Those that view the message of the market on daily basis are likely confused by trading noise. While trading noise contributes to the long-term trends, it does not define them. Human behavior tries to explain trading noise as a meaningful trend. This confuses the majority which, in turn, contributes to their role as bagholders of trend transitions.

While money is flowing from North America to Asia as part of a long duration cycle, it's important to recognize the temporary return to the core economy of the United States as risk-taking, the investment in periphery economies, transitions to risk-aversion throughout global economy. The invisible hand is growing increasingly risk-averse, afraid to take unnecessary risks, due to an ongoing erosion of confidence in global economy and its leadership.

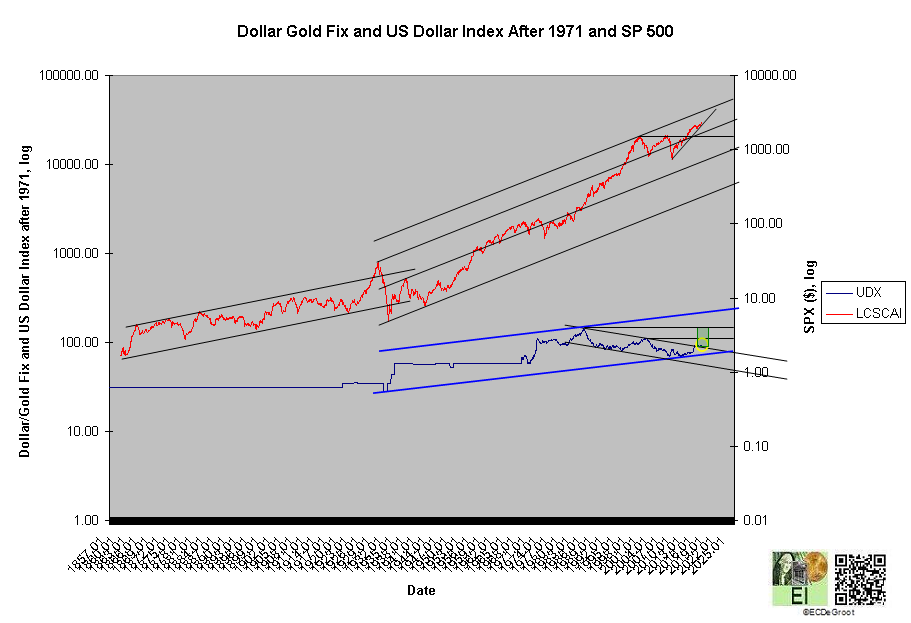

Risk aversion capital flows are driving the dollar rally that FEW recognize even today as a majority breakout (yellow circle) from long term consolidation (chart). Not only will the breakout defy bearish expectations but it will also slow the US economy despite all efforts to make America Great Again. The public, unfortunately, has been sold a 'bill of goods' in terms of what public policy can accomplish against the powerful force of the invisible hand as described Adam Smith. The coupling of safe haven capital flows and rising interest rates, largely because bonds will be rejected in this cycle, means unexpected difficulties for large and small businesses, investment strategies, and a labor force looking for solution through static rather than dynamic thinking.