The inflation rate in the euro area fell in March. What does it mean for the gold market?

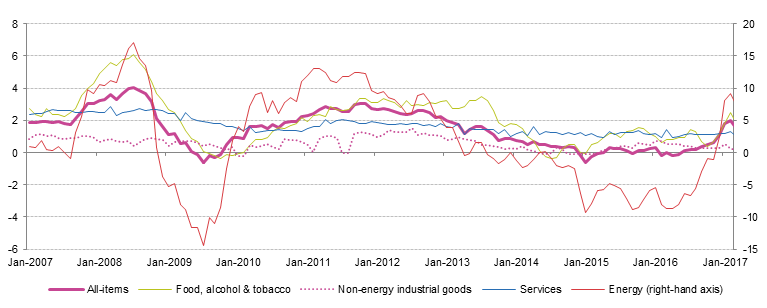

Euro area annual overall inflation is expected to be 1.5 percent in March. It means a decline from 2 percent in the previous month, as one can see in the chart below. Meanwhile, the underlying inflation fell from 0.9 percent to 0.7 percent.

Chart 1: Euro area annual inflation and its main components from January 2007 to March 2017.

The pullback in inflationary pressures is quite important. In February, the overall inflation hit the ECB’s target and some monetary hawks started to call for an end of the ECB’s quantitative easing program. However, Draghi argued that inflation rise was likely to be “transient and to have no implication for the medium-term outlook for price stability”. And now it seems that he was right.

Hence, the ECB may not adopt a more hawkish stance in the near future, as some investors could expect. As ECB Executive Board member Benoit Coeure pointed out: “this clearly suggests that current expectations on the intended horizon of our purchases... and on the sequencing of policy instruments, remain valid today”. This is bad news for the gold market, as a steady ECB means that the monetary divergence between the Fed and the ECB is likely to widen further, which should put upward pressure on the U.S. dollar and downward pressure on the price of gold.

Summing up, the flash estimate of the inflation rate in the euro area in March was 1.5 percent, down from 2 percent in February. It does not necessarily mean that global reflation is over, but rather than the hawkish change in the ECB’s message after its last meeting might have been overinterpreted. In reality, it’s likely that the ECB will remain cautious for a long time. It implies a widening divergence between it and the Fed, which should be positive for the greenback, while negative for the yellow metal, at least in the medium term.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.