Forex News and Events

SNB monetary policy to remain ultra-loose

Yesterday, Thomas Jordan, the SNB Chairman, held a press conference in Bern as the SNB struggles to stimulate its economy. Its short and long-term yields are negative and while the consequences of such a monetary policy are not exactly known, the impact on banks and investors must be assessed.

According to Jordan, “The cost associated with negative interest is lower than the cost of holding cash”, which we do not believe knowing that from our perspective, the cost of negative interest rate will be always higher than the cost of holding cash, especially if inflation comes back. Further decreasing interest rates may trigger a bank run or a least a flight to cash that would be damaging to the economy.

Jordan also mentioned that the SNB is not willing to limit or abolish cash in order to prevent such adverse effects and other monetary tools such as helicopter money. At this point, the SNB has expanded its balance sheet to 110% of its GDP and we believe that there is still more room for further expansion, especially when looking at other countries with significantly higher debt to GDP ratio such as Japan or the United States.

Downside pressures are still weighing on the EUR/CHF despite the SNB’s massive intervention. We naturally remain bearish on the pair. The main driver of the pair is clearly the ECB and the December meeting is highly anticipated by financial markets. Volatility should come back then knowing that the end of the European QE program looms.

USD Firms

USD is marginally weaker today but broader bullish sentiment remains. IMM data indicates steady building of USD long speculative positions. Yesterday’s stronger than expected manufacturing PMI and Feds Evans hawkish speech indicated the Fed will raise interest rates three times in 2017 drove greenback demand (comments over low inflation should be ignored since 75bp of hike in one year for the fed is extremely hawkish).

Expectation for a December 25 bp rate hike is now around 70% probabilities. Yet the USD has been aided by increasing concerns over the Brexit process. Threats by Nicola Sturgeon that Scotland would hold another independence reference if all legislatures are not in agreement and Belgium holding CETA hostage indicate it’s unlikely that Brexit will end smoothly. And most likely trigger collateral political upheaval.

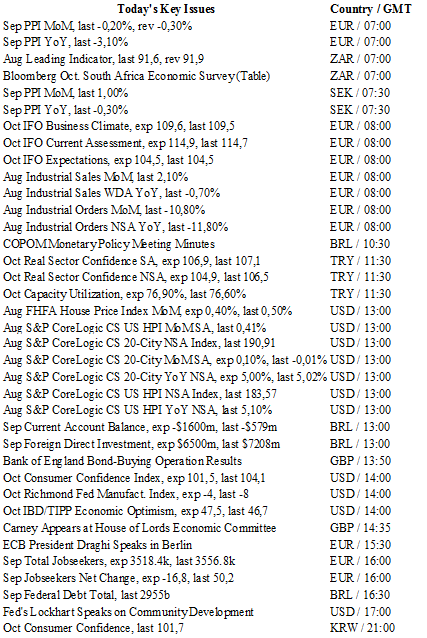

GBP is being driven by Brexit and politics over economic fundamentals making tomorrow GDP less important. Not only is the USD providing a traditional safe-haven, the steeping of the US yields curves has slowed as investor’s chance the higher returns in longer dated maturities. We expected solid US data will have a larger influence on fed expectations then fed commentary. On the docket today we will get the Conference Board consumer confidence which is expected to ease to 101.5 from 104.1 in September.

The weaker read in a low news flow environment should push USD slightly lower. However, sell-offs in USD provide a short term opportunity to reload long positions. Due to the renewed weakness in oil prices due to the lack of OPEC production cut agreement will likely force commodities lower. This scenario should be negative for crude linked currencies in NOK, CAD, MXN and general commodity trades, AUD, NZD and ZAR.

Silver - False Breakout.

The Risk Today

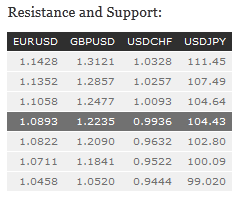

EUR/USD's bearish momentum continues. Selling pressures are important. Resistance can be given at 1.0900 (24/03/2016 low) while stronger resistance lies at 1.1058 (13/10/2016 high). Key resistance is located far away at 1.1352 (18/08/2016 high). Expected to further weaken towards support at 1.0860 (24/10/2016 low). In the longer term, the technical structure favours a very long-term bearish bias as long as resistance at 1.1714 (24/08/2015 high) holds. The pair is trading in range since the start of 2015. Strong support is given at 1.0458 (16/03/2015 low). However, the current technical structure since last December implies a gradual increase.

GBP/USD is well located within a symmetrical triangle. Hourly support is given around 1.2185 (lower bound of the symmetrical triangle) while hourly resistance lies at 1.2332 (19/10/2016 high). Key resistance stands far away at 1.2620 then 1.2873 (03/10/2016). Expected to show further bearish breakout. The long-term technical pattern is even more negative since the Brexit vote has paved the way for further decline. Long-term support given at 1.0520 (01/03/85) represents a decent target. Long-term resistance is given at 1.5018 (24/06/2015) and would indicate a long-term reversal in the negative trend. Yet, it is very unlikely at the moment.

USD/JPY is going higher. A break of hourly support at 102.81 (10/10/2016 low) is unlikely at the moment. Key support can be found at 100.09 (27/09/2016). Hourly resistance can be found at 104.64 (13/10/2016 higher). Expected to see renewed selling pressures around 104.15-30. We favor a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF is still lying within former resistance area between 0.9919 (07/08/2016 low) and 0.9950 (27/07/2016). The pair remains nonetheless on a bullish momentum since September 15. Hourly support is located at 0.9733 (05/10/2016 base) then 0.9632 (26/08/2016 base low). Expected to see continued increase. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours nonetheless a long term bullish bias since the unpeg in January 2015.