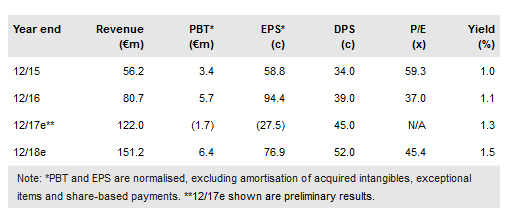

SNP Schneider (DE:SHFG) recorded c 14% organic growth in Q4 and a c 6% EBITDA margin. FY17 group revenue of around €122m was €2m ahead of our forecasts while EBITDA, at €2m, was €1m below our forecast. We have edged up our revenue forecasts while maintaining profit forecasts. After a hectic FY17, with multiple acquisitions, fund-raisings and significant corporate change, we understand that management intends to focus on organic growth in FY18. Given the attractive industry drivers and the potential for margin recovery, the shares look attractive on c 21x our FY19e earnings.

Record revenues in Q417, full year organic growth 8%

FY17 revenue was €122m, up c 51%, including 8% organic growth. This implies Q4 revenues of c €40m (Q416 €23.1m). FY17 EBITDA was c €2m, indicating that Q4 EBITDA was c €2.5m for a c 6% EBITDA margin. Excluding c €4.3m of one-off extraordinary costs, FY17 EBITDA was €6.3m, for an EBITDA margin of c 5.2%. Incoming orders were €130.7m in FY17 for a book-to-bill ratio of 1.07x. This implies that Q4 orders were €35.7m, equating to a book-to-bill ratio of 0.87x.

To read the entire report Please click on the pdf File Below: