilities in China. It's secured its monopoly against the emergence of foreign competitors through the use of export restrictions and taxes. But China now faces the possibility that the WTO ruling could lead to a softening of its industry policies. Its strongest defense without these policies is to cement itself as the global cost leader so it can undercut foreign producers if it feels the need.

The outlook was much different in 2010, when many were predicting REO demand would double by 2016. At that time, I do believe China wanted to see the emergence of foreign producers, but demand hasn't grown much since then. As a result, any new producers that emerge in the near term are going to take a significant bite out of China's market share. If its market share begins eroding too quickly, China may again slash the competition by cutting REO prices. So while prices are likely to strengthen in 2014, they could head lower over the long term.

TMR: Do current REO prices provide the support necessary for new REE projects?

RC: Generally, REO prices are about where they were before the 2011 spike, with the exception of the critical REOs (neodymium [Nd], dysprosium [Dy], Europium [Eu], terbium [Tb] and yttrium [Y] oxides), which are slightly higher. There's been a lot of groaning from investors since then about how prices have come down to levels that challenge the feasibility of many projects. But in actuality, prices are quite similar to what they were in 2007–2009, when many of these projects emerged.

TMR: After the 2011 price spike, many REE end-users began looking for substitutes. Have they found any?

RC: Many end-users have been trying to replace or reduce the amount of REOs or REEs they use in their products, since even before the 2008 economic crisis. However, rather than substituting REEs entirely, they have instead reduced the amount they use in many applications. A car, for example, can have as many as 50 electric motors in it, most of which utilize REE-bearing permanent magnets. Substituting some of these with motors that don't use REEs can go a long way toward reducing costs and supply risk. For instance, BMW's Mini E electric car and Tesla's Roadster are both powered by induction motors, which don't use REE permanent magnets.

TMR: To what extent is an optimistic outlook for REEs dependent upon explosive growth in the adoption of new technologies such as electric cars?

RC: The optimistic outlooks for REO demand that dominated headlines in 2008-2011 were entirely based on forecasts of explosive demand growth for technologies such as electric cars, wind turbines and ubiquitous gadgets and electronics. The demand for these technologies is still growing strong in most cases, but the amount of REO or REE consumed on a per-unit basis for many applications has decreased, leading to slower REO demand growth than predicted.

Somebody once told me that any forecast on future demand is wrong, and I think that's a relevant statement, especially for the nascent REE industry. It's important to realize just how young the REE industry is compared to other industries such as copper, aluminum or steel. We've only realized a small fraction of the potential applications, which will depend on REEs in the coming decades.

It's all about the performance versus economics. If REEs are the optimal material to be used in an application for performance, but translate into very high prices for the end-user, technology developers will likely sacrifice some functionality or efficiency to stay competitive. The question is: How can developers reduce their REE needs without making sacrifices that will reduce their competitiveness and harm their brands?

TMR: What will lower long-term REE prices mean for explorers and developers outside China?

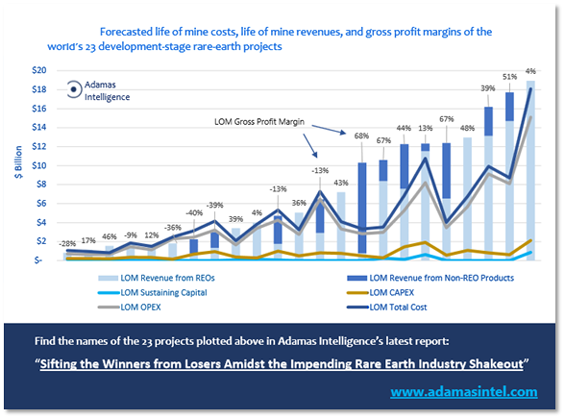

RC: It means that tomorrow's producers will need healthy profit margins to endure potential downturns in pricing. Producers that yield significant revenues from non-REE byproducts will be able to protect themselves against REE price volatility. That's definitely an advantage. Unfortunately, there aren't many projects with that potential.

TMR: Could you name some?

RC: Orbite Aluminae Inc.'s (ORT) Grande-Vallée project in Quebec's Gaspé region is perhaps the best example of a byproduct-sustainable project. But in some respects, you could say that REEs are the byproduct of Orbite's operation, since its REO production will be less than 1,000 metric tons per annum.

Tasman Metals Ltd.'s (TSM) Norra Kärr project in Sweden and Avalon Rare Metals Inc.'s (AVL) Nechalacho project in Canada's Northwest Territories are two other projects that can cover a major portion of operating costs and payback capital using revenue from byproducts alone.

TMR: You wrote in a report, "Sifting the Winners from Losers Amidst the Impending Rare Earth Industry Shakeout," that "misleading metrics and ambiguous reporting practices have pervaded the REE industry." Could you elaborate?

RC: The REE sector is rife with ambiguous and misleading project metrics, for example, basket pricing, which is the go-to practice of calculating a dollar-per-kilogram figure for contained REOs. This metric is abstract, opaque and in direct discordance with NI 43-101 standards. However, the compliant way of reporting, which is to calculate an equivalent grade referenced to one of the REEs that dominate a project's economics, such as the percentage of Nd and Nd equivalent, is even more opaque, I would argue, because it sheds no light on what is in the deposit other than Nd.

Another opaque practice concerns costs-reporting, specifically the reporting of planned production capacity in "metric tons of REOs," versus reporting planned production capacity in "metric tons of REO products." The latter tells you nothing about the quantity of REO in the product (concentrate). It could be an REO product containing 1% REO, or containing 99.9% REO – the investor is left to make their own assumption unless it is specified elsewhere.

Things get even trickier with some companies projecting costs on a "dollar-per-metric-ton of REO produced" basis, whereas others project costs on a "dollar-per-metric-ton of REO product produced" basis, which could refer to anything from low-grade bulk ore to a purified mixed REO concentrate. Here's an example: A project plans to produce 10,000 tonnes of REO concentrate (aka REO product) per annum. In this concentrate is 5,000 tonnes of REOs. Therefore, if it costs the company $1,000 per tonne of REO to produce, you could also say it costs them $500 per tonne of REO product, which looks a lot better. Now if the company doesn't reveal that the "REO product" is actually only 50% REO, then the reader or investor is left to speculate, or maybe even make inaccurate conclusions.

Other confusion arises with some reporting their planned production in "tons" whereas most others report in "metric tons" or tonnes. Since REO prices are denoted on a dollar-per-kilogram basis, reporting in "metric tonnes" is most transparent in my opinion, but reporting in "tons" will naturally make your numbers look larger to anyone skimming through a news release or technical report.

Another foggy practice is the way that projected revenues are discounted in technical reports for projects that aim to produce unseparated REO concentrates. Commonly they will discount by 15–40% for the anticipated cost of paying a third party to separate REOs from the material, but seldom offer justification for this discount rate, or specify exactly which third party will do the separation.

TMR: Is there a best reporting practices code to which some but not all companies subscribe?

RC: Best practices in reporting have been adopted by some companies, but they have not been formally adopted by the industry as a whole. Generally, the best practice is to be as transparent as possible. When companies discuss production in terms of "metric tons of REO product" and fail to mention what the REO grade of that material is, or what the chemical nature of the product is—for example, carbonate, oxalate or chloride—they are not being transparent and this is certainly not a best practice.

TMR: Adamas Intelligence tracks the economic and technical development of 52 REE exploration and development-stage projects. With nearly every release in the sector touting success, how do you distinguish reality from hype?

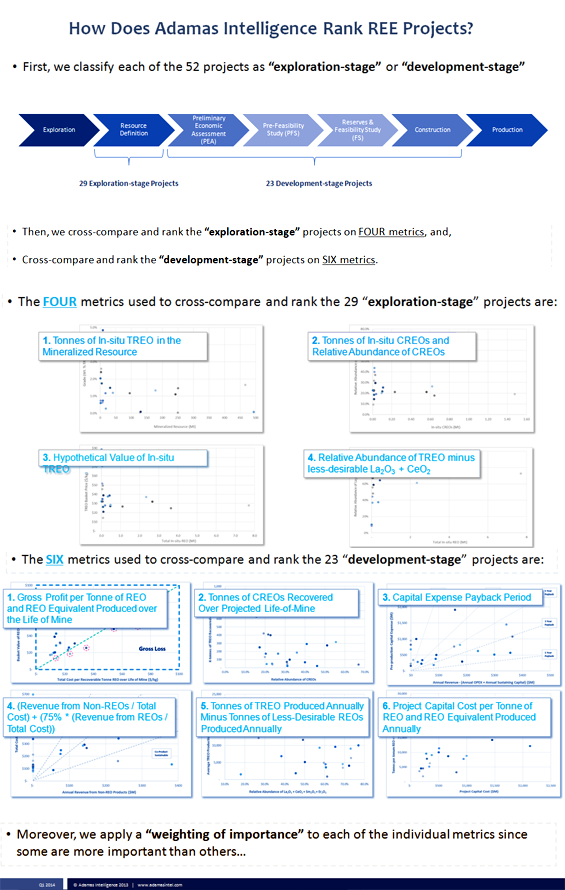

RC: Of the 52 projects that we track, 27 are exploration stage and 25 are development stage. Exploration-stage projects possess compliant resource estimates but lack preliminary economic assessments (PEAs), preliminary feasibility studies (PFSs) or feasibility studies (FSs). Development stage projects possess PEAs, PFSs or FSs but are still preproduction. All the projects we track have either NI 43-101-, JORC- or SAMREC/SAMVAL-compliant resources.

With that sorted, we cross-compare and rank the projects by a suite of metrics that highlight their economic promise or lack thereof. We then cross compare the 27 exploration-stage projects on four metrics and the 25 development-stage projects on six metrics and apply specific weights to the individual metrics, given that some are more important than others. Finally, we sum up the weighted ranks of each of these metrics to see how each project stacks up overall. The metrics and the ranking methodology are detailed in a presentation on the Adamas Intelligence website.

TMR: What are the characteristics common to the projects that score highest in your ranking, and what are the characteristics common to your lowest-ranking projects?

RC: Our top-five ranked development projects offer robust profit margins, timely payback on preproduction capital and the prospect of solid revenues from REOs as well as non-REO products. The most promising projects can endure REO price swings and will remain lucrative in a future marked by low REO prices.

The lower-ranked projects tend to have smaller resources and lower grades. Thus, they have lower volumes of in situ REOs. If you consider that the average project requires around $804 million ($804M) in preproduction capital alone (thus, not including sustaining capital), it quickly becomes apparent to us that a greenfield deposit with only 10,000 or 20,000 metric tons of in situ REOs will struggle. It is important to say preproduction capital since projects also require sustaining capital during their lifetimes which is not included in this average.Other projects that didn't rank highly are those for which we anticipate low profit margins or losses. And there are also those projects with low relative abundances of critical rare earth oxides (CREOs) and heavy rare earth oxides (HREOs). Again, CREOs include Nd, Dy, Eu, Tb and Y oxides. LREOs include lanthanum (La) through gadolinium (Gd) oxides on periodic table. HREOs include Tb through lutetium (Lu), plus Y oxides. Scandium (Sc) is none of the above, but is considered a REE or REO nonetheless.

TMR: The average pre-production capex is $804M?

RC: That's the average of the 25 development projects we cover. The range is quite wide. The lowest figure is somewhere around $65M for AMR Mineral Metal Inc.'s (private) Aksu Diamas project in Turkey, and the highest, at over $3.766 billion ($3.766B), is DNI Metals Inc.'s (DNI) Buckton project.

TMR: In recent years, there has been a negative reaction to projects with capex over $500M. Does this $685M average capex demonstrate that the REE sector itself is high risk?

RC: With the volatility we've witnessed in recent years, it certainly does from a project investor standpoint. And that, in turn, makes projects that can promise a short payback period on preproduction capital the most attractive. Especially to institutional investors, who like to get in and get out.

And while this $685M comes with a lot of sticker shock, it's generally a small figure compared to the life-of-mine operating costs that these projects will incur. We're talking billions of dollars in operating costs, figures that dwarf the preproduction capital expense. When looking for room for improvement in the economics of these projects, operating costs are certainly where the biggest dent can be made.

TMR: Is future success in the REE sector especially correlated with a generalized upturn in the market?

RC: I think so. I think investors and followers of the industry have become a lot more informed in recent years, and the sticker shock of the sector's high capex projects is wearing off. Yes, these projects are extremely expensive and require much technical expertise, but the long-term revenue potential of many of them is tremendous, and will stimulate more economic growth downstream in the market.

If we do see an upturn in prices in 2014, that could result in investors sitting on the sidelines stepping forward.

TMR: Name a couple of projects with the greatest potential to add production in the coming five years.

RC: Given that it can take five years or more to go from PEA to production, later-stage projects have a natural advantage in the near-term. This would include Avalon's Nechalacho Basal Zone. The project's polymetallic revenues offer robust profit margins despite its $1.5B capex. This project also plans to produce separated REOs, which will help align the company's production with the needs of its eventual customers.

Tasman's Norra Kärr project is another very promising contender. In fact, it's ranked first in our development-stage ranking. Norra Kärr is also a polymetallic, heavy rare earth element (HREE)-rich deposit that offers a profit margin healthy enough to endure future price volatility. Based on its PEA, preproduction capex is low, and operating costs will be among the lowest in the sector. Affirming these costs through feasibility studies and arranging toll separation or offtake agreements are the key next steps for Norra Kärr.

TMR: What are some others?

RC: Other contenders to watch out for are Frontier Rare Earths Ltd.'s (FRO) Zandkopsdrift project in South Africa and Greenland Minerals & Energy Ltd.'s (GGG) Kvanefjeld project in Greenland. Zandkopsdrift plans to produce around 20,000 metric tons of separated REOs annually and has a joint venture with Korea Resources Corp., which will help align the project's eventual production with major Korean technology developers and end-users. Kvanefjeld plans to produce around 23,000 metric tons of REOs annually containing a variety of high-grade concentrates, along with significant volumes of uranium oxide, zinc and fluorspar. The Kvanefjeld deposit is massive. It contains more than 6.5 million metric tonnes of in-situ REOs—about 55 times current annual global demand.

TMR: What are some promising exploration-stage projects?

TMR: In recent years, there has been a negative reaction to projects with capex over $500M. Does this $685M average capex demonstrate that the REE sector itself is high risk?

RC: With the volatility we've witnessed in recent years, it certainly does from a project investor standpoint. And that, in turn, makes projects that can promise a short payback period on preproduction capital the most attractive. Especially to institutional investors, who like to get in and get out.

And while this $685M comes with a lot of sticker shock, it's generally a small figure compared to the life-of-mine operating costs that these projects will incur. We're talking billions of dollars in operating costs, figures that dwarf the preproduction capital expense. When looking for room for improvement in the economics of these projects, operating costs are certainly where the biggest dent can be made.

TMR: Is future success in the REE sector especially correlated with a generalized upturn in the market?

RC: I think so. I think investors and followers of the industry have become a lot more informed in recent years, and the sticker shock of the sector's high capex projects is wearing off. Yes, these projects are extremely expensive and require much technical expertise, but the long-term revenue potential of many of them is tremendous, and will stimulate more economic growth downstream in the market.

If we do see an upturn in prices in 2014, that could result in investors sitting on the sidelines stepping forward.

TMR: Name a couple of projects with the greatest potential to add production in the coming five years.

RC: Given that it can take five years or more to go from PEA to production, later-stage projects have a natural advantage in the near-term. This would include Avalon's Nechalacho Basal Zone. The project's polymetallic revenues offer robust profit margins despite its $1.5B capex. This project also plans to produce separated REOs, which will help align the company's production with the needs of its eventual customers.

Tasman's Norra Kärr project is another very promising contender. In fact, it's ranked first in our development-stage ranking. Norra Kärr is also a polymetallic, heavy rare earth element (HREE)-rich deposit that offers a profit margin healthy enough to endure future price volatility. Based on its PEA, preproduction capex is low, and operating costs will be among the lowest in the sector. Affirming these costs through feasibility studies and arranging toll separation or offtake agreements are the key next steps for Norra Kärr.

TMR: What are some others?

RC: Other contenders to watch out for are Frontier Rare Earths Ltd.'s (FRO) Zandkopsdrift project in South Africa and Greenland Minerals & Energy Ltd.'s (GGG) Kvanefjeld project in Greenland. Zandkopsdrift plans to produce around 20,000 metric tons of separated REOs annually and has a joint venture with Korea Resources Corp., which will help align the project's eventual production with major Korean technology developers and end-users. Kvanefjeld plans to produce around 23,000 metric tons of REOs annually containing a variety of high-grade concentrates, along with significant volumes of uranium oxide, zinc and fluorspar. The Kvanefjeld deposit is massive. It contains more than 6.5 million metric tonnes of in-situ REOs—about 55 times current annual global demand.

TMR: What are some promising exploration-stage projects?

RC: Namibia Rare Earths Inc.'s (NRE) Lofdal project in Namibia is very interesting. The resource to date is small: only around 10,000 metric tons of REOs in situ. However, these REOs are 80% heavy rare earth oxides (HREOs) and 70% CREOs.

Another interesting project is Northern Minerals Ltd.'s (NTU) Browns Range project in Australia. Similar to Lofdal, the REOs at Browns Range are around 75% HREO and 70% CREOs.

GéomégA Resources Inc.'s (GMA) Montviel project in Quebec is another rising star. While it lacks the high proportions of HREOs and CREOs of Lofdal or Browns Range, the resource is very large, with around 3.6 million metric tons of REO in-situ. The company recently announced the development of a novel physical separation process for REOs, which it claims could dramatically reduce the capital required for building separation facilities. This is exciting news but still needs more verification and development.

TMR: How important is the potential shortage of HREOs in the next few years?

RC: It has been a big concern for many end-users in recent years, and has fueled a surge in exploration. The big problem is the extreme scarcity of HREO separation capacity outside China. Projects such as Lofdal, Norra Kärr, and Nechalacho have high proportions of HREOs to meet impending shortages, but it's still unclear where those materials could ultimately be separated and where they could be refined into the more specific materials that companies are looking for.

TMR: REEs are often called "critical" or "strategic" metals. Is it possible that Western governments, and the U.S. in particular, could decide that Chinese supply cannot be counted on, so domestic supply must be guaranteed?

RC: I think that is certainly a possibility, and there have been some developments in that direction. A number of legislative proposals have been put forth to Congress to address to the U.S.' supply risks and to support the development of domestic REO production. For example, in June 2013 the U.S. House of Representatives passed the "National Defense Authorization Act for Fiscal Year 2014 (H.R. 1960)" that forces the U.S. Department of Defense (DOD) to develop strategies for mitigating REO supply chain risks. [View source]

In September 2013, the House passed the "National Strategic and Critical Minerals Production Act of 2013 (H.R. 761)," which aims to streamline the federal permitting process for domestic exploration and development of critical and strategic minerals.

REEs are called critical and strategic metals for good reasons. They're at the heart of new automotive technologies, a lot of aerospace technologies, and they play out an important role in certain healthcare applications.

Perhaps even most important, REEs are essential to the macro initiatives of European and American governments with respect to energy efficiency and greenhouse gas emissions reductions. Achieving mandated reductions in energy use or emissions without REEs can be a major challenge.

Consider the ongoing transition from inefficient incandescent lamps to fluorescent lamps, which contain valuable HREOs. Because of anticipated shortages of these HREOs, in 2012, eight major manufacturers of fluorescent lamps applied for (and were granted) "exception relief" by the U.S. Department of Energy that allows them to utilize less REO in their lamps than would otherwise be required to meet efficiency standards for a period of two years. I believe this is indicative of lighting companies' awareness of impending HREO shortages or bottlenecks in the supply chain.

TMR: Are there any downstream gaps in the supply chain that will challenge the establishment of a western REE industry?

RC: As I mentioned above, the lack of REO separation capacity outside China is a challenge. This has become the elephant in the room few wish to acknowledge. Only five of the 24 most advanced projects today plan to produce separated REOs exclusively. That means that as some or all of these 19 other projects near production, this downstream gap in the supply chain will become a major problem.

A few companies, such as Innovation Metals (private), actively seek to fill the separation gap through the establishment of toll separation plants. But any such undertaking comes with a significant lead time. There's really no guarantee that this gap can be closed in time for the emerging producers.

TMR: What other supply chain problems do you see?

RC: Looking even further downstream at the specific needs of end-users, they're not necessarily looking for separated REOs or REEs. They want the alloys, the phosphors, the magnets and the other materials that the REOs and REEs are refined into. For the most part, the West is generally lacking in those areas too.

TMR: 2013 saw a very limited interest in REE projects from institutional investors, private equity and other financiers. Do you foresee this changing in 2014?

RC: As more and more projects advance to later stages, it's becoming clear which hold the greatest near-term promise. This could lead to some big investments in 2014. The risk for financiers and private equity investors interested in the REE space is that, if they wait too long to make their bets, one of their competitors might do so first.

Because the world only really needs a couple of new producers in the near-term, these investors might find themselves with only losing horses left to bet on. I think we could also see some non-traditional deals or partnerships in 2014 as REE end-users look for creative ways to secure supplies.

TMR: Why are creative ways needed?

RC: Aside from Molycorp's vertical integration efforts and similar plans by a couple of others, the rest of the REE industry outside of China is fragmented and disconnected. The problem is that the alignment of these fragments into a competitive supply chain is hindered by catch-22s and chicken-before-egg dilemmas.

For example, bankers are hesitant to finance mine development because of REO price and demand uncertainty. End-users are hesitant to commit to demand because of REO price and supply uncertainty. The supply chain gap still exists because it's a challenge to get backing to build a toll separation plant when you can't guarantee you'll have feed coming in the door until new mines are actually built.

TMR: What are the possible solutions to these catch-22s?

RC: Multi-stakeholder offtake agreements and commitments can help overcome a lot of these challenges. If stakeholders covering each step of the supply chain from the mines to the end-user can agree in advance to link up, major investors would see the light at the end of the tunnel. That's definitely easier said than done, but we're starting to see a lot of multi-stakeholder groups and different industry consortiums popping up, which is a step in the right direction.

TMR: Ryan, thank you for your time and your insights.

RC: My pleasure, thank you.

Ryan Castilloux is the founder of Adamas Intelligence, an independent research and advisory firm that provides strategic advice and ongoing intelligence on critical metals and minerals sectors. He helps investors, financiers, end-users and other stakeholders track emerging trends and identify new business opportunities in the critical metals and minerals sectors. Castilloux is a geologist with a background in mining and exploration and has a Master of Business Administration (finance) from the Rotterdam School of Management, Erasmus University. Subscribe for free updates from Adamas Intelligence at www.adamasintel.com.

DISCLOSURE:

1) Kevin Michael Grace conducted this interview for The Mining Report and provides services to The Mining Report as an independent contractor. He or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Mining Report: Tasman Metals Ltd. and Namibia Rare Earths Inc. Streetwise Reports does not accept stock in exchange for its services or as sponsorship payment.

3) Ryan Castilloux: I or my family own shares of the following companies mentioned in this interview: None. I personally am or my family is paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.