Market movers today

Today, markets will continue to focus on the trade negotiations ahead of the beginning of the US-China talks tomorrow. After the US markets closed deep in the red yesterday, the sour risk sentiment on the back of increased trade uncertainty will also be in focus.

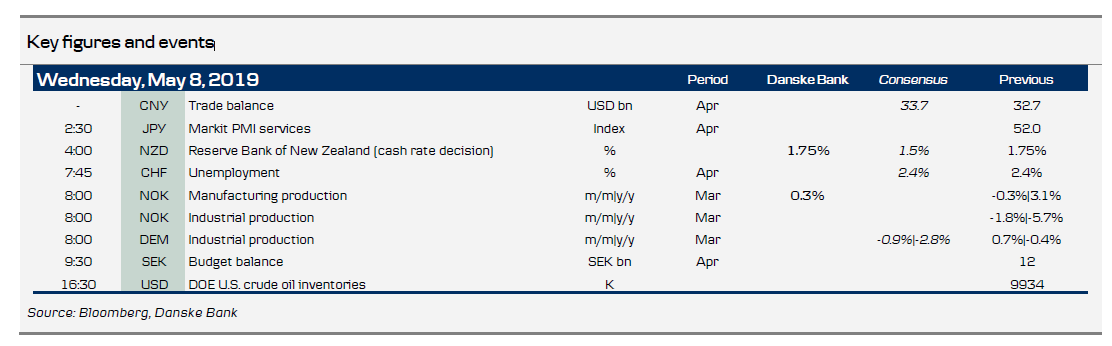

In terms of economic data releases, there is not much on the agenda today. In Norway, production data for March is due out and in Sweden we get budget data for April. See more details on page 2. Otherwise we are looking forward to the Norges Bank meeting on Thursday.

In Germany, industrial production data is due out this morning, which markets will scrutinise given the weakness in German manufacturing production in recent months. Given yesterday's downward revision in the EU Commission's growth forecast and soft factory orders, another set of weak data would send bond yields down further.

The ECB's Draghi speaks in Frankfurt this afternoon, but it is not expected to be a market mover.

Selected market news

Yesterday, Italy came under renewed pressure partly due to the risk-off sentiment, given the sell-off in the equity market, but also on the back of the downward revision of growth in 2019 from 0.2% to 0.1% and a deficit in 2020 above 3%. The 10Y spread to Germany widened some 8bp, while the other peripheral markets was also struggling to follow the move in the 10Y German government bond yield.

The US equity markets ended the day with losses across the different categories. Given the negative sentiment in the US equity market, we saw another decent rally in US Treasuries.

The Asian equity markets followed the negative sentiment from the US equity markets this morning on the back of the uncertainty over a trade agreement between the US and China. The New Zealand central bank (RBNZ) became the first central bank in the developed world to cut rates, lowering by 25bp to an historical low, and signalled that one more cut could come given the downward risk for the economic outlook. A rate cut was to some extent priced in and the market is pricing in the possibility of another cut from RBNZ.

Scandi markets

In Sweden, we get the central government budget balance for April, where the Swedish National Debt Office (SNDO) is forecasting a small surplus of SEK 1.5bn. The SNDO is set to update the central government borrowing forecast on 20 June.

In Denmark, the Danish prime minister has called for a general election on 5 June, 10 days after the EU parliament elections. The election has to take place no later than 17 June. The polls indicate there will be a change of government after the election, but regardless of the result, we do not expect any noticeable market reaction. There is broad agreement on the overall framework for economic policy, and we do not expect any serious question marks over either Denmark’s EU membership or staying out of the euro.

Fixed income markets

There are plenty of bond auctions today. In Sweden, the Debt Office (SNDO) is set to tap SEK1.5bn of SGB1061 (SGB 11/29) at 11.00 CEST. Kommuninvest is expected to launch a new SEK benchmark bond K2611 (KOMMUN 11/26).

The Danish Debt Office will launch a new 2Y benchmark bond. It plans to sell up to DKK5bn in a new 2Y DGB. We expect that the demand will come from Danish investors who need government bonds for their LCR portfolios. Given that the Debt Office needs to build up liquidity in the new 2Y benchmark, it should ease some of the issuing pressure on the 10Y. Given the demand for duration among domestic investors, this should be supportive for the long end of the Danish government yield curve relative to Euroland. See more here.

In Euroland, Portugal is set to tap in the 4Y and 10Y benchmarks today. It is a small tap of up to EUR1.25bn, and we expect that the auction will go well despite the strong performance of PGBs seen in 2019. However, there is ongoing support from the ECB, as it continues to buy some 0.5bn per month in the QE reinvestment programme. Furthermore, the 5Y-10Y curve is still too steep in our view and we recommend to buy the 10Y in a flattener.

Germany is set to tap EUR3bn in the 5Y benchmark. The bid-to-cover in the most recent auction was 1.8, and given the uncertainty in the market and the slowdown in the German economy, we would expect demand to be solid at today’s auction.

FX markets

Brent dropped below USD70/bbl again yesterday following renewed deterioration in risk sentiment. Supply-related news also weighed on oil prices. This included news that Saudi Arabia is supplying more oil to Asia and that the EU and Iran are close to a deal that would allow Iran to sell oil to the EU. Furthermore, the US is drawing down SPR during May.

EUR/NOK and USD/JPY went the usual way, as the rather complacent initial market reaction from Monday went one step further towards risk-off. We continue to believe that the US-China shock is containable (and expect a deal by end-Q2), but given historical evidence from 2018 trade volatility shocks, the current market direction could easily extend for a few more weeks. See more in our one-pager, FX Strategy: Keep faith in trade - but brace for USD/JPY move.

The Riksbank minutes were balanced overall, probably even more so than expected, and the main culprit behind the revised rate path was indeed identified as lower-than-expected inflationary pressure. As for the SEK, the message was probably not as soft as the market (and we) had feared, judging by the initial reaction. Interestingly, Governor Ingves admitted that it might be time for a rethink when it comes to the FX analysis, whether the real exchange rate has weakened due to factors not taken into account in the Riksbank’s analysis, a thought in which he is supported by Deputy Governor Jansson. Deputy Governor Flodén wenr even further and stated that further SEK weakening would “not be welcomed” given current levels and that the Riksbank’s policy actions are probably partly to blame for the weak krona. Although not a game-changer for the SEK in our view, these comments might help stop the bleeding, at least in the short run. If anything, it might be the first glimpse of self-criticism with regards to the board’s views on the SEK.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI