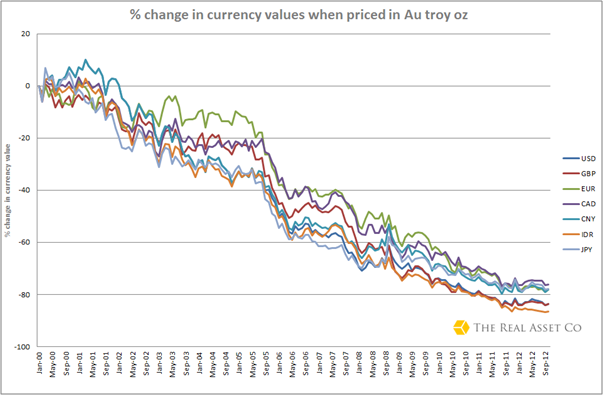

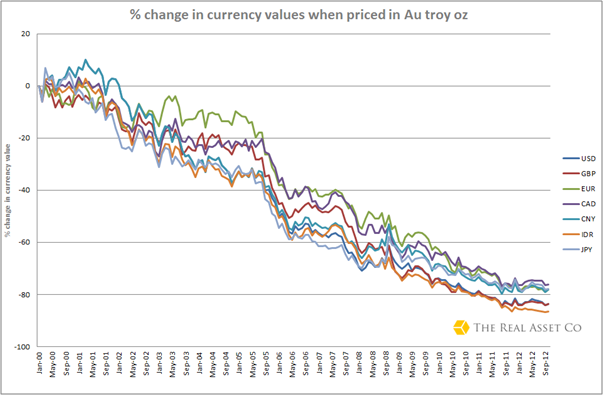

Not long ago we produced a graph that was basically a graph of gold's price turned upside down. It was a graph that showed currencies priced in gold as opposed to the usual -- gold priced in currencies.

As several banks and the media seem to relish the thought of a recovery taking place and the bull market's death, I thought it might be worth bringing those graphs back to remind us just how far we’ve come.

At the moment the gold dollar price is down by over 5.8% for the year. It is that figure that is prompting many to discuss the bitter pill those in gold investment are now having to swallow.

To Each, His Own

However, why are we only looking at the dollar price? Yes, we’re most used to seeing gold priced in U.S. dollars. However, do you buy it in dollars? When you look at the value of your savings, do you price them in dollars? When you buy food, do you price them in dollars? Only for those in the U.S. is the answer ‘yes’, elsewhere we’re all earning, saving and spending in our own national currencies.

So, why worry about the dollar gold price? In some currencies gold has been breaking records in the time we’ve all been worrying if the last three months really have been signalling the end of the gold bull market.

Where The Bull Still Runs

A few examples of where the gold bull market is still running on and on. Whilst each set of circumstances may seem different, at least recall that it all comes down to the politicians and central bankers who arrogantly assume that they are able to not only predict the future but base it on as many assumptions as possible.

Here in the UK, at the time of writing, gold is up 3.8% this year. The majority of our customers are British and, recognising the fall in the value of the pound they’ve been stocking up on gold in order to secure their wealth. The recovery in the UK has been questionable, and even more so since recent industrial and manufacturing figures were released. The bond-centric rescue plan for the Bank of England has meant we’ve had no increase in competitiveness and the funding for lending scheme has benefitted bankers, rather than those it was meant for.

Gold isn’t just up in the pound, many South Americans who decided to buy gold will also be celebrating at the moment.

If you’re in Argentina, then you’d be feeling pretty relieved right now had you decided to invest in gold -- the ARS gold price hit new highs of late. When we were all celebrating the gold price breaking $1,900 in September 2011, they weren’t even close to their recent all-time high of ARS 8,448.65 back in February.

President Fernandez’s entire management is something which almost amuses outside commentators – from her foreign policy to her monetary policy. This year, unofficially, inflation stands at 26% whilst exchange controls and increasing unemployment continue to cause unrest. For a country which has suffered hyperinflation in recent memory, this is a clear example that politicians and central bankers continue to arrogantly assume that they know best.

In the mournful Venezuela they’re also celebrating high gold prices thanks to the continuous devaluation of the currency. They’ll be grateful they brought all that gold back – it’s value to the Venezuelan people has responded well to poor economic management. On the 8th February, President Hugo Chavez announced the devaluation of the bolivar from 4.30 bolivars to the dollar to 6.30 bolivars. The day this was announced the gold price shot up from 7,167 bolivar and reached 10,328 the following Monday – nothing compared to the 2010 devaluation which saw the gold price nearly double from 2,478 to 4,910 bolivars.

By devaluing a currency you effectively tax citizens on the money they hold. They are able to buy less, not able to produce goods to as high a standard and generally living standards begin to decline. Things which don’t exist can have their values erased, doubled, flipped upside-down you name it you can do it because it doesn’t exist. With gold bullion however, it’s real and you can’t mess with it.

The most commonly cited example of gold’s on-going rise, is in the Japanese Yen where the bull market is still very much alive and kicking.

Japan is the world’s fourth-largest economy, yet thanks to the new print-happy government we have seen a fall in the Yen against gold. Gold has risen from 117,000 yen in March 2012 to 154,000 as I write.

Japan’s well documented struggle against deflation is something which new Prime Minister Abe has no more time for. Abe has made it clear that he is prepared to take the remit of the central bank back under the government’s control. Pushing for the central bank to raise the inflation target back in January to 2%, Abe has now seen his currency plummet. A situation which is unlikely to change given the new Central Bank governor in the coming month.

Follow That Central Bank!

As we wrote early last month, we are seeing a change in the nature of central bankers, not just in Japan but across the developed world. The central banks are looking to extend their remit. It’s no longer about looking after monetary policy, it’s now becoming increasingly more to do with finding the right medicine to bring the economy back to full strength.

Gold is up in the aforementioned currencies because of they’ve lost value in recent months, adding to the years and years of abusive monetary policy. All currencies are in this currency-war -- being pitted against one-another, only one can be at the bottom and one at the top. But they’re all in it. At the moment the U.S. Dollar and the Indian Rupee are losing in the race to debase, as Japan takes the lead. But as we see from the graph at the beginning, they’re all heading to the same end point.

For example, don’t forget we are also about to see the second anniversary of the US’s QE1 in less than a week. Since that time we’ve seen gold increase from $924.27 to $1,577. Despite much speculation that the hawks of the FOMC are circling, QE infinity looks set to continue well into 2013. The more dollars, or any currency in fact, which are created the less they are worth.

It’s all down to central banks. You may say that not all banks are so easy with monetary policy, the creditor nations. They’re the ones who are buying gold. But look at it this way, the East and West central banks may well look as though they are carrying out completely different approaches but in fact, both are doing wonders for the those who have chosen to invest in gold.

Please Note: Information published here is provided to aid your thinking and investment decisions, not lead them. You should independently decide the best place for your money, and any investment decision you make is done so at your own risk. Data included here within may already be out of date.

As several banks and the media seem to relish the thought of a recovery taking place and the bull market's death, I thought it might be worth bringing those graphs back to remind us just how far we’ve come.

At the moment the gold dollar price is down by over 5.8% for the year. It is that figure that is prompting many to discuss the bitter pill those in gold investment are now having to swallow.

To Each, His Own

However, why are we only looking at the dollar price? Yes, we’re most used to seeing gold priced in U.S. dollars. However, do you buy it in dollars? When you look at the value of your savings, do you price them in dollars? When you buy food, do you price them in dollars? Only for those in the U.S. is the answer ‘yes’, elsewhere we’re all earning, saving and spending in our own national currencies.

So, why worry about the dollar gold price? In some currencies gold has been breaking records in the time we’ve all been worrying if the last three months really have been signalling the end of the gold bull market.

Where The Bull Still Runs

A few examples of where the gold bull market is still running on and on. Whilst each set of circumstances may seem different, at least recall that it all comes down to the politicians and central bankers who arrogantly assume that they are able to not only predict the future but base it on as many assumptions as possible.

Here in the UK, at the time of writing, gold is up 3.8% this year. The majority of our customers are British and, recognising the fall in the value of the pound they’ve been stocking up on gold in order to secure their wealth. The recovery in the UK has been questionable, and even more so since recent industrial and manufacturing figures were released. The bond-centric rescue plan for the Bank of England has meant we’ve had no increase in competitiveness and the funding for lending scheme has benefitted bankers, rather than those it was meant for.

Gold isn’t just up in the pound, many South Americans who decided to buy gold will also be celebrating at the moment.

If you’re in Argentina, then you’d be feeling pretty relieved right now had you decided to invest in gold -- the ARS gold price hit new highs of late. When we were all celebrating the gold price breaking $1,900 in September 2011, they weren’t even close to their recent all-time high of ARS 8,448.65 back in February.

President Fernandez’s entire management is something which almost amuses outside commentators – from her foreign policy to her monetary policy. This year, unofficially, inflation stands at 26% whilst exchange controls and increasing unemployment continue to cause unrest. For a country which has suffered hyperinflation in recent memory, this is a clear example that politicians and central bankers continue to arrogantly assume that they know best.

In the mournful Venezuela they’re also celebrating high gold prices thanks to the continuous devaluation of the currency. They’ll be grateful they brought all that gold back – it’s value to the Venezuelan people has responded well to poor economic management. On the 8th February, President Hugo Chavez announced the devaluation of the bolivar from 4.30 bolivars to the dollar to 6.30 bolivars. The day this was announced the gold price shot up from 7,167 bolivar and reached 10,328 the following Monday – nothing compared to the 2010 devaluation which saw the gold price nearly double from 2,478 to 4,910 bolivars.

By devaluing a currency you effectively tax citizens on the money they hold. They are able to buy less, not able to produce goods to as high a standard and generally living standards begin to decline. Things which don’t exist can have their values erased, doubled, flipped upside-down you name it you can do it because it doesn’t exist. With gold bullion however, it’s real and you can’t mess with it.

The most commonly cited example of gold’s on-going rise, is in the Japanese Yen where the bull market is still very much alive and kicking.

Japan is the world’s fourth-largest economy, yet thanks to the new print-happy government we have seen a fall in the Yen against gold. Gold has risen from 117,000 yen in March 2012 to 154,000 as I write.

Japan’s well documented struggle against deflation is something which new Prime Minister Abe has no more time for. Abe has made it clear that he is prepared to take the remit of the central bank back under the government’s control. Pushing for the central bank to raise the inflation target back in January to 2%, Abe has now seen his currency plummet. A situation which is unlikely to change given the new Central Bank governor in the coming month.

Follow That Central Bank!

As we wrote early last month, we are seeing a change in the nature of central bankers, not just in Japan but across the developed world. The central banks are looking to extend their remit. It’s no longer about looking after monetary policy, it’s now becoming increasingly more to do with finding the right medicine to bring the economy back to full strength.

Gold is up in the aforementioned currencies because of they’ve lost value in recent months, adding to the years and years of abusive monetary policy. All currencies are in this currency-war -- being pitted against one-another, only one can be at the bottom and one at the top. But they’re all in it. At the moment the U.S. Dollar and the Indian Rupee are losing in the race to debase, as Japan takes the lead. But as we see from the graph at the beginning, they’re all heading to the same end point.

For example, don’t forget we are also about to see the second anniversary of the US’s QE1 in less than a week. Since that time we’ve seen gold increase from $924.27 to $1,577. Despite much speculation that the hawks of the FOMC are circling, QE infinity looks set to continue well into 2013. The more dollars, or any currency in fact, which are created the less they are worth.

It’s all down to central banks. You may say that not all banks are so easy with monetary policy, the creditor nations. They’re the ones who are buying gold. But look at it this way, the East and West central banks may well look as though they are carrying out completely different approaches but in fact, both are doing wonders for the those who have chosen to invest in gold.

Please Note: Information published here is provided to aid your thinking and investment decisions, not lead them. You should independently decide the best place for your money, and any investment decision you make is done so at your own risk. Data included here within may already be out of date.