Share Price: C$0.215

Shares Outstanding: 92.0M

Market Capitalization: C$19.8M

Cash: ~C$3.0M

Total Liabilities: C$0.1M

Sokoman Iron Corp (V:SIC)– These holes prove that the Western Zone holds significant gold mineralization with a series of visible gold bearing veins – confirming and expanding upon previous drill results. . .

This is great news – but from the market’s reaction today, it appears that Sokoman’s release of 12 new holes was a miss.

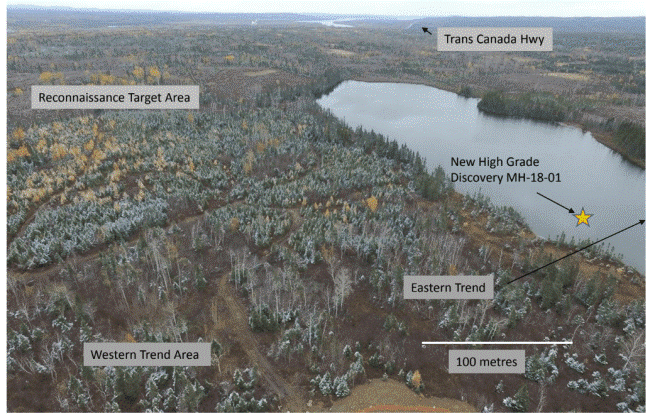

The market is clearly misunderstanding these results. And the reason is not that the results aren’t good – rather it’s that they don’t realize the holes are a full 250 meters away from the bonanza high-grade hole that kicked off the ‘Sokoman Mania’ earlier this month.

That area is to be tested further with drilling this fall and winter. . .

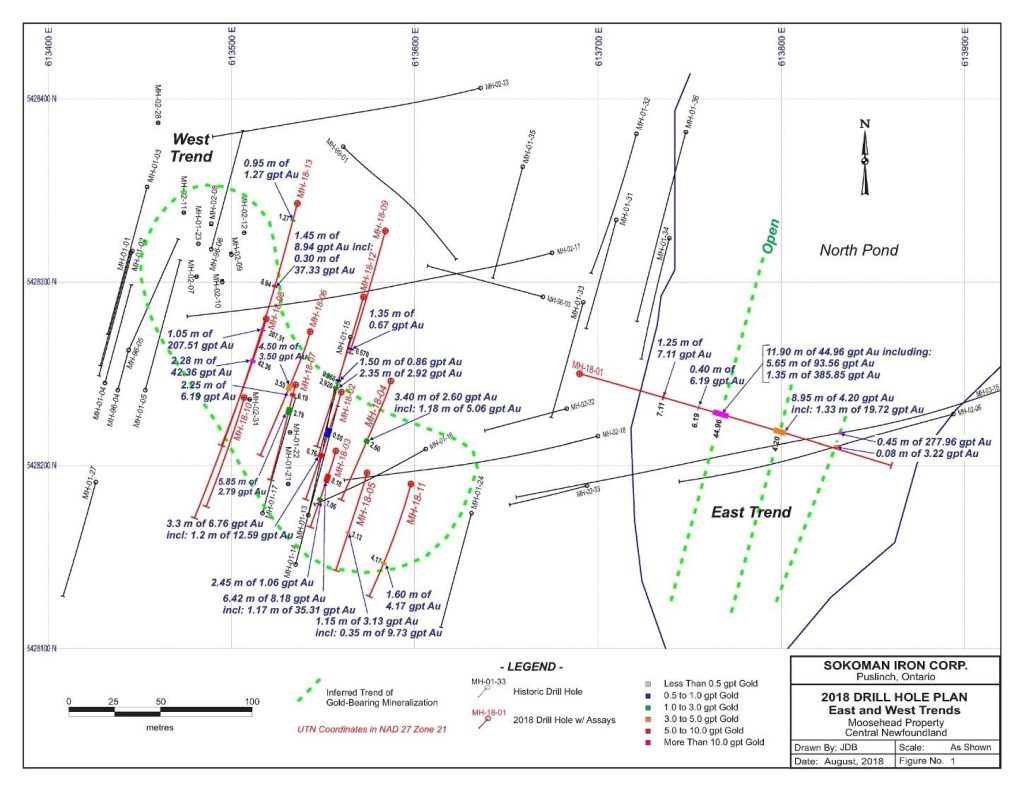

Holes MH-18-07 and MH-18-08 have both returned near surface gold in what is believed to be two new veins.

Further down the holes returned assays concurrent with previous drilling (MH-18-02 & MH-18-03), which shows the mineralization is continuous and open along strike.

Hole MH-18-08 intercepted 5.85m at 2.79g/t Au which – if continuous along strike – is a significant intercept.

MH-18-14 was collared to test a historical hole (MH-02-38) in the SW, which reported 2.02m at 111g/t Au. This hole intercepted what is believed to be the same structure and returned results of 3.10m at 0.65g/t, this will provide understanding on the orientation of the structure enabling a follow up program to be planned.

The nature of these high-grade, structurally complex, and controlled projects is that not all of the mineralized structure is equally mineralized – and hence require a lot of close spaced drilling to delineate a resource.

It appears here that there are multiple vein systems which host high-grade, visible gold mineralization, and the key is to understand these structurally in order to best target the mineralization.

Sokoman Iron has two distinct trends here: one in the East, which appears to strike SW-NE and hosted the high-grade hole MH-18-01. And the Western trench which currently has a strike of SE-NW.

Both these trends are open along strike and at depth.

In-depth structural knowledge will be key to understanding these so they can put the pieces of the puzzle together to form an ore deposit.