Forex News and Events:

The FX markets step into an event-full week: Canadian GDP figures (Mon), RBA policy verdict (Tue), ADP employment report (Wed), NFPs, US unemployment (Thu) and ECB meeting and Draghi’s monthly press conference (Thu) are the main events to monitor this week. Released in the morning, the Euro-zone inflation estimates in June remained soft as expected. EUR/USD extended gains to highest in three weeks signaling that traders might get back to play in favor of high real interest rates in euro (due to subdued inflation across the euro area).

Euro kick-starts the week

On Friday, EUR/USD recorded the highest close since June 5th ECB meeting, the European traders jumped on positive trend as soon they walked in, despite weak retail sales data out of Germany. Later in the morning, the soft inflation estimates in June (CPI y/y estimated at 0.5%, CPI core y/y at 0.8%), lifted the pair towards three week highs.

EUR/USD remains however ranged within 21-200-dma (1.3598/1.3674), the rallies are likely to remain capped below 1.3774/77 (post-ECB Jun 5th meeting) resistance zone before the ECB meeting scheduled on Thursday July 3rd. We do not expect any changes from ECB this week. Trend and momentum indicators are comfortably positive on EUR/USD chart. We are at an important pivot point here. If the post-ECB trades send and sustain EUR/USD above its 200-dma, this will be the signal that the weakness due to ECB’s additional stimulus package (announced on June 5th) is fully digested and traders will be once again motivated by high euro real rates and chase opportunities to jump on EUR-bull moves.

EUR/GBP correction continues. Short-term resistance is eyed at 0.80400 (21-dma & June corrective uptrend top) then 0.81000 (optionality). We remind that our long-run view remains bearish.

RBA gives verdict

The RBA meets on July 1st and is expected to keep its cash rate target unchanged at the record low of 2.50%. Governor Stevens will perhaps reiterate the importance of a “longer period of stable, low rates” and renew its dovish stance. The accompanying statement will be important; we look to deepen our understanding on how RBA perceives the future with tighter budget and the subdued pace of structural transformation from mining to construction business. Stevens will certainly mention the unfavorably high AUD exchange rates, unsupportive of economic reforms and growth recovery. In fact, the recent steps towards fiscal consolidation (lower government spending & higher taxes) are undoubtedly discouraging for homebuyers, thus limiting the expansion of construction business. On the other hand, the RBA board member Edwards is confident in Japan’s recovery, which should temper the drop in Australia’s mining investment.

The Australian 10-year government yields hit the lowest since June 2013 as speculations rise in favor of lower RBA rates before the year-end. The 10-Year Australia /US government yield spread fell to 1.0205% (2013 lowest levels), while the 10-year NZ/AU spread hit 10-year highs on sharp RBA/RBNZ divergence.

AUD/USD test 0.9400 bids this Monday, trend and momentum indicators are perfectly flat. The RBA meeting will define the fresh short-term direction. Any hint on lower rates should send AUD/USD below its 21-dma (0.9370), acting as support since June 5th. On the upside, the resistance remains solid at 0.9445/61 region.

AUD/NZD remains offered pre-1.0789/1.0800 (100-dma / optionality). The bias is certainly on the downside, the significant break below Jun 26/27 double dip support (1.0709/13) will shift the attention down to 1.0649 (May 6th low), 1.0540 (March support), then 1.0493 (year low).

Today's Key Issues (time in GMT):

2014-06-30T12:30:00 CAD Apr GDP MoM, exp 0.30%, last 0.10%2014-06-30T12:30:00 CAD Apr GDP YoY, exp 2.30%, last 2.10%

2014-06-30T13:00:00 USD Jun ISM Milwaukee, last 63.49

2014-06-30T13:45:00 USD Jun Chicago Purchasing Manager, exp 63, last 65.5

2014-06-30T14:00:00 USD May Pending Home Sales MoM, exp 1.20%, last 0.40%

2014-06-30T14:00:00 USD May Pending Home Sales YoY, exp -9.70%, last -9.40%

2014-06-30T14:30:00 USD Jun Dallas Fed Manf. Activity, exp 9, last 8

The Risk Today:

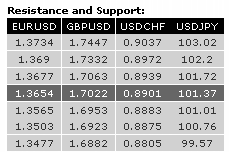

EUR/USD continues to move towards the high of its horizontal range defined by 1.3503 and 1.3677. Monitor the test of the hourly resistance at 1.3644/1.3651. An hourly support lies at 1.3565 (20/06/2014 low, see also the 61.8% retracement). In the longer term, the break of the long-term rising wedge (see also the support at 1.3673) indicates a clear deterioration of the technical structure. The long-term downside risk implied by the double-top formation is 1.3379. Key supports can be found at 1.3477 (03/02/2014 low) and 1.3296 (07/11/2013 low).

GBP/USD is close to the major resistance at 1.7043/1.7063. The current succession of higher lows favours a bullish bias. An initial support lies at 1.6997 (intraday low). Hourly supports stand at 1.6953 and 1.6923 (18/06/2014 low). In the longer term, an eventual break of the major resistance at 1.7043 (05/08/2009 high) is favoured as long as the support at 1.6693 (29/05/2014 low) holds. Other resistances can be found at 1.7332 (see the 50% retracement of the 2008 decline) and 1.7447 (11/09/2008 low).

USD/JPY has broken the support implied by the 200 day moving average (around 101.72), confirming persistent selling pressures. A further decline towards the strong support at 100.76 is likely. Hourly resistances now stand at 101.74 (intraday high) and 101.89 (26/06/2014 high). A long-term bullish bias is favoured as long as the key support 99.57 (19/11/2013 low) holds. A break of the key resistance at 103.02 is needed to suggest the end of the current consolidation phase. A strong support stands at 100.76 (04/02/2014 low). A major resistance stands at 110.66 (15/08/2008 high).

USD/CHF continues to exhibit a short-term succession of lower highs. Monitor the test of the support at 0.8908 (05/06/2014 low, see also the 38.2% retracement). Another support lies at 0.8883. An initial resistance now lies at 0.8939 (intraday high). A more significant resistance stands at 0.8972 (see also the declining channel). From a longer term perspective, the bullish breakout of the key resistance at 0.8953 suggests the end of the large corrective phase that started in July 2012. The long-term upside potential implied by the double-bottom formation is 0.9207. A key resistance stands at 0.9156 (21/01/2014 high).