John Rubino and Gordon T Long discuss the alarming developments in the Junk (High Yield) Bond market. John was warning on his last appearance on Macro Analytics about the things he was seeing, while Gord was warning of a turn he was seeing in the Credit Cycle. Both previous observations have proven correct so John and Gordon postulate what to expect next. It isn't pretty!

A HUGE POTENTIAL PROBLEM

Since the Financial Crisis the US Federal Reserve has increased its balance sheet by approximately $3.5 Trillion. In this same period the Junk Bond (HY) issuers have issued $2.2T of debt which the markets have 'gobbled' up to achieve yield. The question is what happens if they start selling some of that debt to avoid capital losses. This problem is compounded by regulations since the financial crisis which has significantly curtailed banks making markets in these instruments. Many worry that Investment Grade (IG) bonds also issued over the same period will be "infected", especially with a historic $1.3T being sold for the first time in 2015 to significantly fund stock buybacks and dividend payouts. This is a 'witch's brew' for a potential disaster.

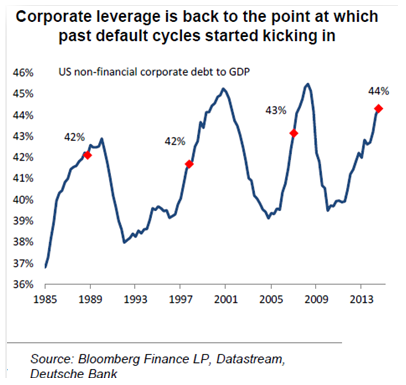

CORPORATE LEVERAGE

With Corporate Leverage back to the point at which past default cycles started kicking in, there are more reasons to worry, as corporate cash flow and EBITDA fall while the Federal Reserve raises rates.

Worsening cash flow to debt ratios normally force credit downgrades making credit more expensive and harder to get. This is coming at a time when major Junk Bond issuers in the Energy and Commodity sector are being hardest hit by falling pricing. They are trapped and investors know this and are now worried about junk bond liquidity.

A SLOWING GLOBAL ECONOMY

John and Gord both see a steadily deteriorating global economy which will bring further pressures to an already troubling situtation.

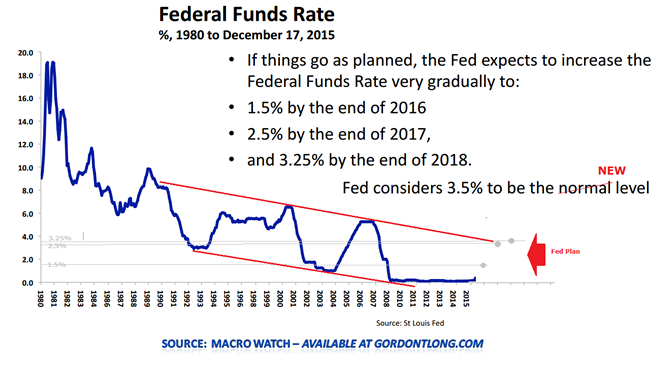

John lays out the torrent of bad news coming as the Fed begins raising rates:

Oil slump resumes on U.S. supply build, expected Fed rate hike

Why the current credit crisis might be 35 times worse than you thought

Freight Shipments Hammered by Inventory Glut, Weak Demand

Baltic Dry Crashes To New Record Low As China “Demand Is Collapsing”

US Markit flash manufacturing PMI slips to three-year low in December

US industrial output falls as manufacturing stays flat

Brazil’s currency sinks after Fitch cuts rating to junk status

The question is whether the Fed will be able to follow through with its stated policy direction.

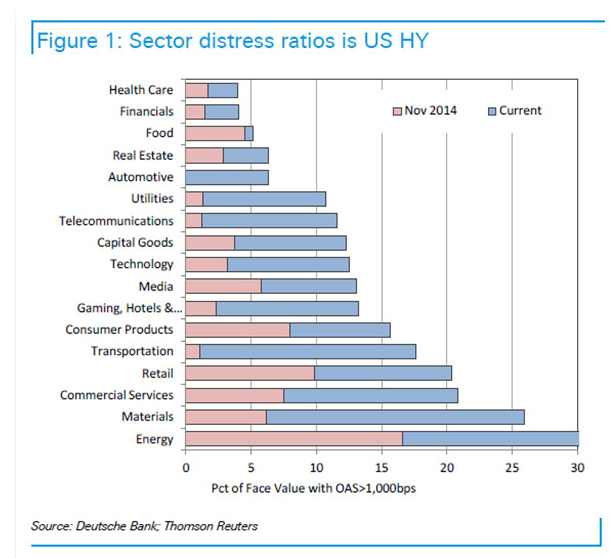

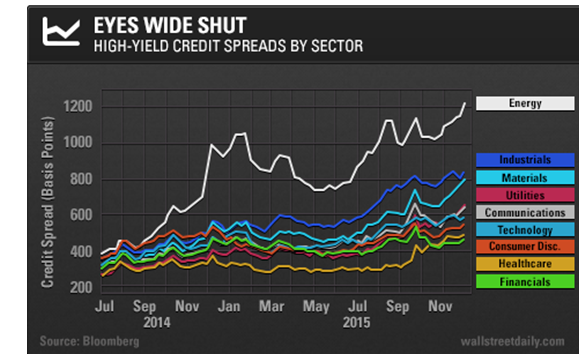

WORRY OF CONTAGION

The problems in the Junk Bond market are not isolated to just the hard hit commodity and energy sectors. The protracted period of "easy money" created by Fed policy has sowed its seeds across all economic sectors.

Disclaimer: GordonTLong.com & Global Insights may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of Futures Contracts or Options on Futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.options on futures.