Easily one of the top performing sectors so far in 2013 has been the solar space. The segment has roared higher thanks to a huge level of panel installations, a focus on high beta and small cap stocks, and the desire by investors to get into quickly growing names.

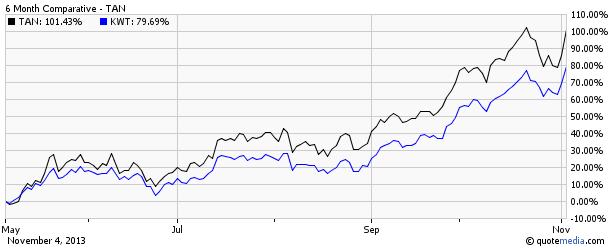

This has propelled many stocks up by more than 100% on the year, with several companies seeing even better returns (including triple digit percentage moves in ETFs tracking the space YTD as well). Yet, leading up to a crucial earnings season for the sector, many solar stocks were in trouble.

The space saw flat to negative returns over the past two weeks, including a nearly 2% loss in solar ETFs at a time when the broad market was higher. Thanks to this, and due to worries over the looming earnings season, some were starting to wonder if the bull run in solar power investments was nearing a pause, if not an end.

However, recent trading in the space—and solid earnings—suggests that we might actually have a bit further to run in the solar investment space. In fact, both of the solar ETFs—the Guggenheim Solar ETF (TAN) and the Market Vectors Solar Energy ETF (KWT)—moved significantly higher (both added more than 5%) in Monday trading, and look to continue this run as more companies in the space report later in the week.

Behind the Surge

During Monday trading, gains were pretty widespread across the sector. FirstSolar (FSLR) added about 4.6% on the day, while SunPower (SPWR) jumped close to 10.6%, and SolarCity (SCTY) finished the session up more than 11.4%.

There were a number of reasons for this big jump, though solid earnings was definitely at the heart of the surge. Additionally, many are now looking for firms that report later in the week—such as SolarCity—to post solid numbers too, further adding to the trend.

Investors also saw some updated guidance figures for Canadian Solar (CSIQ), which were yet another reason to be bullish on solar power. The company announced that it expects Q3 shipments to be in the range of 460 MW to 480 MW, higher than the original guidance of 410 MW to 430 MW it provided on August 8th.

Profit margins look to be roughly double original forecasts too, so this was obviously another point for the bulls to hang their hats on going forward. Investors in CSIQ definitely appreciated it as well, as the stock moved higher by over 12% on double the average volume.

Beyond earnings, investors should also note that SunPower made an acquisition of Greenbotics, which could help the company to better compete in sandy or generally dirt heavy areas. It could also suggest that we might finally start to see some M&A activity in the solar market, a situation which may help to boost share prices as well.

ETF Impact

The two ETFs in the market have big holdings in many of the aforementioned companies, and thus were big beneficiaries on the day. TAN was up nearly 8.4% on the session, on volume that was roughly four times normal, while KWT also saw a huge volume increase, and gains of about 5.9% on the day.

KWT actually gives its top weight to FSLR, while SCTY and SPWR also find their way into the top ten holdings. For TAN, FSLR again takes the top spot, while SCTY, CSIQ, and SPWR are all top five allocations.

Due to this bigger allocation to some of the big winners on the day like Canadian Solar, TAN easily outperformed its counterpart on the session. Investors should also note though, that TAN is winning on a longer term look too, as it has outperformed its counterpart 129% to 93% year-to-date (before today’s gains).

Still, both are clearly crushing the market, and with today’s jump are outperforming the S&P 500 on a year-to-date basis even more. And with the trend towards higher guidance and earnings beats as of late, there is plenty of reason to believe that this surge in solar ETFs can continue in the near term.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Solar ETFs Stay White Hot, What's Behind The Surge?

Published 11/05/2013, 07:29 AM

Updated 10/23/2024, 11:45 AM

Solar ETFs Stay White Hot, What's Behind The Surge?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.