As many will remember, many pundits (aka economists) predicted an upsurge in consumer spending resulting from lower fuel prices. Here is a quote from Federal Reserve Chair Yellen in her 17 December 2014 press conference:

I think the judgment of the Committee is that, from the standpoint of the United States and the U.S. outlook, that the decline we have seen in oil prices is likely to be, on net, a positive. It’s something that’s certainly good for families, for households. It’s putting more money in their pockets. Having to spend less on gas and energy, and so, in that sense, it’s like a tax cut that boosts their spending power. The United States remains—although our production of oil has increased dramatically, we still remain a net importer of oil. Of course there may be some offset in the form of reduced drilling activity, and possibly some change, some reduction in cap-ex plans in the drilling area. But, on balance, I would see these developments as a positive for the standpoint of the U.S. economy.

Follow up:

And in the 28 January 2015 FOMC meeting minutes:

Participants generally regarded the net effect of the recent decline in energy prices as likely to be positive for economic activity and employment..... Recent declines in oil prices, which had boosted household purchasing power, were among the factors likely to underpin consumer spending in coming months; ...

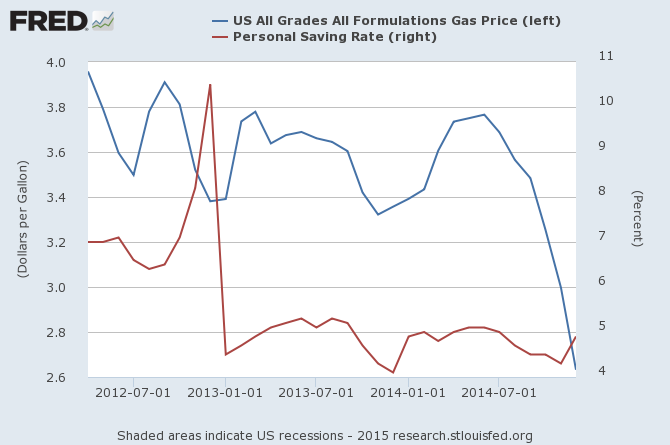

Oh really? The preliminary hard data is not confirming the gut feeling of economists in general, and the Federal Reserve specifically, concerning the effect of the oil price decline.

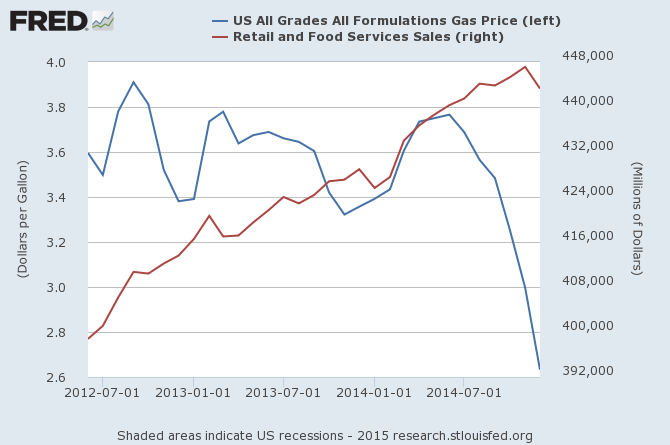

Seasonally adjusted retail sales have now been declining for two months. The three month rolling averages of the unadjusted data are also declining. Of course such a short duration movement proves little - but the direction is down, not up, and not even unchanged.

Retail sales includes gasoline sales where falling fuel prices automatically reduce sales - so a decline in consumer spending means consumers are not spending the fuel price savings.

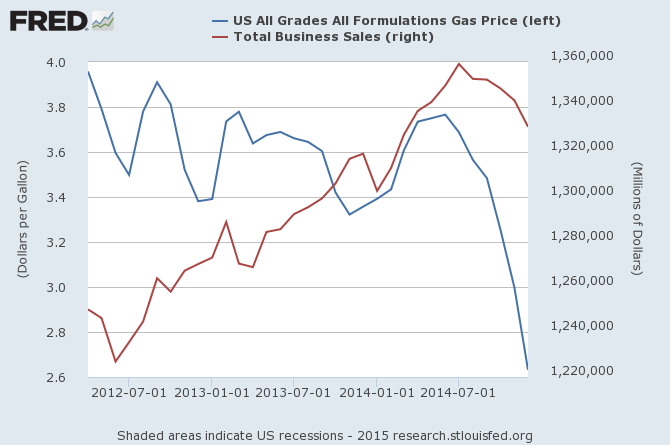

When one looks at the total spending of the private sector (retail plus wholesale plus manufacturing) - the negative affects of falling oil prices are obvious. One would expect a decline in capital investment spending overall for manufacturing and wholesale caused by falling prices.

So the question remains - if consumers are not spending the savings resulting from lower fuel prices - where is this savings going? At this point the savings is not showing up in the personal savings (although this series is fairly inaccurate in real time).

This brings me back to my position on change - all change is disruptive - and usually manifests as an economic negative. In the case of oil prices specifically - there is no way the consumer (who has seen fuel prices to up, go down, go up, and go down) would ever believe a reduction in fuel prices means cheap oil is here to stay. So what does a consumer do? They spend a little of the savings in fuel prices, and maybe pay down some of their debt [note that consumer credit series lags real time and is initially inaccurate - so my thought about paying down debt is a guess]. And now consumers are beginning to see an increase in the prices they are paying at the pumps - and the opportunity to spend the windfall may be fleeting.

As far as businesses are concerned, it is easy to believe that manufacturing and wholesale does not benefit from the lower fuel prices - as they react like deer in the headlights putting some spending on hold waiting to see the effects. They too do not believe low fuel prices are here to stay.

It may be counter-intuitive to mainstream economists - but lower fuel prices can not be proven to be an economically positive event. Rapid change in fuel prices is an economically disruptive event.

Other Economic News this Week:

The Econintersect Economic Index for February 2015 continues to show a stable and growing economy - again with a modest decline in growth from last month. All portions of the economy outside our economic model - except residential housing - are showing reasonable expansion. The growth trend line for our model is decelerating, however, if we toss in a few more elements which we analyze (but do not include) in our economic forecast model (such as employment or consumer sentiment) - the trends are improving rather than slowing.

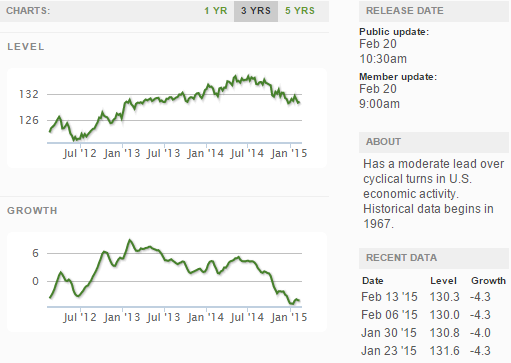

The ECRI WLI growth index value crossed slightly into negative territory which implies the economy will not have grown six months from today.

Current ECRI WLI Growth Index

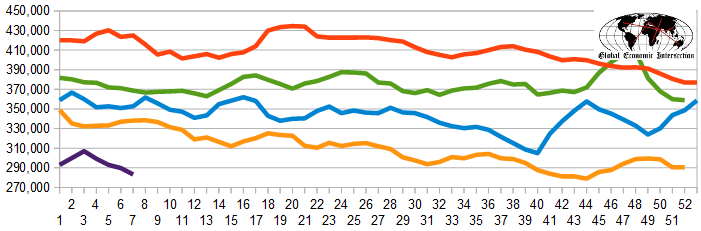

The market was expecting the weekly initial unemployment claims at 270,000 to 305,000 (consensus 290,000) vs the 283,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 289,750 (reported last week as 289,750) to 283,250. The rolling averages have been equal to or under 300,000 for the 22 of the previous 23 weeks.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: Winland Ocean Shipping, Cayman Islands-based Caledonian Bank Limited (Chapter 15), Allen Systems Group

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: