PMI data from China exceeded analyst forecasts, rising to an 11-month high of 53.1, lifting some Asian markets. The Nikkei rose .3% to 10110, led by car makers, and the Kospi climbed .8% to 2029. Moody’s raised its credit rating on South Korea’s sovereign debt, boosting financial stocks. The Hang Seng slipped .2% to 20522, and the ASX 200 eased .1%, while the Shanghai Composite was closed for a holiday which will extend through Wednesday.

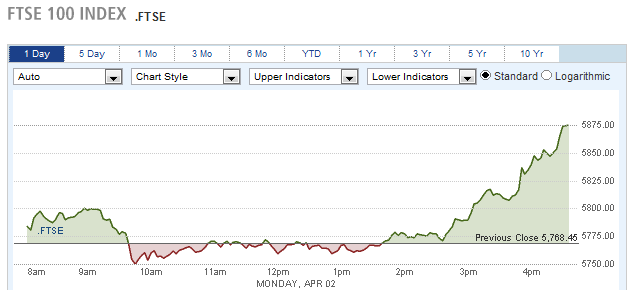

European markets traded sharply higher, as the upbeat news from China, and solid US data lifted investor optimism. The FTSE rallied 1.9%, the DAX climbed 1.6%, and the CAC40 gained 1.1%. The gains came despite a disappointing manufacturing report from the eurozone, indicating the region is in the midst of another recession.

Afternoon Rally Boosts FTSE 1.9%

US stocks gained, with the Dow ticking up 52 points to 13264, the Nasdaq jumping .9% to 3120, and the S&P 500 climbing .7% to 1419.

Currencies

The yen climbed 1% to 82.03 in a steady day-long rally, and the commodity currencies gained, with both the Australian dollar and the Canadian dollar up .8%. The euro eased .1% to 1.3326, the Swiss franc declined .2% to 1.1067, while the pound edged up .1% to 1.6032.

Economic Outlook

Monday’s economic data was mixed. ISM manufacturing PMI rose to 53.4 from last month’s 52.4 reading, slightly above forecasts. However, construction spending unexpectedly fell 1.1%, extending last month’s decline.

FOMC Minutes Suggest No More Easing

EquitiesAsian markets traded mostly higher, following Monday’s advance in Western shares. The Hang Seng climbed 1.3% to 20791, and the Kospi gained 1% to 2049. The ASX 200 edged up .2%, as the country’s central bank held rates steady. Lagging behind, the Nikkei slipped .6% to 10050, as the yen spiked to a 3-week high against the dollar, hurting exporters.

European stocks slumped, as concerns over Spanish debt weighed on investors. The CAC40 tanked 1.4%, the DAX sank .8%, and the FTSE fell .4%.

US stocks mostly recovered from their losses, but still ended down. The Dow dropped 65 points to 13200, the S&P 500 fell .4% to 1413, and the Nasdaq declined .2% to 3114. Following the release of the minutes from the FOMC’s last meeting, the indexes briefly tumbled 1%. The minutes indicated it is unlikely the Fed will authorize another round of easing, thanks to an improving economy.

Dow Drops 65 Points But Well Off Lows

GM shares tumbled 4.6% after monthly sales fell short of estimates, despite posting an impressive 11.8% increase.

Currencies

The dollar rallied against global currencies. The yen fell 1% to 82.90, erasing Monday’s gains, and the Australian dollar fell .9% to 1.0318. The pound, euro, and Swiss franc all dropped .8%. The Canadian dollar largely escaped the downtrend, easing less than .1% to .9914.

Economic Outlook

US factory orders rose by 1.3%, slightly below forecasts for a 1.5% gain. Monthly auto sales also fell short of forecasts, as the annual rate declined to 14.4M from last month’s 15.1M reading.

Global EquitiesTumble On Spanish Debt Fears

EquitiesAsian markets tumbled on Wednesday, as hopes for another round of easing by the Fed faded. The Nikkei tanked 2.3% to 9820, its steepest drop in 5 months. The Kospi slumped 1.% to 2019, while the ASX 200 managed to ease just .1%, as a slide in the Australian dollar helped exporters. In China, the Shanghai Composite and Hang Seng were closed for a holiday.

Selling pressure intensified in Europe following a weak Spanish bond auction. The DAX plunged 2.8%, the CAC40 tumbled 2.7%, and the FTSE skidded 2.3. Spain sold just 2.6 billion euros in short-term debt, an amount which was at the bottom of its target range, and yields on Spanish 10-year notes climbed to 5.61%.

US stocks fared modestly better, but still closed sharply lower. The Dow dropped 125 points to 13075, the S&P 500 fell 1% to 1399, and the Nasdaq shed 1.5% to 3068.

Currencies

The US dollar benefited from the shift away from risk, climbing .7% against the euro, Swiss franc, and Australian dollar. The yen climbed .5% to 82.42 as traders unwound carry trade positions. The Canadian dollar declined .6% to .9966, while the pound eased .2% to 1.5888.

Economic Outlook

The ADP payroll report indicated the economy added 209K jobs last month, slightly more than forecast, but a smaller gain than last month’s 230K jump. On Friday, the government will release the official nonfarm payroll report, which is expected to show a gain of 211K jobs. ISM non-manufacturing PMI slid to 56.0 from 57.2, slightly below forecasts.

US Weekly Jobless Claims Continue To Drop

EquitiesChina’s Shanghai Composite returned from a 3-day holiday to rally 1.7%, while most Asian markets traded lower. The Hang Seng fell 1% , the Nikkei slid .5%, and the ASX 200 declined .3%. Sharp gains in car makers lifted the Kospi .5%, as Hyundai Motors rallied more than 4%.

European markets recovered from early losses after the weekly US jobless claims report showed modest progress. The FTSE gained .4%, the CAC40 rose .2%, while the DAX lagged behind, easing .1%.

US stocks closed mixed after a quiet session. The Dow slipped 15 points to 13060, the S&P 500 eased 1 point to 1398, while the Nasdaq gained .4% to 3081. The VIX rose 1.6% to 16.70, up 7.8% for the week.

Volatile Week Ends On A Quiet Note

On the earnings front, beverage maker, Constellation Brands tumbled 12.5% after lowering its outlook, while Bed Bath & Beyond jumped 8.5% after beating earnings forecasts.

Currencies

European currencies retreated, as the euro skidded .6% to 1.3067, while the pound and Swiss franc declined .4%. The Australian dollar and Canadian dollar both rose .3%, and the yen inched up .1% to 82.36.

Economic Outlook

Weekly unemployment claims declined by 6000 to 357K, slightly weaker than the 355K forecast by analysts. Overseas, Canada’s payroll report showed the economy staged a sharp upswing last month, adding 82.3K jobs. The figure blew past forecasts for a modest 11.3K.

Western Markets Tumble As Data Disappoints

EquitiesAsian markets gained on Friday, as investors disregarded a North Korean rocket launch and disappointing growth data from China. GDP data from the first quarter showed the Chinese economy grew at 8.1%, down from 8.9% in the previous quarter. The Shanghai Composite rose .4%, amid hopes that signs of a slowdown will prompt more easing from the government. The Hang Seng jumped 1.8% to 20701, the ASX 200 climbed 1%, and the Nikkei advanced 1.2% to 9638. Korea’s Kospi snapped a 3-day losing streak, bouncing 1.1%.

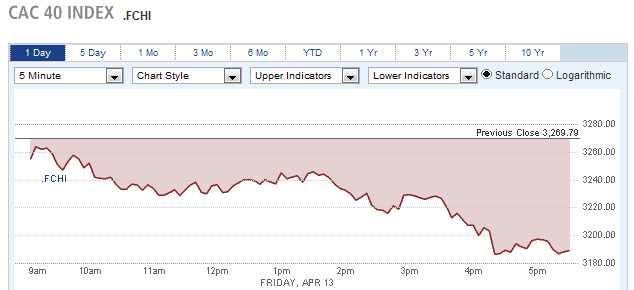

Meanwhile, European markets tanked amid growing debt concerns, and selling accelerated in the afternoon after US consumer sentiment data disappointed. The CAC40 sank 2.5%, the DAX slumped 2.4%, while the FTSE fell 1%. Markets in Spain and Italy plunged more than 3% after data showed Spanish banks were borrowing extensively from the ECB.

France's CAC40 Tumbles 2.5%

US markets closed at the low of the session, dropping more than 1%. The Dow shed 137 points to 12850, the Nasdaq declined 1.5% to 3011, and the S&P 500 fell 1.3% to 1370.

Currencies

The US dollar benefited from the switch to “risk off” mode, particularly against its European counterparts. The euro fell .8% to 1.3078, the Swiss franc skidded .9% to 1.0877, and the pound dropped .6% to 1.5856. The Canadian dollar declined .5% to .9996, and the Australian dollar lost .6% to 1.0378. The yen eased fractionally to 80.93.

Economic Outlook

Consumer sentiment data from the University of Michigan disappointed, unexpectedly sliding to 75.7 from last month’s 76.2 reading. CPI data showed prices rose .3%, above forecasts, but the less volatile core CPI was in line with estimates, rising .2%.