Forex News and Events

SNB ready to react but no need right now

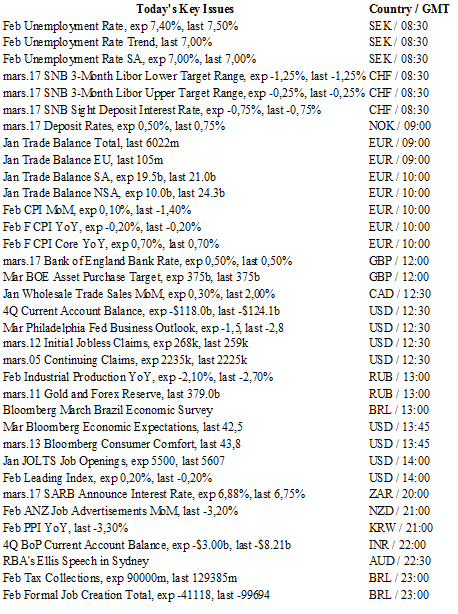

The SNB has clearly taken a reactive rather than a proactive stance. With pressure off the SNB will sit back and watch how things develop. As we expected, the SNB held its policy rates unchanged (sight deposit rate -0.75% & 3-month libor -0.25% to -0.75%), while not tinkering with tightening banks’ threshold exemptions on negative rates. Given the SNB’s rather depleted toolbox, tightening exemption would be its first retaliatory strike (outside minor & systematic fx interventions). We heard the standard CHF “significantly overvalued” and “will remain active in the FX markets” rhetoric but expected no less and markets were numb to the threat. The SNB statement indicated that the conditional inflation forecast has to be revised downwards as the decline in oil prices has contributed to weaker inflation pressures. In what we view as optimistic thinking inflation is expected to return to positive territory in the coming year. In regards to the global outlook, the SNB stated economic performance as “slightly weaker” as “manufacturing and trade remained sluggish” resulting in the fact that “global economic outlook is somewhat less favorable than in December”. The result was forecasted GDP growth of between 1% to 1.5%. Finally, slowdown in real estate prices momentum was “confirmed” as mortgages lending slowed reflecting weakness in growth fundamentals (toned down form prior statement).

Unlike previous ECB actions, which forced the SNB to react, the most recent ECB easing measures are perceived to be a precursor to negative rates. EUR/CHF has the greatest sensitivity to interest rate differentials, alongside risk appetite. Despite Draghi’s pledge that rates could go lower, the subtle shift from using interest rates as opposed to credit easing, signals that reliance on further cuts is unlikely. The subsequent lack of CHF strength indicates that the market was satisfied, narrowing of spreads was less likely, and pressure on the SNB to act decreased. Moving forward, the SNB will remain vigilant on CHF and potential capital inflows from Europe either ECB or event inducted (i.e. Brexit, Grexit, Spanish elections etc.). Barring an event shock we anticipate the EUR/CHF will continue to trend higher in the near term. EUR/CHF resistance at 1.10229 remains the primary bullish target.

Despite SNB president Jordan’s recent comments suggesting that Swiss monetary policy strategy has limited the appeal of the CHF we suspect that the SNB actually has less control. In addition, deeper negative rates lower band to -1.25% or expansion of balance sheet of 100%+ of GDP has the potential of destabilizing risks that are hard to model. We agree with SNB governor board member Andrea Maechler’s statement that there are limits to central bank effectiveness. And believe the SNB is very close to those limits. Most likely the SNB will target negative interest rate exemption as first strike. For now it’s unlikely the SNB will have to dig into their depleted tool kit, yet given the ECB deteriorating inflation and growth outlook we suspect that additional policy measures will be needed. We remain negative on the EUR/CHF in light of mounting European event risks and the steady demand of long-term safe haven assets.

An unsurprisingly dovish Fed

In the FOMC statements, the key words were as usual oriented towards the labour market and the inflation target. Optimism abounds. Yet, continued improved job conditions have not yet provided the expected boost in inflation despite the slight pick-up in recent months. Nonetheless, it continues to run below the 2% longer-term objective. The Fed remains confident that the effect of declining energy and import prices will fade and increase upside inflation pressures. Energy prices may go up, but we think that overall weaker demand will continue to push prices down. The Fed’s inflation target of 2% seems far away.

From our standpoint energy prices and imports are far from being the only driver of a Fed rate hike - global economic and financial conditions are also important factors preventing the American central bank from acting. However, the Fed clearly refuses to admit that the Chinese slowdown has exposed the underlying difficulties of the U.S. economy. Chinese exports dampened by 25% in 2015, meaning that western countries have simply bought less from the Asian economy. As a result, the U.S. manufacturing sector is suffering, putting pressure on the labour market. For the time being, it remains resilient. Unfortunately, there is no mention of these domestic difficulties in the FOMC’s statements showing that the Fed may be over-optimistic regarding the current health of its economy.

Gold - Upside Pressures Are Back On.

The Risk Today

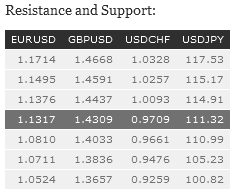

EUR/USD has increased on Fed maintaining rates unchanged yesterday. Hourly resistance at 1.1218 (10/03/2016 high) has been broken. Hourly support can be located a 1.1058 (16/03/2016 low). Expected to show further consolidation. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD is back above 1.4200. Yet, the technical structure is still showing a medium-term bearish trend-line. Hourly resistance can be found at 1.4437 (11/03/2016 high) while hourly support can be found at 1.4033 (03/03/2016 low). Expected to show further weakness. The long-term technical pattern is negative and favours a further decline towards key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY remains in a range between strong resistance at 114.91 (16/02/2016 high) and support at 110.99 (11/02/2016 low). There is strong volatility but the pair keeps on trading without clear momentum. We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

USD/CHF has declined yesterday on Fed maintaining its rates unchanged. An hourly support at 0.9796 (11/03/2016 low) has been broken. Hourly resistance is located at 0.9914 (16/03/2016 high). Expected to show further increase. In the long-term, the pair is setting highs since mid-2015. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias.