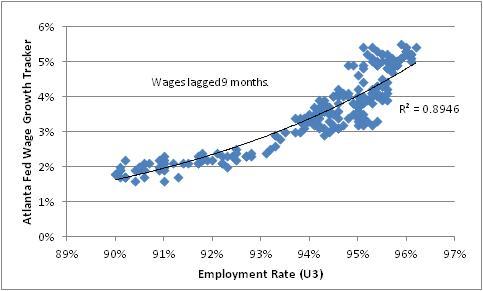

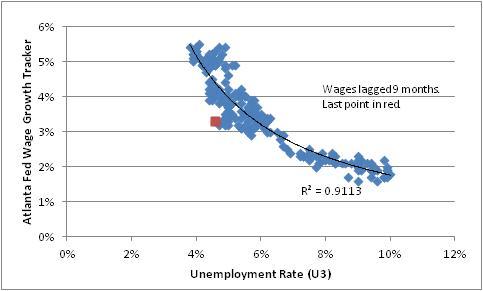

Before I begin, let me say that if you haven’t read yesterday’s article, please do because it represents the important argument: the Phillips Curve doesn’t need rehabilitating, because it is working fine. In fact, I would argue that the Phillips Curve – relating wages to unemployment – is a remarkably accurate economic model prediction. The key chart from that article I reproduce here, but the article (which is brief) is worth reading.

Following my publication of that article, I had a few more thoughts that are worth discussing on this topic.

The first is historical. It’s incredibly frustrating to read article after article incorrectly stating what the Phillips Curve is supposed to relate. Of course one writer learns from another writer until what is incorrect becomes ‘common knowledge.’ I was fortunate in that, 30 years ago, I had excellent Economics professors at Trinity University in San Antonio, and I was reflecting on that fact when I said to myself “I wonder if Samuelson had it right?”

So I dug out my copy of Economics by Samuelson and Nordhaus (the best-selling textbook of all time, I believe, and the de rigeur Intro to Economics textbook for generations of economists). My copy is the 12th Edition, so perhaps they have corrected this since then…but on page 247, there it is – the Phillips Curve illustrated as a “tradeoff between inflation and unemployment.” Maybe that is where this error really propagated – with a Nobel Prize-winning economist making an error in his incredibly widely-read text! Interestingly, the authors don’t reference the original Phillips work, but refer to “writers in the 1960s” who made that connection, so to be fair to Samuelson and Nordhaus they were possibly already repeating an error that had been made even earlier.

My second point is artistic. In yesterday’s article, I said “The Phillips Curve…simply says that when labor is in short supply, its price goes up. In other words: labor, like everything else, is traded in the context of supply and demand,…” But students of economics will note that the Phillips Curve seems to obfuscate this relationship, because it is sloping the wrong way for a supply curve – which should slope up and to the right rather than down and to the right. This can be remedied by expressing the x-axis of the Phillips Curve differently – making it the quantity of labor demanded rather than the quantity of labor not demanded…which is what the unemployment rate is. So the plot of wage inflation as a function of the Employment Rate (as opposed to the Unemployment Rate) has the expected shape of a supply curve. More labor is supplied when the prices rise.

Again, this is nuance and not a really important point unless you want your economics to be pretty.

My third point, though, is important. One member of the bow-tied fraternity of Ph.D. economists told me through a friend that “the Phillips Curve has evolved to the relationship between Unemployment and general prices, not simply wages.” I am skeptical of any “evolution” that causes the offspring to be worse-adapted to the environment, but moreover I would argue that whoever led this “evolution” (and as I said above, it looks like it happened in the 1960s) didn’t really understand the way the economy (and in particular, business) works.

There is every reason to think that wages should be tied to available labor supply because one is the price of the other. That’s Microeconomics 101. But if unemployment is going to be a good indicator of generalized price inflation too, then it means that prices in the economy are essentially set as the price of the labor input plus a spread for profit. That is not at all how prices are set. Picture the businessperson deciding how to set prices. According to the “evolved Phillips Curve” understanding, this business owner looks at the wages he/she is paying and then sets the price of the product. But that’s crazy. A business owner considers labor as one input, as well as all of the other inputs, improvements in productivity in producing this good or service in question, competitive pressures, and the general state of the national and local economy. It would be incredible if all of these factors canceled out except for wage inflation, wouldn’t it? So in short, while I would expect that unemployment might have some explanatory power for inflation, I wouldn’t expect that explanatory power to be very strong. And, in fact, it isn’t. (But this isn’t new – it never has had any power.)