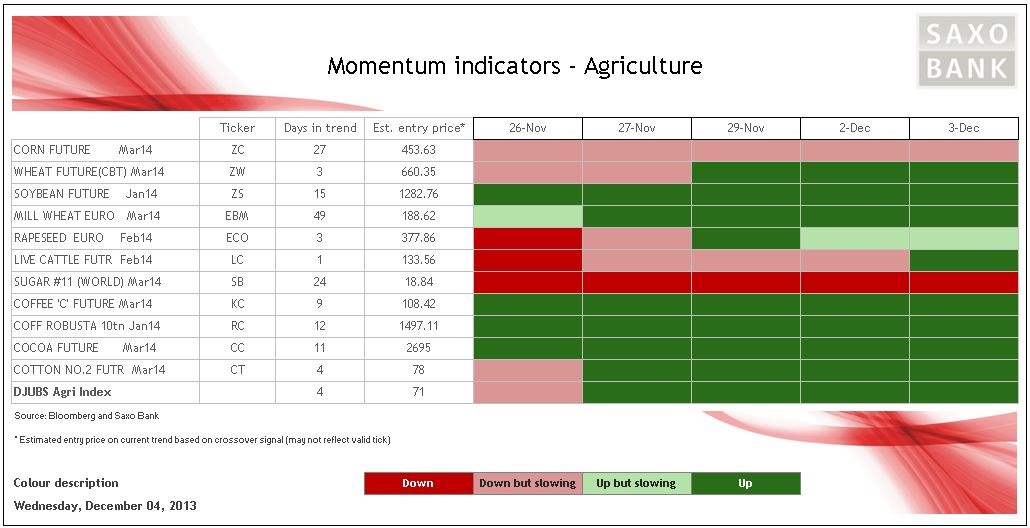

As the table below shows, the short-term momentum on key agriculture commodities is predominantly still pointing higher, but a couple of warning signs have emerged. That is especially so in the soft sector where the recent recovery in both coffee contracts has been running out of steam and also both cocoa contracts which have been witnessing a strong build in net-longs by hedge funds over the past couple of months.

In cocoa this has resulted in the net-long positions as of November 26 reaching a size which would require six days of average volumes on Ny Sugar and five days on London cocoa to close down. Both contracts are down around two percent today with Ny Cocoa now looking for potential support at USD 2,700/tons, the 50 percent retracement of the November rally.

Coffee prices have come under some renewed selling pressure with Robusta reversing most of the seven percent gain seen since yesterday afternoon when the market reacted to news about a slump in stockpiles after exports from Vietnam fell by one-third during November. Arabica coffee earlier today reached the highest level since October 25 but has since succumbed to selling resulting in a loss of one percent. The technical picture could indicate that the bounce since early November now carrying the risk of turning into a bear-flag which could signal a return to the lows and beyond.

Sugar remains firmly in the negative momentum camp after having dropped non-stop since October with losses seen in 25 out of the last 27 trading days. As we approach the July low at 16.7 cents per pound, some support may emerge, not least considering the current oversold reading on 14 days RSI at 19.4. Hedge funds long liquidation has been the main driver during the last month as net-longs have only slowly been scaled back. A break to a new low on the year may trigger some additional capitulation but for now a low RSI reading and the July low may offer some support.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Soft Commodity Update: Warning Signs Take Shine Off Momentum

Published 12/05/2013, 12:31 AM

Updated 03/19/2019, 04:00 AM

Soft Commodity Update: Warning Signs Take Shine Off Momentum

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.