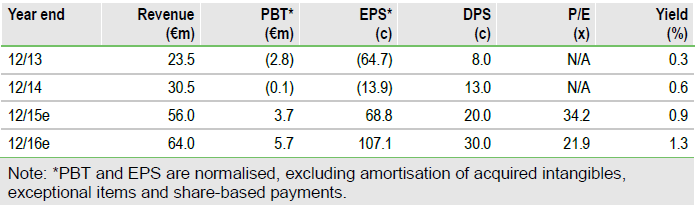

SNP Schneider-Neureither & Partner (DE:SHFG) has announced that, due to continued healthy business activity in Q4, it has again raised guidance for FY15. Consequently, we have raised our EPS forecasts by 24% in FY15, by 5% in FY16 and by 2% in FY17. These numbers are before the inclusion of Astrums, the fast growing, Singapore-based consulting and IT services company, which SNP announced it intended to acquire earlier this month. Given the continuing high level of activity, we believe the shares remain attractive on c 16x our FY17e earnings.

New guidance: €56m revenues and a 8% EBIT margin

SNP has increased its FY15 revenue guidance to c €56m (previously €51-53m, which was upgraded in October), while the EBIT margin is expected to be about 8% (previous guidance 6%). The new guidance does not take into account the impact of the proposed acquisition of Astrums, which has not yet been finalised. Astrums offers solutions around various ERP systems in the Malaysian and Singaporean markets. The group has had an extremely busy year, and completed a prestigious contract with Hewlett-Packard (HP) well ahead of schedule. The HP contract involved an ERP “carve-out” as part of the US technology giant’s plan to demerge into two separate companies in early November. The HP contract demonstrates the value and efficiency of the group’s SNP Transformation Backbone software, which is the only off-the-shelf software solution that automates the process of combining, upgrading or carving out data from ERP systems.

To Read the Entire Report Please Click on the pdf File Below