The main reason I do not like to write on economic theory is the same reason I do not write on religion or politics - the concepts are not provable and the background dynamics required for theory validation continue to change making comparisons between time periods invalid.

Follow up:

Scientific proof requires that you control all economic dynamics except the variable you are trying to prove.

Most now say free trade agreements have moved USA jobs to other countries - and this is the reason for a decline in jobs in the USA. This is LIKELY true as there is a time correlation between trade deficits, free trade agreements, and poor employment growth - but this is not provable as other dynamics could have been the cause.

The first major free trade agreement was the North American Free Trade Agreement (NAFTA) which came into force in 1994.

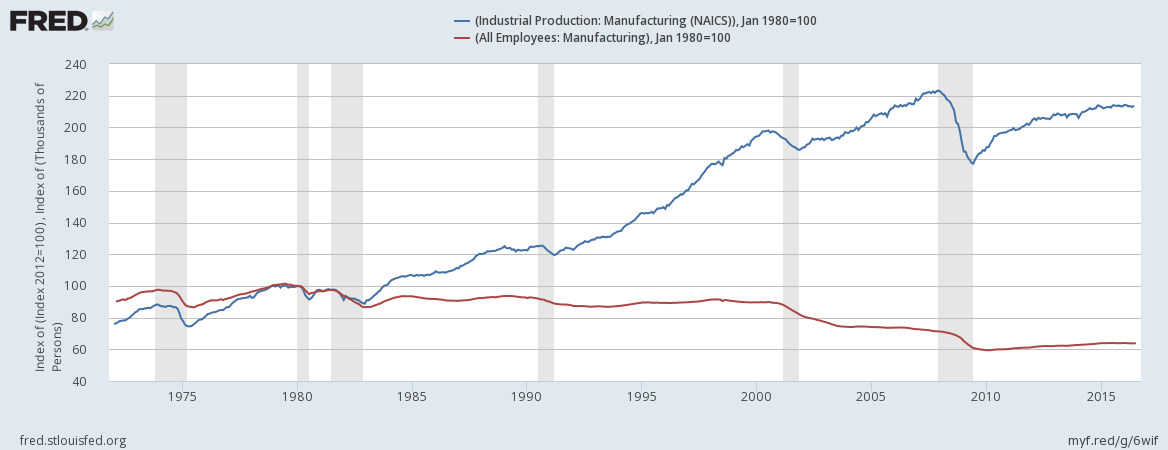

In January 1994 there were 16.8 million manufacturing jobs in the USA - currently there are 12.3 million. Can one imply that the USA has lost 4.5 million jobs to free trade? The Federal Reserve's manufacturing index has risen 59% since January 1994, so if free trade was solely responsible - the loss of jobs would be 41% or 1.8 million jobs?

The effects of labor productivity (using the BLS productivity data) shows that productivity has nearly DOUBLED in the manufacturing sector from 1994 until present. Here I am specifically talking about manufacturing labor productivity - not the multifactor productivity headlined. If all this is really true, then no jobs have been lost to free trade. (I remain a cynic of this data because of the way it is gathered).

There is another way to look at the effects of free trade on labor.

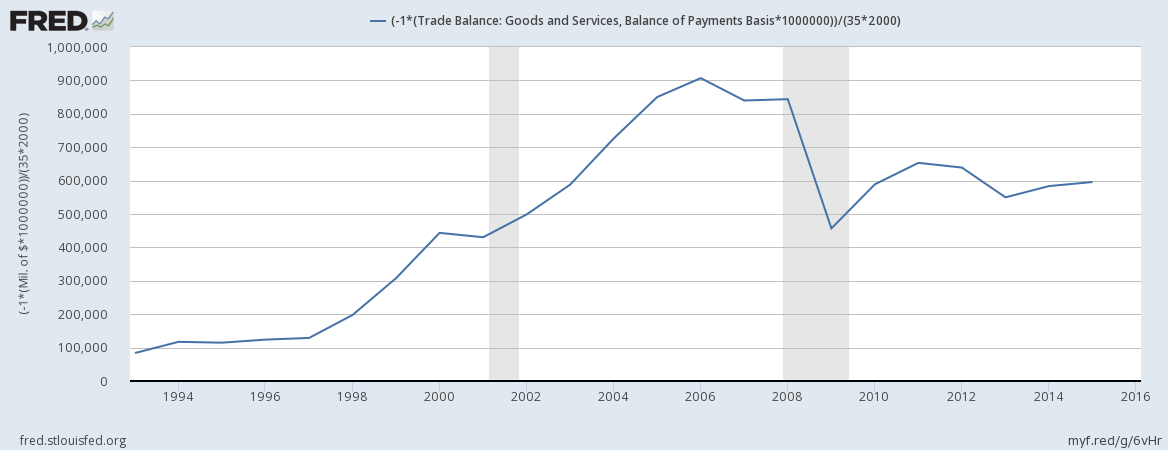

The above graph y-axis is the number of CALCULATED jobs lost IF the trade deficit did indeed represent jobs lost. The calculation is based on $35 per man-hour (2012 estimated cost to employer of a manufacturing job not including productivity deltas). I do have concerns this may not be exactly accurate, but it this gets you in the ballpark to understand the effect of free trade on employment:

- Much of the deficit represents raw materials (say oil). It can be argued that raw materials do not have much labor content.

- What is not considered in the calculation is that there could have been a trade surplus without free trade agreements. In this case, the amount of jobs lost to free trade could be significantly higher.

If the above calculation is correct, it represents little more than a few month's of job gains at the current rate of growth. Not a significant figure as some pundits have implied.

Yet, I have big concerns with free trade as the rate of USA economic growth has slowed correlating to the rise of free trade agreements. Is this a coincidence? What other dynamics are in play? As an engineer, one does not continue down the path if expected results and actual results do not match. Remember being told by President Bill Clinton of the benefits of NAFTA and GATT:

... In a few moments, I will sign the North American free trade act into law. NAFTA will tear down trade barriers between our three nations. It will create the world's largest trade zone and create 200,000 jobs in this country by 1995 alone. The environmental and labor side agreements negotiated by our administration will make this agreement a force for social progress as well as economic growth ...

... Now we must recognize that the only way for a wealthy nation to grow richer is to export, to simply find new customers for the products and services it makes ...

... The United States must seek nothing less than a new trading system that benefits all nations through robust commerce but that protects our middle class and gives other nations a chance to grow one, that lifts workers and the environment up without dragging people down, that seeks to ensure that our policies reflect our values ...

There is a growing canyon between theory and results in economics. Steps by central banks and governments to alter economic direction (except in the short term) are dangerous given they are not using proven economic laws. Over the long term, I would trust market forces more than intervention using unproven theories.

Other Economic News this Week:

The Econintersect Economic Index for August 2016 is no longer in contraction but its level correlating to snail's pace economic growth. The index remains near the lowest value since the end of the Great Recession.

Bankruptcies this Week: LRI Holdings (Logan's Roadhouse)

Click here to view the scorecard table below with active hyperlinks.

Weekly Economic Release Scorecard: