Are Soft commodities finding a major low here? Could be but it will vary by commodity and could take another few months to a year for some.

Here is update with charts on PowerShares DB Agriculture (NYSE:DBA), Teucrium Soybean (NYSE:SOYB) , JJG VanEck Vectors Agribusiness (NYSE:MOO) and I may add Sugar and Coffee later if I find time. The first three charts are DBA which covers a broad mix of various softs. Also charts on SOYB for Soybeans and iPath Bloomberg Grains Subindex Total Return Exp 22 Oct 2037 (NYSE:JJG), an ETF that buys Futures in Soybeans, Corn and Wheat.

My first chart on DBA s nasty 8 year downtrend. The only thing interesting on that chart is that we are in my timing band to find a Yearly Cycle Low (YCL). Note the rallies out of a YCL if you can catch them. The last 3 YCL’s have made lower lows but the rallies before they topped were a nice ride if you catch them. My second DBA chart is a close up daily that shows we may be bouncing out of a Half Cycle Low. My 3rd DBA chart shows you the resistance near 19.60 that I will be watching closely and may take a position if it does.

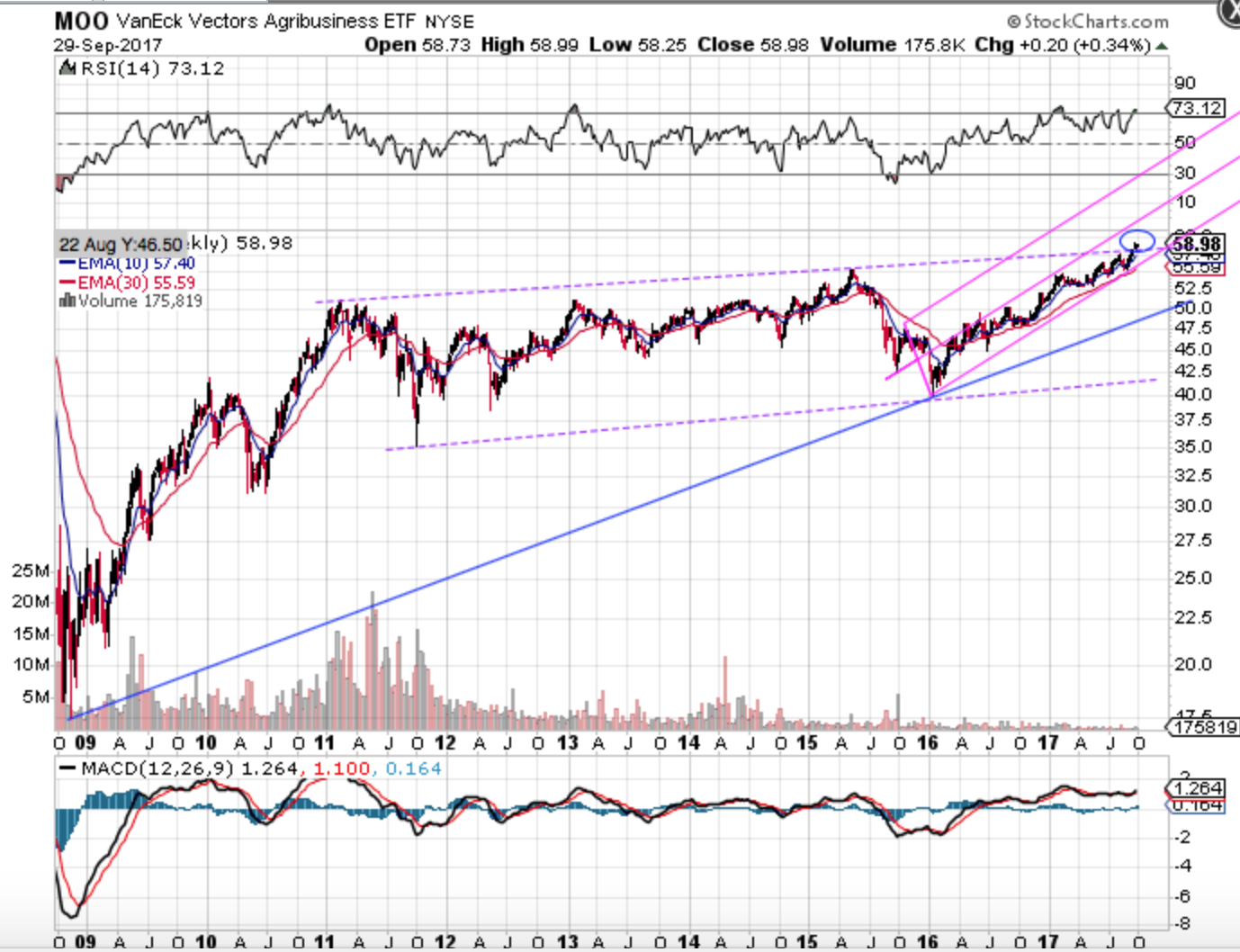

MOO is an Agri-Business EFT which has done quite well while the broader CRB has suffered: