News reports covering yesterday’s April report on consumer inflation emphasize that the monthly increase fell short of the consensus forecast. The cooler-than-expected gain is cited by some analysts as a factor that will allow the Federal Reserve to slow its plans for raising interest rates. Perhaps, but reviewing the annual pace of inflation and the latest estimates for GDP growth in the second quarter suggests that it’s premature to assume that the central bank is set to back off its recent plans for three or four rate hikes this year.

The Consumer Price Index (CPI) increased 0.2% last month, below the 0.3% that economists were looking for via Econoday.com’s consensus forecast. Core inflation, which ignores energy and food prices and is generally considered a more reliable measure of pricing pressure, was up 0.1% in April, below the crowd’s 0.2% forecast.

Note, however, that the unadjusted (before seasonal adjustment) one-year change for headline CPI ticked up last month to 2.5%, the fastest gain in more than a year and moderately above the Fed’s 2.0% target. Core CPI in unadjusted terms held steady at a 2.1% rate, but the gain marks the second straight reading of a one-year high.

“Labor market conditions are still tightening [and] we think underlying inflation will trend higher from here,” Michael Pearce, senior US economist at Capital Economics, tells Market Watch. “That should convince the Fed to raise rates a total of four times in 2018.”

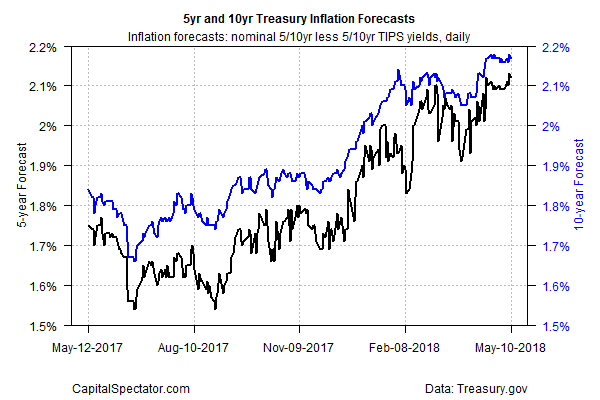

Meanwhile, the Treasury market’s implied inflation forecast is sticking close to a five-year high. The yield spread for the nominal five-year rate less its inflation-indexed counterpart, for instance, settled at 2.12% yesterday (May 10). It appears that yesterday’s CPI data had no effect on the crowd’s expectations for pricing pressure.

Keep in mind, too, that the early estimates for GDP growth in the second quarter point to a pickup in growth. If accurate, the macro trend appears set to keep the current inflation rate steady if not raise it further.

The Atlanta Fed’s current GDPNow estimate (May 9) for growth in Q2 points to a 4.0% increase, a hefty improvement over Q1’s 2.3% gain. Today’s update via Now-casting.com calls for a lesser 3.6% increase in Q2, but that too reflects a solid improvement over the previous quarter.

Fed funds futures continue to price in another rate hike for next month’s monetary policy meeting. CME data at the moment points to a 100% probability that the Fed will lift its target rate by 25 basis points to a 1.50%-to-1.75% range.

Although there’s no sign that inflation is poised to sharply accelerate from current levels, the case for expecting a gradual increase is reasonable. Until or if the incoming economic data delivers a major downside surprise, the Fed remains on track to continue its policy of squeezing the money supply and hiking rates.

A new survey of economists assumes no less, based on a Wall Street Journal survey published on Thursday, which advised that analysts are looking for four rate hikes this year. By that reasoning there are three more hikes on the 2018 calendar following the increase in March.