The US markets are reopening after being closed on Thursday for Independence Day. Investors will be eyeing the payrolls report due later today. The US economy is forecast to add 162k jobs in June.

Besides the US payrolls report, Canada will also be releasing its monthly employment data. Canada’s unemployment rate is expected to rise slightly from 5.4% previously to 5.5% in June. Elsewhere, the economic data remains sparse.

Euro Muted After Retail Sales

The euro traded flat on Thursday. Economic data from the eurozone saw the release of the monthly retail sales report. The report showed that sales in the eurozone fell 0.3% in June. This was below the forecasts of a 0.4% increase and down from June’s revised print of a 0.1% decline.

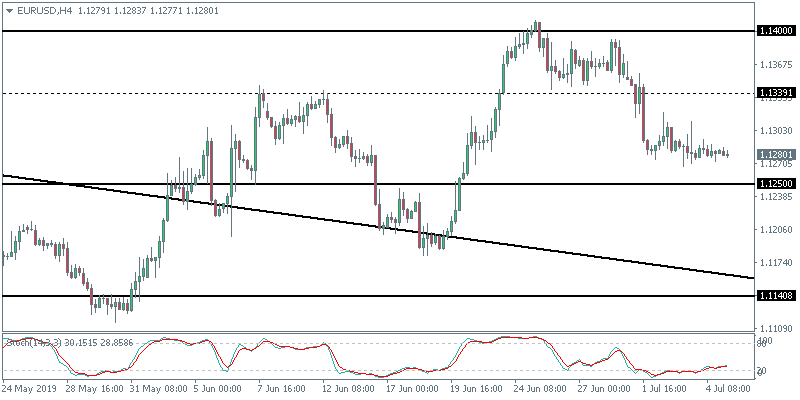

EUR/USD Edges Closer to 1.1250

Price action in the currency pair has been somewhat flat over the past few days after the initial decline earlier. This has kept the currency pair trading within the range of the 1.1400 and 1.1250 levels. The current declines could potentially push the EURUSD lower to test the 1.1250 level of support. However, in case of a reversal, we could expect to see the 1.1400 resistance level being tested once again.

Crude Oil Slips on Fears of Slowing Demand

WTI Crude oil prices posted declines early on Friday. The declines came on investor concerns about slowing demand. The futures markets saw crude oil falling 1.1% while Brent futures were down 0.1%, extending declines from the day before. The declines come after OPEC and Russia agreed to extend the current production cuts for the next six to nine months.

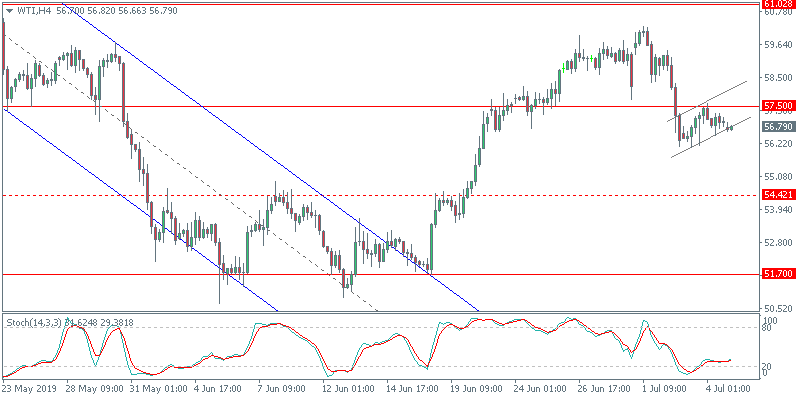

WTI Crude Oil Forms a Bearish Flag

Following the recent declines off the highs near the 60.00 handle, oil prices have been consolidating sideways. This has led to a bearish flag pattern being formed just below the resistance area of 57.50. A breakdown below the previous lows of 56.25 could confirm the downside bias. This will validate the bearish flag pattern which puts the downside target to 54.42 where support level exists.

Gold Prices Hold Steady Near Highs

The precious metal was traded a bit volatile near the highs on Thursday. Price action was rather muted as gold traders await the payrolls report due later today. A weaker payrolls report could potentially cement expectations of a July rate cut. This comes following the ADP (NASDAQ:ADP) private payrolls once again falling short of expectations. The pace of hiring was also somewhat slower compared to the previous months.

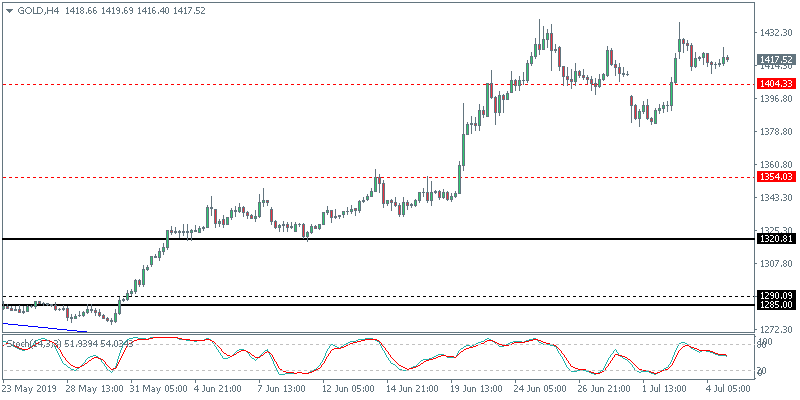

Will Gold Breakout Higher?

Given the current set up, gold prices are likely to see a breakout in either direction. To the upside, price will need to breach past the recent highs of 1431 in order to confirm the upside bias. There is a cup and handle type of pattern forming near the current highs that validates this view. To the downside, if the 1404 level of support gives way, then gold could extend declines to1354.