The US dollar continued marching north yesterday and today in Asia, but some equity indices, especially the European ones, managed to rebound. However, with no clear driver behind the rebound, we believe that the fundamental outlook remains the same as yesterday, with expectations around the Fed’s future course of action staying on the front page of investors’ agendas.

USD Rallies, Wall Street Slides, as Participants Still Bet on Aggressive Fed

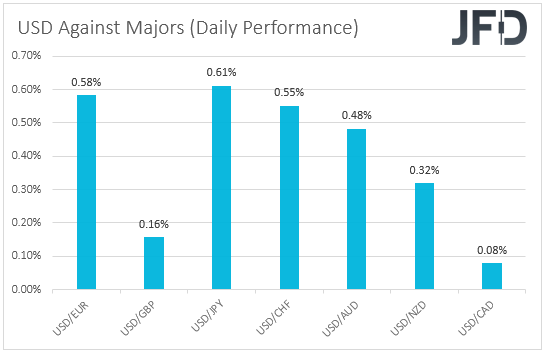

The US dollar traded higher against all the other major currencies on Thursday and during the Asian session Friday. It gained the most versus JPY, EUR, and CHF, in that order, while it lost the least ground versus GBP and CAD.

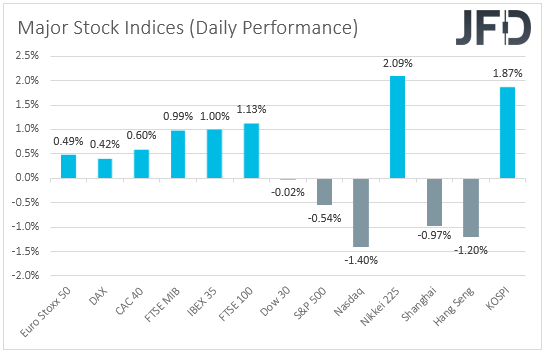

Despite a surging dollar, the yen and the franc were the main losers, while the pound and the Loonie performed relatively better than others, which suggests that market anxiety eased somehow. Indeed, turning our gaze to the equity world, we see that major European indices traded in the green, and although Wall Street closed mainly in the red, some Asian indices enjoyed decent gains today.

With no clear catalyst behind the relative improvement in investors’ appetite, we believe that the fundamental outlook remains the same as yesterday. Thus, we are reluctant to alter our view. European share may have rebounded due to bargain hunters stepping into the action. In contrast, the gains we saw today in Asia may have been the result of Apple’s (NASDAQ:AAPL) impressive earnings.

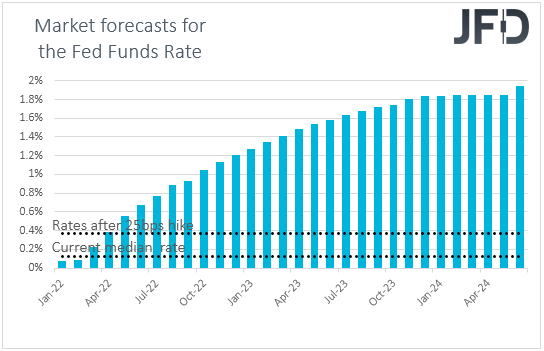

However, by no means is this an indication that participants scaled back their bets over aggressive tightening by the Fed. After all, Wall Street traded lower even after data showed that the US GDP for Q4 grew 6.9% QoQ SAAR.

In our view, investors may have abandoned US equities just because of that. Strong economic performance adds credence to the Fed’s view of a March hike and perhaps a faster subsequent rate path than indicated in December’s “dot plot.”

Indeed, according to the Fed funds futures, we see that market participants are pricing in slightly more than four quarter-point hikes by the end of this year. Therefore, we stick to our guns that equities could turn south again, especially the US ones, and that the US dollar could continue marching north.

European shares may not suffer that much, as there is a decent likelihood of the ECB refraining from lifting rates this year.

EUR/USD - Technical Outlook

EUR/USD tumbled yesterday, falling below the 1.1234 barrier, which acted as the lower end of the sideways range that had been containing most of the price action since Nov. 26. On top of that, the rate also dipped below the 1.1185 zone, marked by the low of Nov. 24, entering territories last seen in June 2020. In our view, this paints an overly bearish picture.

Even if we see a slight rebound soon, as long as the rate remains below the downside resistance line drawn from the high of Jan. 14, we would see decent chances for the bears to retake the reins. We believe that they will try to reach the 1.1100 territory, marked by the low of Jun. 1, 2020, the break of which could carry extensions towards the 1.1010 hurdle, characterized by the inside swing high of May 19.

To abandon the bearish case, we would like to see an apparent recovery back above 1.1263. This could signal the rate’s return back within the aforementioned sideways range and may initially target the 1.1300 barrier, marked by the peak of Jan. 26.

A break higher could aim for the 1.1335 hurdle, marked by the high of Jan. 24, the break of which could extend the advance towards the high of Jan. 21, at 1.1360, or the upper end of the range at 1.1375.

NZD/JPY – Technical Outlook

NZD/JPY traded lower yesterday, after hitting resistance at 76.43, but the slide was stopped slightly above the 75.65 barrier. Overall, the pair remains below the downside resistance line drawn from the high of Jan. 5 and below another steeper one taken from the peak of Jan. 13. Therefore, we believe that the near-term outlook stays bearish.

A clear and decisive break, not only below 75.65 but also below 75.40, which is the low of Aug. 17, could extend the current downtrend towards the 74.60 territory, marked by the lows of August 19th and 20th. However, before that happens, we may see a slight bounce towards the downside line drawn from the high of Jan. 13.

We will start examining the case of a more significant correction to the upside only if we see a recovery back above the high of Jan. 26. This could confirm the break above the downside resistance line taken from the high of Jan. 13 and may initially see scope for extensions towards the inside swing low of Jan. 20.

Another break above 77.30 could pave the way towards the 77.60 barrier or the downside resistance line drawn from the high of Jan. 5.

Elsewhere

We have the US personal income and spending rates for December, alongside the core PCE index for the month, the Fed’s favorite inflation metric. Personal income is expected to have accelerated somewhat, but spending is forecast to have declined. No forecast is available for the core PCE index yet.