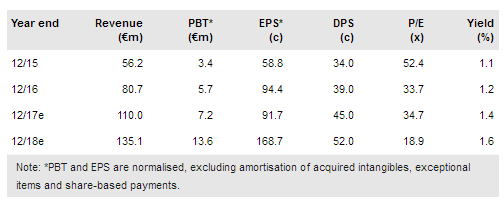

SNP Schneider (DE:SHFG)reported a 27% growth in H1 revenues, including 6% organic growth. While the growth was significantly lower than budgeted, management remains very buoyant, and activity has been picking up, with the book-to-bill ratio rising to 1.26 in Q2. The hyperactive acquisition strategy is based on the view that there is a potential tsunami of data migrations building up across the globe, particularly around SAP S/4HANA, with some 50,000 companies expected to upgrade to the new SAP ERP platform over the next few years. SNP’s goal is to be the global leader in software-based transformation projects and, following the recent correction, we believe the shares look increasingly attractive on c 16x our FY19e EPS.

Q2 results: Book-to-bill rises to 1.26x

SNP reported 36% growth in Q2 revenues and the group returned to a profit, after posting a loss in Q1 (after a host of one-off costs). The group finished Q2 with net debt of €14.9m and adjusted debt was c €24.8m. SNP maintained its guidance, in spite of the ADEPCON acquisition, which will contribute for five months in FY17. However, management plans to review the situation over the next one or two months after taking into account new orders, the backlog and the acquisition.

To read the entire report Please click on the pdf File Below: