Manufacturer of consumer and industrial packaging products, Sonoco Products Co. (NYSE:) is scheduled to report second-quarter 2017 results on Jul 20, before the opening bell. In the last reported quarter, Sonoco’s both top-line and bottom-line have dipped on a year-over-year basis. While earnings beat the Zacks Consensus Estimate, revenues came in line. Let’s see how things are shaping up prior to this announcement.

Earnings Whispers

Our proven model does not conclusively show that Sonoco is likely to beat on earnings this quarter. That is because a stock needs to have both a positive Earnings ESP as well as a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) for this to happen. However, this is not the case here as elaborated below.

Zacks ESP: Sonoco has an Earnings ESP of 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 71 cents per share. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Sonoco carries a Zacks Rank #3, which increases the predictive power of ESP. However, a 0.00% Earnings ESP makes the surprise prediction difficult.

Importantly, the Sell-rated stocks (Zacks Rank #4 or 5) should never be considered going into an earnings announcement.

Surprise History

Sonoco Products Company Price and EPS Surprise

Sonoco Products Company Price and EPS Surprise | Sonoco Products Company Quote

In the last reported quarter, the company posted a negative earnings surprise of 3.51%. Sonoco has outpaced the Zacks Consensus Estimate in three of the trailing four quarters, with an average positive earnings surprise of 3.79%.

Factors at Play

For second-quarter 2017, the company anticipates earnings per share in the range of 69–73 cents. Compared with the year-ago quarter’s earnings of 71 cents per share, the mid-point of the guidance reflects a decline of 3%. This guidance takes into consideration the negative impact of divestitures in 2016, partially offset by the acquisition of Peninsula Packaging and other buyouts completed in 2016.

Old Corrugated Cardboard (OCC) and resin prices are on the rise. The company has implemented price increases. These increases, as well as contractual price adjustments, should offset the increased cost for OCC. A stronger dollar, weak results from single corrugated medium machine, and slowdown in manufacturing remain concerns.

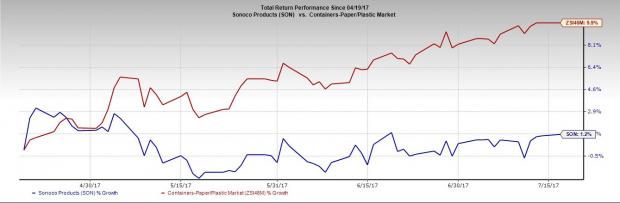

Price Performance

Sonoco has underperformed Zacks categorized Containers-Paper/Plastic industry in the past three months. The company’s shares gained around 1.2% compared with 9.9% growth recorded by the industry.

Stocks to Consider

Here are some stocks which you may consider as our model shows that they have the right combination of elements to post an earnings beat in their upcoming releases:

Avery Dennison Corporation (NYSE:) has an Earnings ESP of +1.68% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Caterpillar Inc. (NYSE:) has an Earnings ESP of +11.67% and a Zacks Rank #2.

Owens-Illinois, Inc. (NYSE:) has an Earnings ESP of +3.03% and a Zacks Rank #2.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Sonoco Products Company (SON): Free Stock Analysis ReportOwens-Illinois, Inc. (OI): Free Stock Analysis ReportCaterpillar, Inc. (CAT): Free Stock Analysis ReportAvery Dennison Corporation (AVY): Free Stock Analysis ReportOriginal postZacks Investment Research