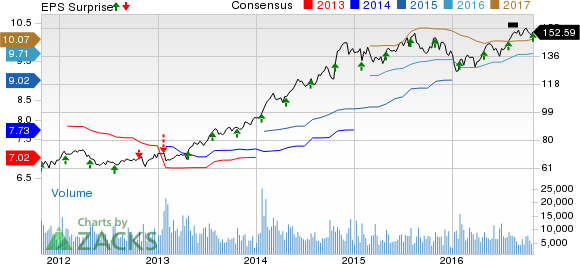

General Dynamics Corporation (NYSE:GD) announced third-quarter 2016 earnings from continuing operations of $2.48 per share, beating the Zacks Consensus Estimate of $2.37 by 4.6%. Reported earnings were also up 8.8% from $2.28 recorded in the year-ago quarter.

Total Revenue

General Dynamics’ total revenue of $7,731 million missed the Zacks Consensus Estimate of $7,905 million by 2.2%. Reported revenues were also down 3.3% from $7,994 million in the year-ago quarter.

The decrease was due to lower contributions from the Aerospace, Combat Systems and Marine segments.

Backlog

The company recorded total backlog of $62 billion, down 9.8% year over year. Funded backlog at the quarter-end was down 4.4% to $51.4 billion.

Segment Performance

Aerospace: The segment reported third-quarter 2016 revenues of $2,017 million, down 13.9% year over year. Operating earnings of $437 million increased from $426 million in the year-ago quarter.

Combat Systems: Segment revenues dropped 1.1% to $1,330 million. Operating earnings were up 0.5% to $219 million in the quarter.

Information Systems and Technology: The segment reported revenues of $2,341 million, up 5.5%. Operating income improved 16.9% to $256 million.

Marine Systems: The segment’s revenues of $2,043 million were down 2.1% from the year-ago figure of $2,087 million. Operating income also declined 8.3% to $166 million.

Operational Highlights

Company-wide operating margin expanded 90 basis points to 13.8% from the year-ago level of 12.9%.

In the quarter under review, General Dynamics’ operating costs and expenses declined 4.3% to $6,662 million.

Financial Condition

As of Oct 2, 2016, General Dynamics’ cash and cash equivalents were $2,303 million, compared with $3,372 million as of Oct 4, 2015.

Long-term debt as of Oct 2, 2016 was $3,885 million, higher than the 2015-end level of $2,898 million.

At the end of Oct 2, 2016, the company’s cash flow from operating activities was around $1,372 million, compared with $2,270 million in the year-ago period. Free cash flow from operations in the third quarter was $389 million, as against $1,128 million in the prior year.

Other Aerospace & Defense Releases

Rockwell Collins Inc. (NYSE:COL) reported results for fourth-quarter fiscal 2016 ended Sep 30. The company’s adjusted earnings per share of $1.58 surpassed the Zacks Consensus Estimate of $1.57 by 0.6%. Reported earnings also improved 14.5% from $1.38 a year ago. It has a Zacks Rank #4 (Sell).

Honeywell International Inc. (NYSE:HON) reported third-quarter 2016 adjusted earnings of $1.67 per share, comfortably beating both the Zacks Consensus Estimate and the year-ago equivalent figure of $1.60 by 4.4%. It also carries a Zacks Rank #4.

Lockheed Martin Corp. (NYSE:LMT) reported third-quarter 2016 earnings of $3.61 per share, surpassing the Zacks Consensus Estimate of $2.86 by 26.2%. Earnings also increased 49.2% from the year-ago level. The company has a Zacks Rank #4.

Zacks Rank

General Dynamics currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

GENL DYNAMICS (GD): Free Stock Analysis Report

LOCKHEED MARTIN (LMT): Free Stock Analysis Report

ROCKWELL COLLIN (COL): Free Stock Analysis Report

HONEYWELL INTL (HON): Free Stock Analysis Report

Original post

Zacks Investment Research