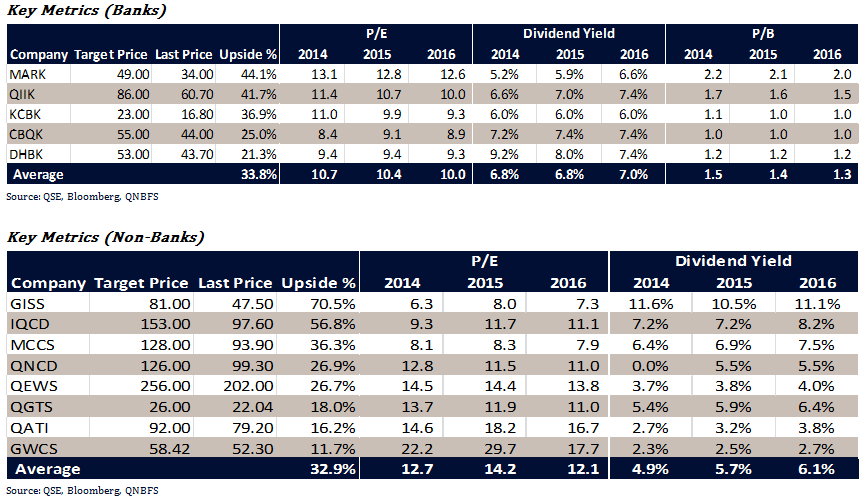

We remain optimistic on the Qatari equity market in the long term. We believe the significant sell-offs driven by declining oil prices have been overdone and consider most of our equities under coverage as attractive opportunities. On an average basis, the 17 Qatari equities we coverimply a long-term upside of 26% to our price targets. Dividend yields remain strong with stocks under coverage expected to yield 5.6% and 5.9% in 2015 and 2016, respectively. Valuations continue to be attractive with most companies trading at compelling price-to-earnings multiples along with the best dividend yields in the region. On an overall basis, the Qatar Exchange Index trades at a 2016 P/E of 10.4x complemented by a dividend yield of 5.6%, while the Bloomberg GCC 200 Index trades at 10.8x 2016 P/E along with a 2016 dividend yield of 4.9%.

Highlights

- According to QNB Group, Qatar’s economy is expected to remain resilient to lower oil prices. Qatar is well-positioned to withstand lower oil prices thanks to its strong macroeconomic fundamentals including a relatively low fiscal breakeven oil price ($60.7/b in 2015), the accumulation of significant savings from the past and low levels of public debt. QNB Group forecasts real GDP growth will accelerate from 4.0% in 2014 to 4.7% in 2015 and 6.4% in both 2016 and 2017, as the government expands its investment spending program in the non-hydrocarbon sector. The non-hydrocarbon sector is projected to remain the engine of growth in the economy. Its near double-digit expected growth is underlined by strong investment spending in line with the Qatar National Vision 2030. QNB Group anticipates non-hydrocarbon GDP growth at 10.4% in 2015, followed by 9.9% in 2016 and 10% in 2017.

- We forecast a decent 6.5% increase in aggregate earnings by key Qatari equities in 2016. We have compiled net income expectations of key Qatari equities that we cover. Factors that can positively reinforce our thesis includes but not limited to improvement in oil prices, positive global economic growth prospects, easing of regional geo-political issues and better than expected earnings from stocks under coverage. Key risks include: depressed oil prices, increase in volatility, exit of hot money from emerging/frontier markets, etc.

- Valuation remains attractive.The QSE Index is trading at attractive 2016 multiples, with a P/E ratio of 10.4x complemented by a dividend yield of 5.6%. We note the Qatari equity market remains relatively compelling as compared to its GCC peers with the Bloomberg GCC 200 Index trading at 10.8x 2016 P/E along with a 2016 dividend yield of 4.9%.

- QSE Index is trading at a discount to its historical mean. The Index is currently trading at a TTM P/E of 10.08x vs. its Qatar 10-Year historical average of 12.95x. This implies that the market is trading at a significant discount of 22.2%. Hence, current valuation appears to be inexpensive.

- “What goes up must come down”;the opposite also applies (from a historical perspective). The Qatar Index has corrected by 32.8% (27.5% annualized) to 9,643.65 as of the 13th of December 2015 from its all-time high of 14,350.50 (18th of September 2014). Like any other market, the QSE Index experienced regular troughs and peaks. As such,we revisit past periods of significant movements when the Index corrected and subsequently followed through with a major rally. For instance, the Index dropped by 54.8% (48.2% annualized) and by 66.5% (77.8% annualized) between 2005-2006 and 2008-2009, respectively. Consequently, the Index gained 112.4% (88.5% annualized) and 118.5% (51.8% annualized) during 2007-2008 and 2008-2011, respectively. Having said that, we can expect history to repeat itself.