Last week, I was having lunch with a prospective portfolio management client discussing the current market and economic backdrop and the related risk to invested capital. During our appetizer of stone crabs and lobster-corn chowder, (if you ever drift into a Truluck’s restaurant I highly suggest both) he discussed how his father had bought a basket of stocks 25-years ago and had essentially performed in line with the markets during that time.

Why shouldn’t he just do the same?

It’s a great question.

The most valuable commodity that we all have is “time.” While the markets may have recently hit “all-time” highs, for the majority of investors this is not the case. They didn’t sell at the previous peak, and they sure as heck didn’t buy at the financial crisis lows. In fact, the reality is quite the opposite, and once again investors appear to be buying the market peak under the belief somehow “this time is different.”

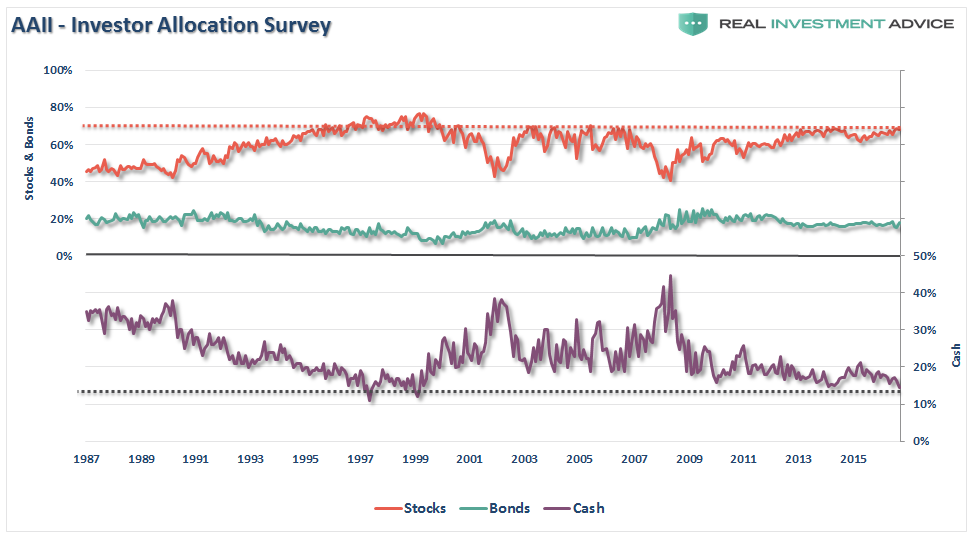

The chart below shows, according to the American Association of Individual Investors (AAII), investors currently have the highest allocation to stocks, and lowest to cash, since the Dot.com bubble in 2000.

But, even if investors have fully recovered from the financial crisis, or the “Dot.com” bust, the time lost in getting back to even can never be recovered.

Unfortunately, for far too many Americans today, time will run out for them as they are faced with the tough retirement choices of being forced to work far longer than any of them ever planned.

Yet, after two major market reversions, business remains brisk for fortune tellers, psychics and market analysts who continue to make guesses about the future. Amazingly, individuals still place too much faith in predictions of these future outcomes when it comes to their savings, and more importantly, their retirement.

I was listening to an interview recently by a leading asset manager who says that the market will end the year higher and that you should remain fully invested in the market. This sounds great, and there is a decent possibility he will be right. However, this is the same prediction made every year…even in 2000 and 2008. The issue is that when these “prognostications” go wrong it can be fatal to those retirement goals.

In order to be truly successful over the long term, and this is especially important if you are close to your retirement date, a focus on 1) capital preservation and 2) returns at a rate to offset inflationary pressures are the most critical. The second part is the most important. People that try to build wealth by investing, rather than saving, tend to lose more often than not as they inherently take on excessive risk trying to “beat the market.”

The understanding that has been lost in recent years by both advisors and investors is the financial markets are a tool to make sure that your “savings” maintain their future purchasing power parity. In other words, your savings are adjusted for inflation over time.

It is important to remember this. NONE OF US are investors.

Not in any sense of the word.

We are all SPECULATORS betting on the future price movement of the market. The difference, just as gamblers in a casino, that separates winners from losers is knowing the odds of success on each and every bet you make. If the odds of success are high then make a bet. If not, don’t.

I have never understood the rationale of individuals who tell me they “have to be invested”.

Why?

Investing just for the sake of having your money in the stock market is a fools bet. As the old adage goes:

“If you are sitting at a poker table and can’t figure out who the pigeon is…it is probably you.”

If you truly have 30 years to be invested before you retire, then you can ignore this article, buy a stock market index fund, stick 20% of income into it every month and most likely you will be better off than most. However, if you are like me, and the millions of other Americans who are within 10-15 years to retirement, we don’t have the luxury of time on our side. Therefore, sudden market losses can be devastating to long term financial sustainability in retirement.

The most basic goal of investing is to “buy low” and “sell high.” This is the only way money is actually created out of the investment process. Unfortunately, this obvious rule is consistently disregarded as investors panic and sell at market lows, or greedily buy market tops. It is human nature, and emotionally based investing almost always results in losses. For those individuals willing to bet at the casino without even looking at their hand, they are most likely going to lose much more often than they win.

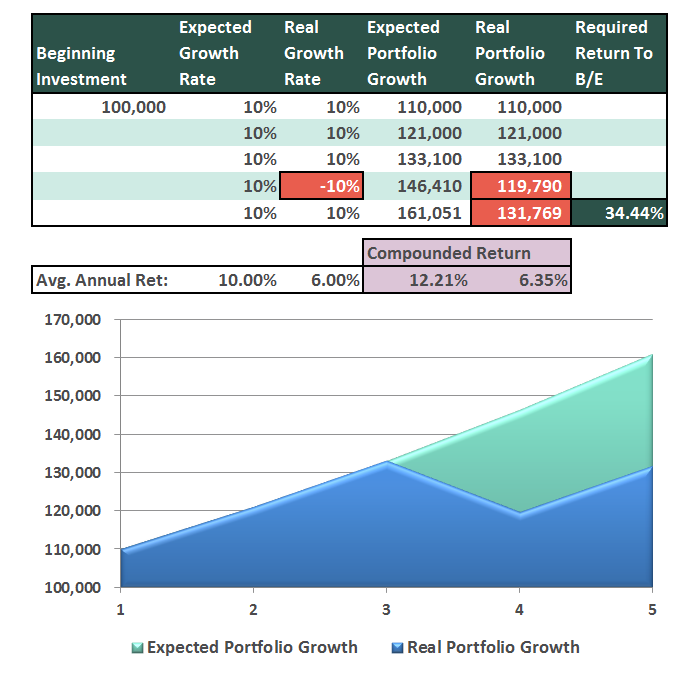

Let’s assume that you want to maintain an annualized return of 10% over the next 5 years. Here are the hypothetical market returns: +10%, +10%, +10% -10%, +10%. Those returns look stellar on the surface. However, the impact on actual investment dollars is quite different.

While many individuals profess to regularly beat the market – the reality is that few do. Most investors tend to do well on the way up but fail to sell before the decline. However, for argument sake, we will assume that the average investor exactly matches market returns. The table shows an investment of $100,000 based on our hypothetical returns for the five-year period.

The important point is that it only takes one draw down over any one-year period to destroy compounded returns. In our example, it would take an astounding 34% return in year 5 to return the portfolio to the original goal. Furthermore, the compounded annual growth rate is cut by almost half due to the one down year. This is why most investors real net returns since the turn of the century are far less than that of the actual market. Emotional mistakes of selling low, and buying high, have consistently put investors on the wrong side of their investment goals.

As Albert Einstein once stated:

“The most powerful force in the universe is that of compounding.”

However, compounding of returns only works with investments that have NO downside risk. Price declines destroy the effect of compounding rapidly. This is why employing a more conservative approach to investing over the “long term” has a higher chance of success than chasing a random benchmark.

Let’s go back to my lunch conversation.

While his father had done very well by simply holding stocks and performing “in line with the market” over that 25-year period, my question was simple:

“How much better would he have done by avoiding some of the drawdowns along the way?”

This was a point I addressed recently:

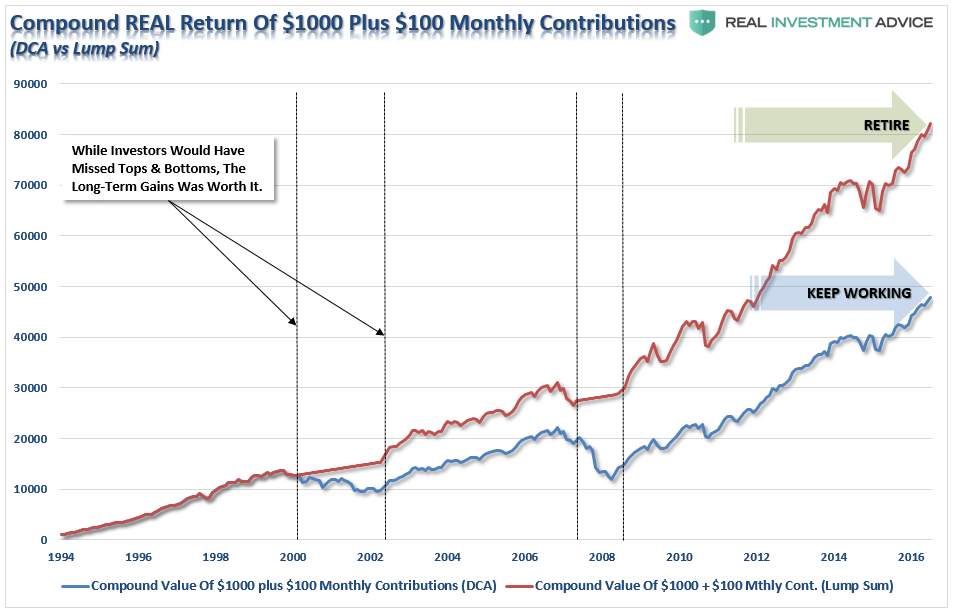

“The chart below is the inflation-return of $1000 invested in 1995 with $100 added monthly. The blue line represents the impact of the investment using simple dollar-cost averaging. The red line represents a ‘lump sum’ approach. The lump-sum approach utilizes a simple weekly moving average crossover as a signal to either dollar cost average into a portfolio OR move to cash. The impact of NOT DESTROYING investment capital by buying into a declining market is significant.”

“Importantly, I am not advocating ‘market timing’ by any means. What I am suggesting is that if you are going to invest in the financial markets, arguably the single most complicated game on the planet, then you need to have some measure to protect your investment capital from significant losses.”

The difference to long-term returns by managing drawdown risk is significant.

This brings up some very important investment guidelines that I have learned over the last 30 years.

- Investing is not a competition. There are no prizes for winning but there are severe penalties for losing.

- Emotions have no place in investing. You are generally better off doing the opposite of what you “feel” you should be doing.

- The ONLY investments that you can “buy and hold” are those that provide an income stream with a return of principal function.

- Market valuations (except at extremes) are very poor market timing devices.

- Fundamentals and Economics drive long term investment decisions – “Greed and Fear” drive short term trading. Knowing what type of investor you are determines the basis of your strategy.

- “Market timing” is impossible – managing exposure to risk is both logical and possible.

- Investment is about discipline and patience. Lacking either one can be destructive to your investment goals.

- There is no value in daily media commentary – turn off the television and save yourself the mental capital.

- Investing is no different than gambling – both are “guesses” about future outcomes based on probabilities. The winner is the one who knows when to “fold” and when to go “all in”.

- No investment strategy works all the time. The trick is knowing the difference between a bad investment strategy and one that is temporarily out of favor.

As an investment manager, I am neither bullish or bearish. I simply view the world through the lens of statistics and probabilities. My job is to manage the inherent risk to investment capital. If I protect the investment capital in the short term – the long term capital appreciation will take of itself.